Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 09, 2017

Japan powers Asian securities lending

Japanese securities lending continues to drive Asian securities lending revenues in 2017 after a bumper 2016.

- Japanese securities lending revenue is up 46% yoy in the first ten weeks of 2017

- A 57% jump in fees was the largest contributor to the large jump in revenue

- The proportion of Japanese shares trading special doubles in the last two years

Japan was the single largest force behind the 10% jump in Asian securities lending revenues registered last year. The country's equities earned over 50% more revenues in dollar terms than the total recorded over 2015. This bumper surge in revenues means Japan was responsible for one third of the region's equities revenue; a sharp increase from the 22% share seen in 2015.

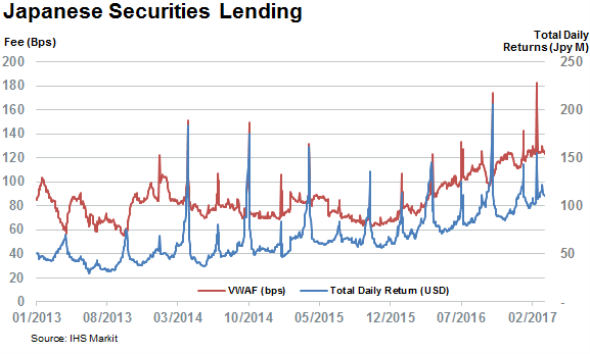

The revenue momentum has continued into the 2017 as Japanese equities have generated 46% more yen denominated revenues in beneficial owners for in the opening ten weeks of 2017 than they did over the same period in 2016. This jump is even more significant in dollar terms as the rising value of the yen means that the $57m generated by Japanese equities lending year to date (ytd) is 66% ahead of the $34.3m generated at the same point in 2016.

This will come as welcome news for the industry considering that the rest of the Asian region is has so far failed to match the revenues generated at this point last year. This is evidenced by the fact that overall Asian equity securities lending revenues have been flat as $170m has been earned in the opening ten weeks of the year.

Fees behind this surge of revenues

Fees are by far and away the single largest contributing factor behind Japan's rosy revenue figure. The weighted fee commanded by Japanese equities ranged between 75bps and 80bps from 2013 to 2015, however that number went on to surge to 100bps last year. The increase in fees is showing no sign of slowing down in 2017 as the weighted average fee charged to borrow Japanese equities so far this year is 126bps, far above the 80bps weighted average fees generated in the opening weeks of 2016.

This massive 57% increase in the fees commanded by Japanese loans has so far failed to scare off investors as the average balances were JPY 3trn since the start of the- roughly on par with the JPY 3.2trn seen over the start of 2016.

Specials multiply

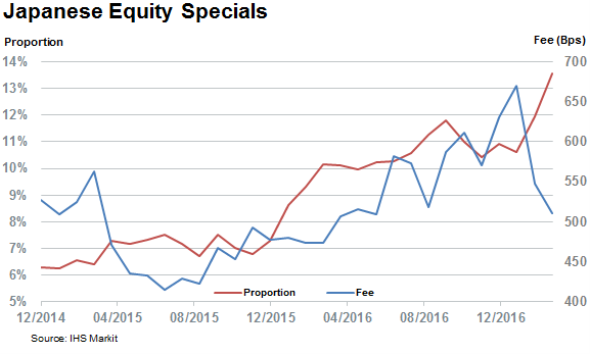

The minority of Japanese stocks that trade special have played an outsized role in the surge in fees as their proportion has doubled over the last two years. Japanese stocks now have a 14% chance trading special using a threshold of 100bps for fees. This proportion is by far and away the highest out of any period registered over the last 24 months.

Furthermore these specials are getting increasingly more expensive to borrow as the weighted average fee of all specials registered a 24 month high of 670bps in the opening weeks of the year. The Japanese specials fee has come in somewhat over the last month to 500bps; however the current rate is still materially higher than the 430bps needed to borrow Japanese specials over the middle of 2015.

These specials are more than likely driven by short seller demand as technology and consumer discretionary firms, which have long been favorite targets of short sellers, make up over half of the current crop of Japanese specials.

Standout tech specials includes such firms as internet messaging portal Line Corp which now costs over 11% to borrow after a series of lackluster earnings took its shares below their IPO price and AI software provider Jig-Saw which commands an astronomical 33% in the securities lending market.

Highlights in the consumer discretionary sector, which includes retailers and automobiles firms, include electronics retailer Edion, which has 16% of its shares outstanding on loan, as well as airbag maker Takata whose shares cost more than 15% to borrow after the some of its products were found to be defective.

Beneficial owners share in fee surge

Not surprisingly these resilient fees and the ensuing revenues they generate are increasing the attractiveness of Japanese equities for beneficial owners who are willing to lend these assets. Beneficial owners have earned 1.1 basis points from the JPY 68 trn of Japanese equities in lending programs; one third more than the year to date earnings figure registered at the same point last year.

Bumper revenues generated from lending Japanese equities have so far failed to attract any significant new supply looking to grab a piece of the action. If anything the lendable pool has been getting shallower over the last 12 month as the value of Japanese equities in lending programs only jumped by 25% in yen terms. While significant at first glance it's worth noting that the surge in lendable is 5% less than the 30% jump registered in the Nikkei 225 index over the same period.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09032017-Equities-Japan-powers-Asian-securities-lending.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09032017-Equities-Japan-powers-Asian-securities-lending.html&text=Japan+powers+Asian+securities+lending","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09032017-Equities-Japan-powers-Asian-securities-lending.html","enabled":true},{"name":"email","url":"?subject=Japan powers Asian securities lending&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09032017-Equities-Japan-powers-Asian-securities-lending.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+powers+Asian+securities+lending http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09032017-Equities-Japan-powers-Asian-securities-lending.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}