Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 10, 2015

Swiss yields negative; jumbo Turkish issue

Switzerland's new ten year government bond becomes the first to yield below zero, while Turkey dips into the US dollar sovereign market to enthusiastic demand.

- Switzerland's government yield curve returns negative out till 13 years

- Sovereign US dollar bonds in high demand as Turkey dips into the primary market

- BG and Shell's 5-yr yields have converged 25bps since merger announced

Below zero

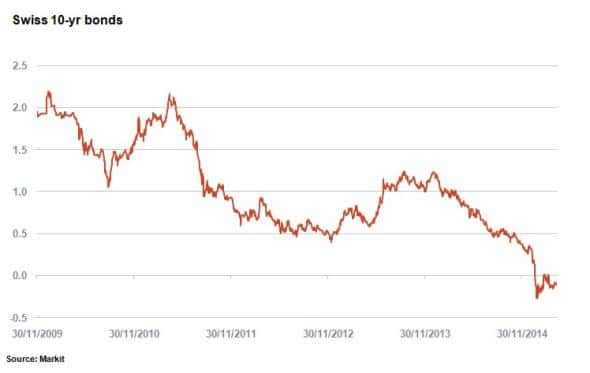

Switzerland has become the first country to issue a ten year bond with a negative yield.

But the 1.5% 2025 issue, priced to yield

-0.055%, came as no surprise as much of the Swiss government curve had already fallen into deep negative territory since the Swiss National Bank (SNB) removed its currency peg against the euro in January. Ten year rates have been teetering below zero ever since. In fact, negative yields can be seen as far as 2028, but are likely remain above the SNB's deposit rate of -0.75%.

Fears of deflation and ECB QE have driven yields below zero across Europe. Twelve European countries now exhibit negative yields across their government bond term structure, according to Markit's bond pricing. Southern European peripherals, Spain and Portugal are the most recent to join the club, having largely escaped any contagion from Greece's troubles and enjoying a sustained economic recovery.

But why would investors buy bonds that offer a negative return? For one, aggressive monetary policy can cause distortions in the supply and demand dynamic in bond markets, creating shortages even as zero interest rate policy and negative deposit rates try shift investors into risky assets. These shortages are magnified further as investors who require government bonds as part of their asset allocation or for tracking purposes further drive demand, pushing yields down further.

US dollar demand

Turkey, just like many emerging market countries has seen its currency, the lira, and slide against the dollar over the past year. The added cost of servicing this debt coupled with the threat of increased interest rates has seen the jumbo US dollar sovereign market wither.

With issuance sparse in the US jumbo sovereign bond market, it was no surprise that Investor demand was strong as Turkey issued a $1.5bn 2026 this week.

The timing of the deal, on the back of positive economic data, and sustained low oil prices boosted investor confidence. Turkey also benefited thanks to a lack of supply in the market. Other competitors in the market, namely Russia and Brazil, have been locked out of capital markets due to declining oil revenues and political uncertainty.

Whether Russia and Brazil will take advantage of the huge investor demand remains to be seen, but judging by their perceived credit risk both are on the road to recovery. The gap between Turkey's 5-yr CDS spread and Brazil's has closed to 25bps from recent highs of 97bps three weeks ago, while Russia's 5-yr CDS spread has closed to 123bps from highs of 434bps on January 30th .

Turkey's 2026 notes have since performed well in the secondary market; the deal priced at 250bps over treasuries but has since tightened to 239bps, according to Markit's bond pricing data.

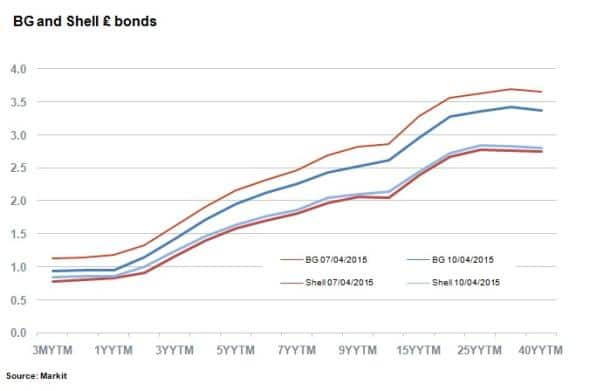

BG Group and Royal Dutch Shell's credit profiles continued to converge on the back of the mega $70bn merger announced earlier this week. The 5-yr point on their respective sterling yield curves converged, reducing the yield gap from 56bps to 31bps. BG bond holders enjoyed much of the gains.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10042015-Credit-Swiss-yields-negative-jumbo-Turkish-issue.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10042015-Credit-Swiss-yields-negative-jumbo-Turkish-issue.html&text=Swiss+yields+negative%3b+jumbo+Turkish+issue","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10042015-Credit-Swiss-yields-negative-jumbo-Turkish-issue.html","enabled":true},{"name":"email","url":"?subject=Swiss yields negative; jumbo Turkish issue&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10042015-Credit-Swiss-yields-negative-jumbo-Turkish-issue.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Swiss+yields+negative%3b+jumbo+Turkish+issue http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10042015-Credit-Swiss-yields-negative-jumbo-Turkish-issue.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}