Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 09, 2016

Week Ahead Economic Overview

The US Federal Reserve and Bank of England will take the spotlight next week, as key announcements on monetary policy decisions are made. Flash PMI results will provide insight into global economic performance, while latest inflation, trade and industrial production figures for the eurozone will offer further indications to the health of the currency bloc's economy.

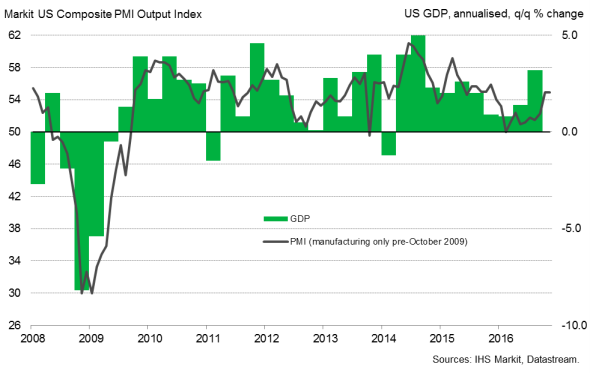

Many analysts are pencilling in a 0.25% interest rate hike from the US Federal Reserve next Thursday. This would be the first increase during 2016 and only the second since the start of 2009. Speculation of a rise has been growing in recent weeks, most notably after Federal Reserve chairwoman Janet Yellen was quoted saying "The evidence we have seen since we met in November is consistent with our expectation of strengthening growth and improving labor markets and inflation moving up." These sentiments were shared in November's PMI surveys, where both the US manufacturing and services sector data signalled robust expansions in output, new orders and jobs, while input cost inflation remained close to October's 15-month peak.

US GDP and the PMI

Industrial production, retail sales, mortgage numbers and Flash PMI data released next week will also provide central bankers will further understanding of the well-being of the US economy and could be important steers to future monetary policy.

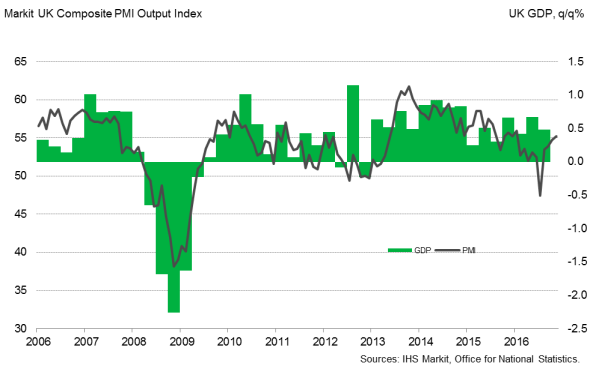

In the UK, the Bank of England will make a decision on monetary policy. When the Monetary Policy Committee congregated last month, members voted unanimously to maintain the current bank rate at 0.25%, the asset purchase programme at "435bn and continuing with corporate bond purchases totalling up to "10bn, with forecasters predicting this to be sustained through to the new year.

UK GDP and the PMI

Inflationary pressures and signs of stronger than expected economic growth are restricting any thoughts the BoE may have of further monetary stimulus at present, especially since PMI surveys also indicated 0.5% UK GDP growth for the fourth quarter. Consequently, the release of ONS inflation data next week will be carefully scrutinised. Although consumer price inflation fell fractionally to 0.9% in October from 1.0% the previous month, a rise is expected for November with the BoE anticipating inflation to pick-up to 2.7% by Q4 2017.

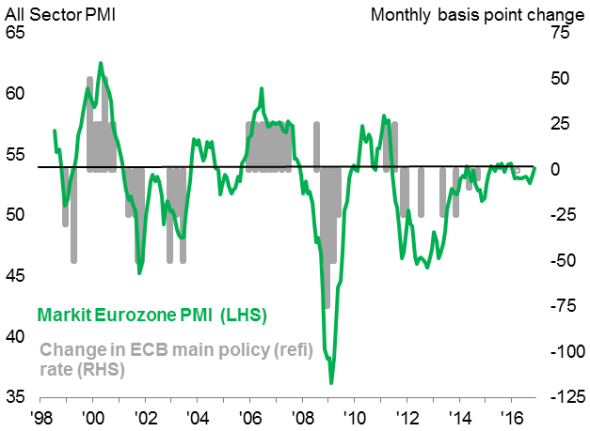

Updates on inflation, trade and industrial production figures next week will provide eurozone policymakers with further clarity on the extent of the region's upturn. Recent data releases have been encouraging, not least the November PMI survey data which pointed to the fastest growth for 11-months, as well as workforce numbers rising at one of the quickest rates seen for over five years. Although the ECB announced that they would extend their quantitative easing programme to the end of December 2017, the intention to trim their monthly asset purchases was seen by some as a sign that the central bank has more confidence in the currency bloc's economy.

ECB policy bias and the PMI

Sources: IHS Markit, ECB.

Over in China, industrial output and retail sales figures are issued. Asia's largest economy experienced a robust rise in manufacturing production in November, with goods producers enjoying their best quarter for over three-and-a-half years. However, producer price inflation recently jumped to 3.3%, meaning intensifying cost pressures could weigh on future manufacturing performance.

Meanwhile, other key data releases next week include an update on industrial production data in Japan and Russia, as well as the latest Indian wholesale price figures.

The Bank of Russia also makes a decision on the course of its latest monetary policy amid signs of the economy showing a strengthening rate of expansion.

Monday 12 December

Corporate goods and machinery order figures are published in Japan.

India sees the release of trade and inflation numbers.

The Lloyds Bank Commercial Banking England & Wales Regional PMI results are issued.

Tuesday 13 December

Australia sees the release of business confidence and house price data.

In India, current account numbers are updated.

Industrial output and retail sales figures are issued in China.

Revised third quarter GDP results are meanwhile out in Russia.

Employment numbers are released in the eurozone, while Germany sees the publication of inflation and ZEW economic sentiment data.

Meanwhile, industrial production figures are out in Italy.

The Office for National Statistics issues inflation data in the UK.

Retail sales numbers are released in Brazil.

The NFIB Business Optimism Index is updated in the US.

Wednesday 14 December

Consumer sentiment numbers are updated in Australia

In Japan, industrial production data are released, while wholesale price figures are out in India.

Meanwhile, consumer price and retail sales numbers are released in South Africa.

Eurostat issues industrial production figures for the currency bloc.

France sees the publication of inflation data.

Labour market numbers and the latest Markit UK Household Finance Index are updated in the UK.

Industrial production, retail sales and mortgage data are released in the US.

Thursday 15 December

Flash PMI results are released in Japan, the eurozone and the US.

Unemployment figures are issued in Australia.

Russia sees the publication of industrial production numbers.

In South Africa, producer price data are out.

The Bank of England announces its latest monetary policy decision. Moreover, the UK also sees the release of retail sales numbers.

Manufacturing sales figures are updated in Canada.

In the US, the Federal Reserve announces its latest monetary policy decision, while the country also sees the release of current account, inflation and retail sales data.

Friday 16 December

The Bank of Russia announces its latest monetary policy decision. Moreover, the country sees the release of producer price figures.

Inflation and trade numbers are updated in the eurozone.

Meanwhile, business confidence data are out in France.

The Knight Frank/Markit UK House Price Sentiment Index is published, while the Confederation of British Industry releases industrial orders numbers.

Housing starts and building permit figures are issued in the US.

Samuel Agass | Economist, Markit

Tel: +441491461006

samuel.agass@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09122016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09122016-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09122016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09122016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09122016-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}