Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 10, 2014

UK trade deficit hits seven-month low, but few signs of rebalancing

A slight rise in exports failed to halt the underlying trend of deteriorating UK trade performance in October, and survey data suggest exports have fallen in November. Any improvement in coming months is largely dependent on demand in the eurozone starting to revive but, until then, the UK upturn remains worryingly dependent up on the domestic market.

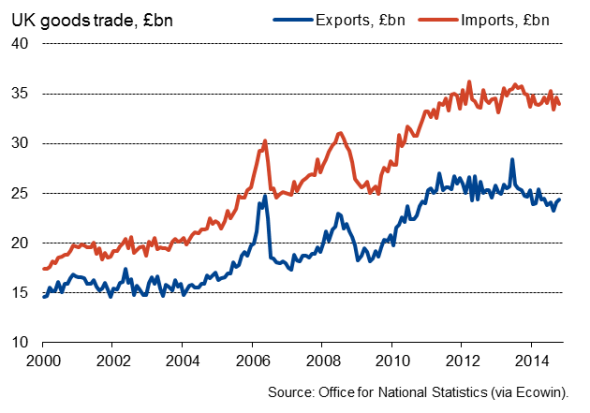

The UK's overall trade deficit narrowed from "2.822 billion in September to "2.024 billion in October, according to the Office for National Statistics, its lowest since March.

The goods deficit was also the smallest since March, as exports rose 0.9% and imports fell 1.9%. However, the ONS reported that this was partly due to exports of erratic items, notably silver, suggesting it should not be seen as a fundamental improvement in underlying export performance.

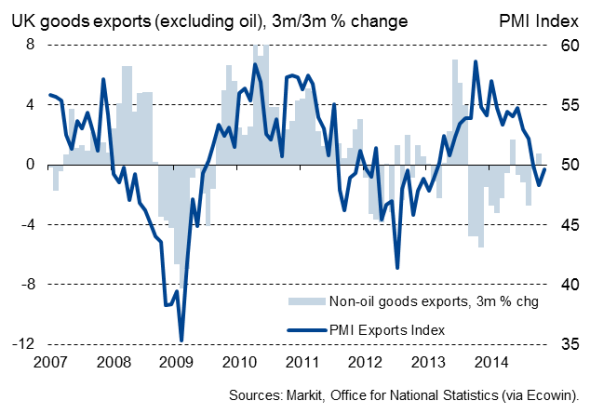

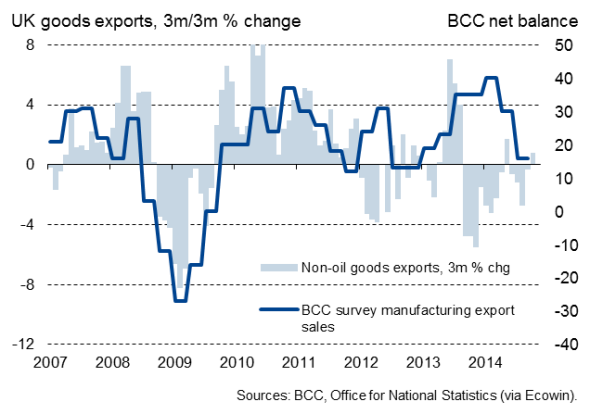

Looking at the three-month trend, goods exports were down 0.9% in the three months to October, which represents an easing in the rate of decline compared to the peak of 4.3% seen in the three months to August. However, a further deterioration in exports has been signalled for November by the Markit/CIPS Manufacturing PMI survey.

