Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 09, 2015

Loose policy buoys investor interest in UK

The Bank of England's Monetary Policy Committee held interest rates at 0.5% and maintained its asset purchases at "375bn at its April meeting. No statement was made alongside the announcement.

Investors have meanwhile stormed have back into both equity and fixed-income funds as the 'goldilocks' scenario of robust economic growth and ultra-loose policy shows little sign of ending any time soon.

Policy on hold

The lack of action at the Bank of England was no surprise: while the economy is showing signs of continuing to grow strongly in 2015 so far, the absence of inflationary pressures means policymakers are likely to be in no rush to pull the trigger on rate hikes. The majority of the MPC are likely to prefer to leave policy as accommodative as possible, especially in the face of heightened political and economic uncertainty resulting from the May general election.

The economy grew by a robust 0.6% in the final three months of the year, and this rate of expansion looks to have been at least matched, if not bettered, in the first quarter of 2015. PMI survey data are pointing to GDP having risen 0.7% in the three months to March, with growth having accelerated at the end of the quarter. Such a robust pace of expansion indicates that the economy should be able to withstand modest and gradual interest rate rises.

But inflation fell to zero in February, a record low, and looks set to fall further in coming months due to low energy prices and intense price competition among supermarkets.

There's some uncertainty about the medium-term outlook for inflation, on which current policy is largely based, with the recent fall in oil prices set to fall out of the year-on-year comparisons and therefore putting upward pressure on the inflation rate.

Lack of pay pressures

However, crucially, there remain few signs of pay pressures moving significantly higher, which should keep core inflation down. Average employee earnings, excluding bonuses, rose by just 1.6% on a year ago in the three months to February, and recent survey data indicate that employees on average expect pay to rise by just 1.1% in 2015. Despite the labour market tightening, driving pay for new recruits higher, employers are expected to be mindful of low inflation in annual wage reviews, keeping overall pay growth down to levels that will not worry policymakers into hiking rates.

Investors regain their appetite for UK exposure

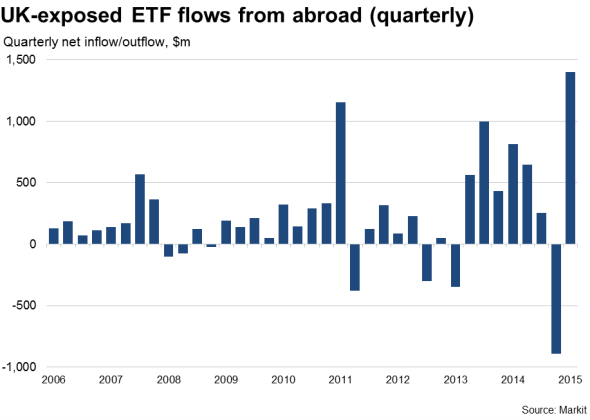

Low inflationary pressures therefore suggest that policymakers will not feel the need to hike rates this year. The prospect of interest rates being kept low for longer than was envisaged late last year appears to have prompted an influx of investor interest in the UK. Overseas listed funds with an exposure to the UK saw the largest net inflow on record in the first quarter, according to Markit's ETF database, reversing steep outflows in the final quarter of last year.

Investors have stormed have back into both equity and fixed-income funds as the 'goldilocks' scenario of robust economic growth and ultra-loose policy shows little sign of ending any time soon.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09042015-Economics-Loose-policy-buoys-investor-interest-in-UK.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09042015-Economics-Loose-policy-buoys-investor-interest-in-UK.html&text=Loose+policy+buoys+investor+interest+in+UK","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09042015-Economics-Loose-policy-buoys-investor-interest-in-UK.html","enabled":true},{"name":"email","url":"?subject=Loose policy buoys investor interest in UK&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09042015-Economics-Loose-policy-buoys-investor-interest-in-UK.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Loose+policy+buoys+investor+interest+in+UK http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09042015-Economics-Loose-policy-buoys-investor-interest-in-UK.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}