Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 08, 2017

October eurozone PMI sets the scene for another strong quarter

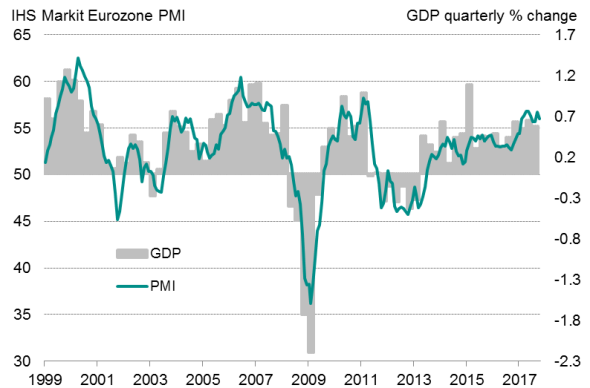

The eurozone growth spurt retained strong momentum the start of the fourth quarter. At 56.0, the October headline composite PMI reading was identical to the average seen in the third quarter and puts the region on course for another 0.6-7% expansion in the closing quarter of 2017.

The positive signal for the fourth quarter was added to by new business growth ticking higher in October, suggesting November should also prove a good month for business activity.

Another 0.6% expansion in the fourth quarter would mean growth of 2.2% in 2017 as a whole.

Eurozone PMI v GDP

Bright outlook

Prospects further out also look good, as reflected by the degree to which business optimism has held up. In particular, the survey results indicate that political uncertainty and the stronger currency appear to have weighed only modestly on business optimism about the year ahead, meaning confidence remains elevated by historical standards, albeit down on recent highs. At 65.2, down of 67.1, the current composite future expectations compared favourably with a five-year average of 61.7.

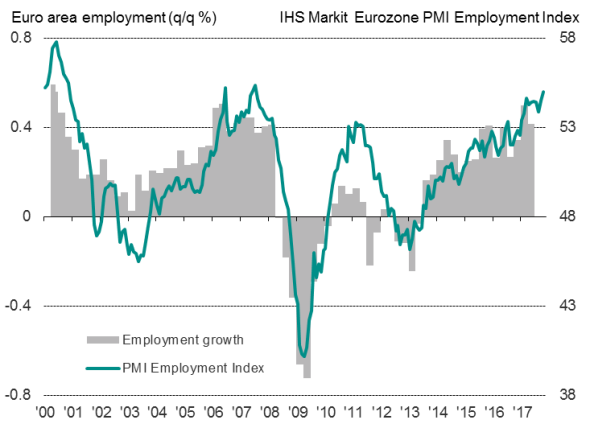

The anecdotal evidence from the PMI survey responses suggests that companies are focusing on buoyant demand from domestic markets, remaining firmly in expansion mode in line with expectations of stronger business and consumer spending. Hence an upturn in employment growth to a decade high in October, with job creation in manufacturing the fastest since the series began in 1997.

Eurozone employment

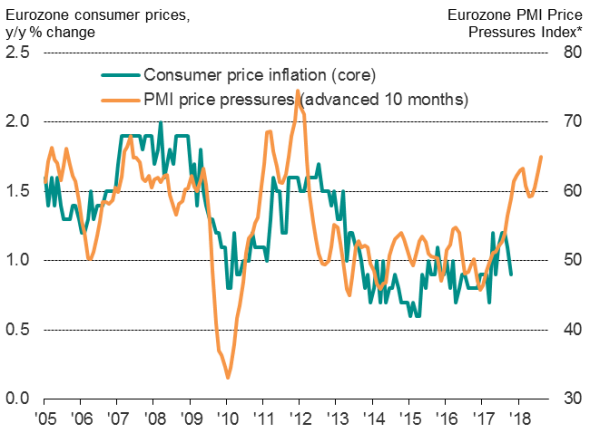

Inflation pressures tick higher

Inflationary pressures have meanwhile lifted higher, with prices charges for goods and services rising at a rate not beaten for over six years in October. Some price rises merely reflect the pass-through of higher costs, but companies are also reporting stronger pricing power as demand conditions continue to improve, which suggests underlying inflationary pressures are becoming more engrained.

Eurozone inflation

Sources: IHS Markit, Eurostat.

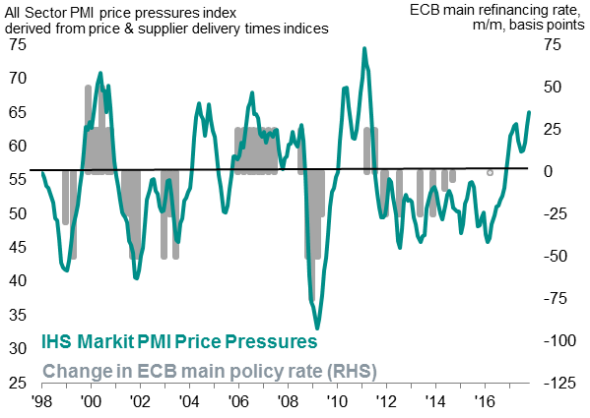

A key indicator of the improvement in pricing power is the suppliers' delivery times index, which showed delivery delays to have risen to the highest since April 2011. Busier suppliers are commonly able to negotiate higher prices. A composite index based on manufacturing input prices and supplier lead times acts as a leading indicator of core inflation, and suggests that core pressures are set to rise again after dipping in October.

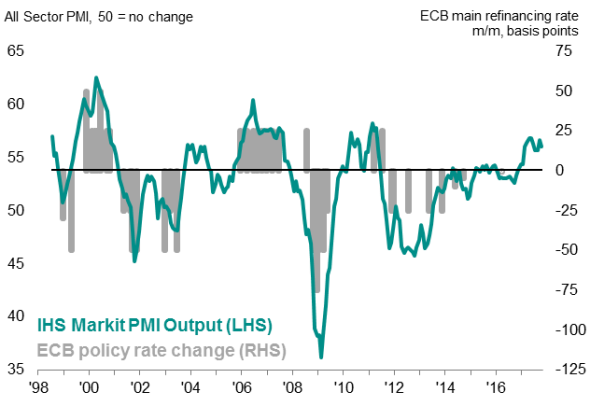

ECB policy taper

When charted against historical ECB policy decisions, the composite price pressures gauge has clearly moved into territory normally associated with a tightening of monetary policy. Similarly, the headline PMI measuring business activity (as a gauge of economic growth) is also sending hawkish policy signals.

ECB policy and business activity

It's therefore little surprise that the ECB has announced its decision to rein-back some of its stimulus, reducing its asset purchases in 2018. Further tapering rhetoric may follow if the PMI data continue to show strong economic growth and further upward price pressures.

ECB policy and price pressures*

* blended index of price and supply chain pressures.

Sources: IHS Markit, ECB

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08112017-economics-october-eurozone-pmi-sets-the-scene-for-another-strong-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08112017-economics-october-eurozone-pmi-sets-the-scene-for-another-strong-quarter.html&text=October+eurozone+PMI+sets+the+scene+for+another+strong+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08112017-economics-october-eurozone-pmi-sets-the-scene-for-another-strong-quarter.html","enabled":true},{"name":"email","url":"?subject=October eurozone PMI sets the scene for another strong quarter&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08112017-economics-october-eurozone-pmi-sets-the-scene-for-another-strong-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=October+eurozone+PMI+sets+the+scene+for+another+strong+quarter http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08112017-economics-october-eurozone-pmi-sets-the-scene-for-another-strong-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}