Trade balance

Deteriorated export climate

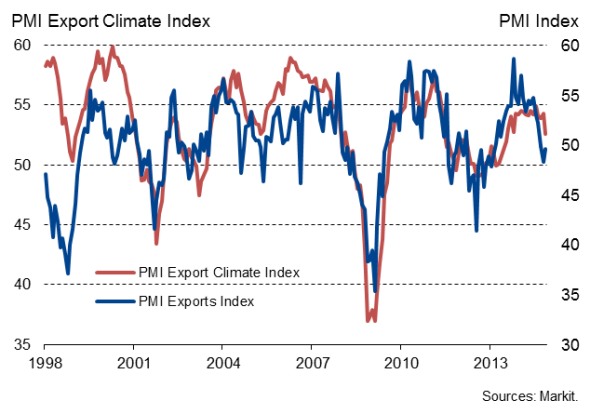

We don't have to look far for the reason why exports are in decline. Demand in the UK's trade partners is growing at the slowest rate since July of last year, according to trade-weighted PMI data for the various economies to which the UK traditionally exports. Most evident is the near-stagnation of economic growth in the eurozone, alongside a similar near-stalling of growth across the emerging markets.

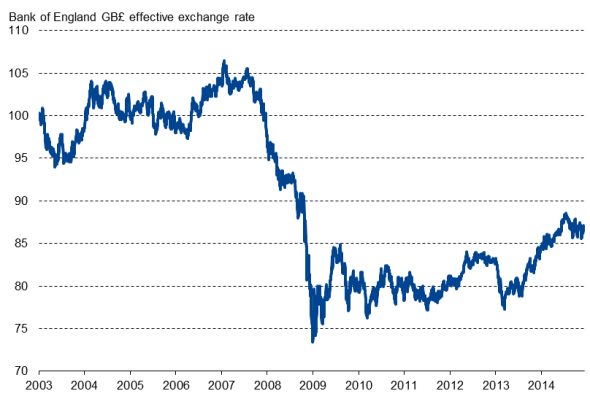

Exports have also been affected by the rise in the exchange rate over the past year, although the recent steadying of sterling should take some pressure off exporters. Sterling has appreciated by just over 12% from the lows seen last year but has stabilised in recent weeks. This steadying is largely due to the prospect of imminent interest rate hikes by the Bank of England having diminished alongside worries about the growth outlook and benign inflationary pressures.

The hope is that, with ECB stimulus acting as a tailwind, economic growth should pick up in the eurozone in 2015, boosting demand for UK exports. However, at present, the data suggest that UK growth remains all too dependent on the domestic economy, and consumer spending in particular. The rebalancing of the economy from domestic consumption to export-led growth remains disappointingly elusive.

Exports and demand in the UK's trading partners

Exchange rate

Imports fall

Imports of goods meanwhile fell 1.9% in the three months to October, which would normally be a sign that domestic demand is weakening. However, caution is required in this respect, as the ONS attributed to the fall to lower oil imports, possibly reflecting the resumption of some production capacity in the North Sea. Note that higher oil production was also linked to a slight overall increase in goods exports to other EU countries.

Exports and the PMI survey

Exports and the BCC survey

GDP revision?

One piece of good news was that revisions to past data should mean that trade acted as less of a drag on the economy than previously thought in the third quarter, raising the possibility that GDP growth could be revised higher from the current estimate of 0.7%. Upwards revisions to exports would bring the official data more into line with the PMI and BCC business surveys.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122014-economics-uk-trade-deficit-hits-seven-month-low-but-few-signs-of-rebalancing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122014-economics-uk-trade-deficit-hits-seven-month-low-but-few-signs-of-rebalancing.html&text=UK+trade+deficit+hits+seven-month+low%2c+but+few+signs+of+rebalancing","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122014-economics-uk-trade-deficit-hits-seven-month-low-but-few-signs-of-rebalancing.html","enabled":true},{"name":"email","url":"?subject=UK trade deficit hits seven-month low, but few signs of rebalancing&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122014-economics-uk-trade-deficit-hits-seven-month-low-but-few-signs-of-rebalancing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+trade+deficit+hits+seven-month+low%2c+but+few+signs+of+rebalancing http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122014-economics-uk-trade-deficit-hits-seven-month-low-but-few-signs-of-rebalancing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}