Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 11, 2013

M&S quashes LBO talk

Marks & Spencer revealed fourth-quarter sales figures on Thursday, but credit investors remained firmly focused on the possibility of a leveraged buyout of the UK retailer.

However, Marc Bolland, the company’s ceo, denied that “serious” talks had taken place with Qatar’s sovereign wealth fund, which is thought to be a potential suitor.

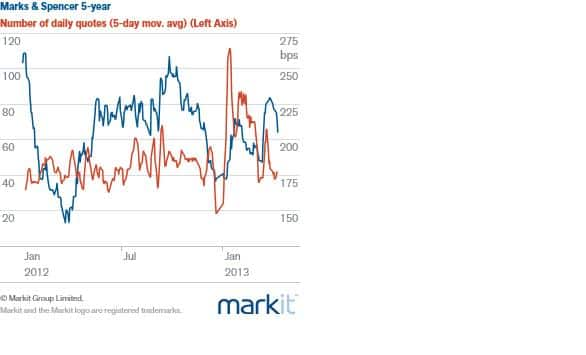

Rumours that Qatar is considering a bid led to M&S widening from 175bps at the beginning of the year to 230bps on March 28, making it one of the worst non-financial performers in the Markit iTraxx Europe. The recent credit deterioration means M&S trades with an implied rating of ‘BB’, according to Markit data, below its average rating of ‘BBB’.

Liquidity, as measured by the number of daily quotes received through Markit’s CDS service, shot up in January when the speculation surfaced, and did so again last month, though to a lesser extent. M&S’s spreads tightened 7bps to 205bps today, and it was one of the strongest performers in the investment grade universe.

Overall, the market continued to rally on the back of the Bank of Japan’s liquidity injection. Italy’s solid debt auction today, where €7.2 billion in bonds were sold, was no doubt helped by investors chasing high-yield assets. However, contrary to the conventional wisdom they may not have been Japanese.

Figures released today by Japan’s Ministry of Finance showed that domestic investors were selling foreign bonds last week. It is probable that the recent demand for peripheral exposure has been driven by non-Japanese investors anticipating capital outflows from Japan.

Nonetheless, the trend shows little sign of stopping, and spreads continued to rally. The Markit iTraxx Europe tightened 1.5bps to 108bps and Series 18 of the index is now trading at 99bps, the first time it has dipped below 100bps.

News that the size of the Cypriot bailout has increased to €23bn and will now be larger than the country’s GDP, as well as a leaked report suggesting that Portugal will struggle to avoid a second bailout, didn’t stand in the way of the rally.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11042013113207m-s-quashes-lbo-talk.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11042013113207m-s-quashes-lbo-talk.html&text=M%26S+quashes+LBO+talk","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11042013113207m-s-quashes-lbo-talk.html","enabled":true},{"name":"email","url":"?subject=M&S quashes LBO talk&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11042013113207m-s-quashes-lbo-talk.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=M%26S+quashes+LBO+talk http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11042013113207m-s-quashes-lbo-talk.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}