Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 11, 2015

Week Ahead Economic Overview

The highlight of the week is the Federal Open Market Committee’s latest monetary policy decision, which is accompanied by US industrial production and consumer price updates. Employment and inflation numbers are updated for the euro area plus the UK, and the Bank of England releases minutes from its June policy meeting.

Consumer prices

No change is expected when the Federal Open Market Committee announces its latest monetary policy decision on Wednesday and it is likely that policy makers will wait until at least September before starting to raise interest rates. While labour market data have been strong recently, the FOMC will be watching the data flow keenly in coming months to seek reassurance that the US economy is not losing too much momentum, with eyes on the impact of a strong dollar in particular.

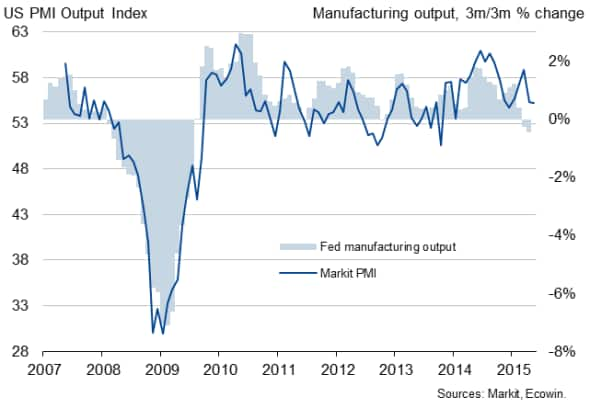

Industrial output numbers will be eyed for signs that the manufacturing sector has recovered from the downturn seen over the past two months. However, PMI data signalled that a strong dollar continued to hurt the economy in May, with new order growth the weakest in nearly one-and-a-half years, suggesting that the sector is likely to act as a drag on economic growth in the second quarter.

US manufacturing production and the PMI

Consumer price data for May are also updated in the US. In April, prices were down 0.2% on a year ago, but core inflation remained at a five-month high of 1.8%. A further upturn in the core rate would add to pressure on policy makers to start hiking interest rates this year rather than delaying any tightening of policy into 2016.

The Bank of England releases minutes from its June monetary policy meeting on Wednesday, at which the Bank held interest rates steady at 0.5%. The minutes are likely to show that all nine Monetary Policy Committee members again voted to keep policy on hold, though the text will be gleaned for hawkish views as at least two members are likely to have seen the decision as finely balanced. The lack of action at the Bank does not come as a surprise. UK economic growth stuttered to a two-year low in the first quarter of 2015, inflation has gone negative and the Bank of England lowered its growth forecast for the year to 2.4% (previous forecast was +2.9%). The Bank further stated that interest rates are unlikely to rise before mid-2016.

UK data watchers will therefore focus on latest inflation, retail sales and labour market data. In April, the UK fell into deflation for the first time since data were first compiled in 1989. While further weak inflation numbers are expected in coming months, it is likely that actual deflation will be short-lived, largely a result of rising oil prices. There is greater uncertainty therefore, as to the extent to which inflation may take off later this year, with important implications for both economic growth and interest rates.

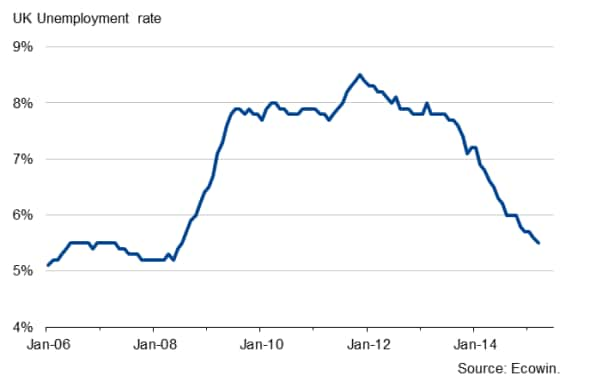

Wage growth data, also updated on Wednesday, will therefore also be important in gauging the future path of UK interest rates, with past data having showed signs of pay picking up. There’s also a chance that the UK unemployment rate will fall to 5.4% from 5.5%, adding to signs of a tightening labour market While business survey data signalled a slight slowing of employment growth in May, the data continued to signal historically robust job gains.

UK unemployment

In the eurozone, an update on inflation numbers will provide policy makers with more information on price trends in the region. Consumer prices rose at an annual rate of 0.3% in May according to flash data, in what is a strong turnaround from the 0.6% rate of decline seen at the start of the year. Solid PMI results meanwhile support the ECB’s view of the eurozone recovery being on track, with the bank keeping its foot firmly on the stimulus pedal at its June policy meeting.

Monday 15 June

- In India, wholesale price inflation numbers are out.

- Revised first quarter GDP data are published in Russia, while the Bank of Russia Board of Directors announce their latest monetary policy decision.

- The latest Bank of Scotland Report on Jobs is released.

- Eurostat issues trade data for the currency union.

- Italy meanwhile sees the publication of consumer price figures.

- Manufacturing sales numbers are updated in Canada.

- In the US, industrial production data are released.

Tuesday 16 June

- Employment numbers are released for the euro area by Eurostat.

- Russia sees the publication of industrial output data.

- In Germany and the UK, inflation figures for May are issued.

- Retail sales numbers are updated in Brazil.

- Housing starts and building permit data are released in the US.

Wednesday 17 June

- Trade data are published in Japan and Italy.

- South Africa issues updates on inflation and retail sales numbers.

- Eurostat releases inflation figures for the currency bloc. Moreover, the European Central Banks Governing Council meets, but no interest rate announcement is scheduled.

- The Bank of England publishes minutes from its latest monetary policy meeting, while unemployment and wages data, as well as the UK Household Finance Index are also out.

- The Federal Open Market Committee announces its latest interest rate decision.

- In Canada, wholesale trade numbers are released.

Thursday 18 June

- House price information are updated in China.

- The latest Reuters Tankan Diffusion Index is published in Japan.

- In Russia, real wage data, retail sales numbers and unemployment figures are released.

- The Swiss National Bank and the Norwegian central bank announce their latest monetary policy decisions.

- Labour costs data are out in the eurozone.

- The Office for National Statistics releases retail sales figures for the UK.

- In the US, inflation numbers, current account data and initial jobless claims figures are published.

Friday 19 June

- The Bank of Japan announces its latest monetary policy decision.

- Inflation numbers are out in Russia and Canada, with the latter also seeing the release of retail sales figures.

- In Germany, producer price information are issued.

- Current account data are meanwhile published for the eurozone.

- The latest Knight Frank UK House Price Sentiment Index is released.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11062015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11062015-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11062015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11062015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11062015-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}