Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 10, 2015

Week Ahead Economic Overview

All eyes will be on the Federal Reserve Bank in a week that is likely to see US interest rates rise for the first time since 2006. Meanwhile, Markit's flash PMI results will provide the first available information on global economic trends in December, while inflation numbers are issued in the eurozone and the UK.

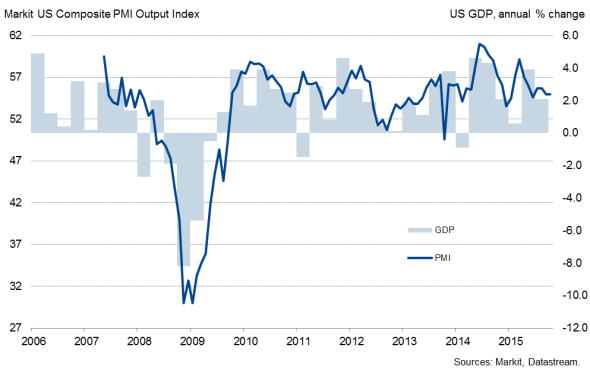

It could be a historic week for policy makers in the US, as the Federal Open Market Committee (FOMC) is likely to announce a tightening of monetary policy for the first time in nine years. The US labour market looks strong, inflation is showing signs of edging higher, and survey data suggest the economy is in good shape. Moreover, Fed chair Janet Yellen has been preparing the markets for a potential rate hike with her latest comments leaving little doubt that the Fed will start raising its benchmark interest rate on Thursday.

US GDP and the PMI

While the Fed announcement is clearly the highlight of the week, the US also sees the release of Markit's flash PMI results for both the manufacturing and service sectors, inflation numbers and industrial production data. Despite being held back by weak exports, the US manufacturing sector is showing signs of rebounding, according to Markit's PMI results, thereby contributing to robust fourth quarter economic growth so far. The flash PMI results for manufacturing and services in December will provide an update on the economy's performance at the end of the year. Low oil prices are meanwhile expected to continue to keep headline inflation down around zero with little sign of core pressure rising. Oil prices slumped 10% in November.

The eurozone also sees the publication of flash PMI results, as well as official industrial production and inflation data, all of which will give clues as to future ECB policy. The region's economy grew 0.3% in the third quarter, with business survey data available for the fourth quarter so far pointing to a slight acceleration in GDP growth. The Eurozone Composite PMI rose close to August's multi-year high in November, and the release of flash PMI results, out on Wednesday, will present a clearer picture of the economy in the closing quarter.

Euro area industrial production data for October are released on Monday. Industrial output fell 0.3% in September, but production was up 0.1% over the third quarter as a whole and the PMI data point to an increased rate of growth in the fourth quarter so far. Final inflation numbers for November are released on Wednesday and are likely to confirm the earlier flash estimate of consumer prices rising 0.1%.

Eurozone industrial production and the PMI

Official updates on UK inflation, retail sales and unemployment during the week could prove important for central bank policy. PMI data available for the fourth quarter so far point to 0.6% GDP growth and recruitment survey data point to a tightening labour market. All eyes will fix on the labour market data therefore to see if the upturn is feeding through to higher wages, which could be a trigger for higher UK interest rates in 2016. Visa Expenditure data meanwhile point to modest growth of consumer spending in November, up 1.1% on a year ago, down from 2.1% in October.

UK unemployment rate

Consumer prices across the UK fell for the second month running in October and PMI data signalled that average prices charged for goods and services were unchanged in November, with factory gate prices falling at the steepest rate since August 2009 and oil prices collapsing. The deflationary picture supports the Bank of England's dovish outlook, which envisages interest rates staying on hold until 2017.

Finally, Nikkei flash Japan Manufacturing PMI results, produced by Markit, are released on Wednesday and will provide the first insight into economic trends in the country in December. GDP revisions mean Japan is no longer in a recession and have brought the official data more in line with the PMI, which show an acceleration of GDP growth in the fourth quarter up to November.

Monday 14 December

India sees the release of inflation and trade data.

The latest Lloyds Bank Commercial Banking England & Wales Regional PMI and Bank of Scotland PMI results are published.

Industrial output numbers are issued in the euro area and Japan, with the latter also seeing the publication of business sentiment figures.

Consumer price data are meanwhile updated in Italy.

In Brazil, payroll job growth numbers are released.

Tuesday 15 December

In Australia, house price and vehicle sales data are published.

Industrial production numbers are out in Russia.

Employment figures are meanwhile issued in the eurozone.

Economic sentiment data for Germany are published by ZEW.

Spain sees the release of inflation numbers.

The Office for National Statistics issues inflation data for the UK.

Manufacturing sales figures are out in Canada.

In the US, consumer price, real earnings and NAHB housing market data are issued alongside the latest NY Fed Manufacturing Index.

Wednesday 16 December

Flash PMI results are out in Japan, the eurozone and the US.

Eurostat releases inflation and trade data for the euro area.

Latest unemployment numbers are published by the Office for National Statistics in the UK.

Meanwhile, retail sales figures are issued in Brazil.

The US sees the release of housing starts and industrial production figures.

Thursday 17 December

Japan's Ministry of Finance publishes trade numbers.

In Russia, retail sales, unemployment and wages data are released in Russia.

Meanwhile, producer price figures are issued in South Africa.

Latest Ifo business climate data are out in Germany.

Italy's National Institute of Statistics publishes trade balance information.

Unemployment figures are updated in Greece.

Retail sales and CBI orders numbers are released in the UK.

Brazil sees the publication of service sector and unemployment data.

The Federal Reserve Bank announces its latest monetary policy decision. Moreover, current account and initial jobless claims data are issued in the US.

Friday 18 December

The Bank of Japan announces its latest monetary policy decision.

House price figures are released in China.

Inflation numbers are issued in Canada and Russia.

Current account data are meanwhile published in the euro area.

In France, business climate and producer price numbers are updated, while Italy sees the release of wage inflation figures.

The latest Knight Frank/ Markit UK House Price Sentiment Index is published.

Markit releases flash PMI results for the US service sector.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122015-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122015-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}