Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 11, 2015

Week Ahead: Tension builds ahead of Fed rate meeting

Markets will be on tenterhooks in the lead up to Thursday's FOMC's decision on US interest rates. With stock markets tumbling and emerging market currencies under pressure in recent weeks, market expectations of the Fed hiking have cooled. However, the futures markets are still pricing in a one-in-three chance of a hike. That's down from 50:50 before the China crisis, but still means the door has by no means shut on September seeing the first Fed rate hike since 2006, fuelling speculation about the potential impact of tighter policy and a stronger US dollar on global markets.

Why raise rates? The economy is growing strongly (another spell of solid, circa 2.5%, growth is signalled for the third quarter) and the labour market has hit what's widely considered to be full employment, soon after which wage growth usually tends to accelerate. Delaying rate hikes means there's a danger of policy having to be tightened more aggressively in the future.

Although growth has slumped in emerging markets, many would argue that the FOMC needs to set policy for the US, not the rest of the world. However, many would see it as an unnecessarily risky move for the Fed to tighten when so much uncertainty abounds in the markets and inflation shows little sign of taking off, suggesting policymakers could easily be swayed into delaying hikes until later in the year.

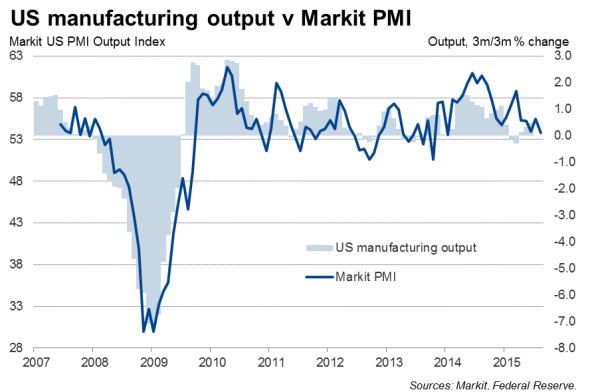

A final flurry of data prior to the FOMC meeting includes important insights into the latest US retail sales and industrial production trends. Sales and factory output could both disappoint, with PMI data pointing to growth of both waning from 0.5% and 0.6% expansions in July.

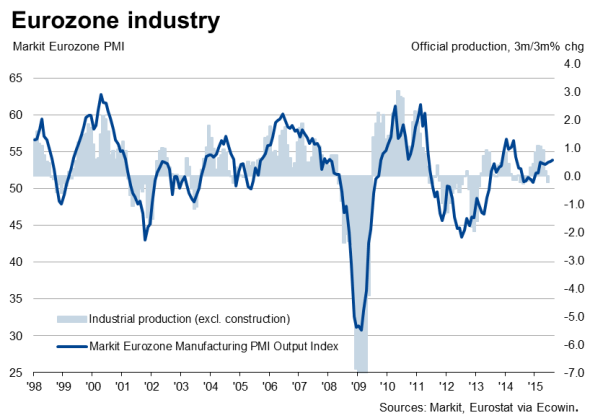

Industrial production, trade and employment data will be important signals for the ECB as it mulls over the possible need for further stimulus. However, PMI data will prove reassuring to the central bank. The surveys pointed to the strongest rates of economic growth and job creation for four years in August. However, inflation data for the Eurozone are likely to show a worrying lack of price pressures in the single currency area.

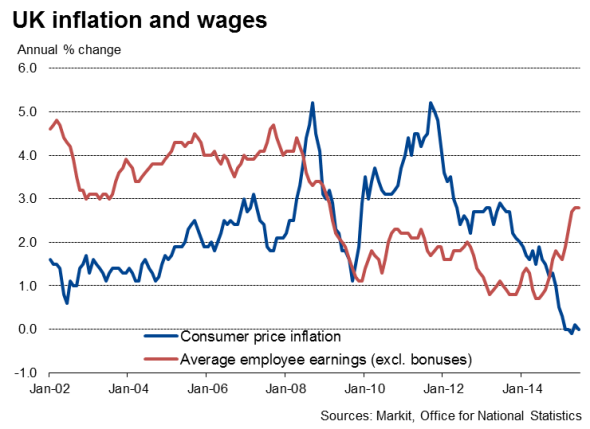

The September meeting of the Bank of England's Monetary Policy Committee showed only one of the nine members voted to raise interest rates again, but inflation and labour market data releases on Tuesday and Wednesday respectively could change that picture. Inflation is zero, but wage growth has picked up to 2.8% once erratic bonus payments are stripped out. Any further increase will ignite rate-rise talks. On the other hand, job creation has shown signs of cooling, which could take pressure off salary growth.

UK retail sales data and Markit's Household Finance Index will also reveal the extent to which consumers are providing an ongoing support to the economy.

In Asia, a key release will be house price data for China. The strength of the property market is widely seen as vital to the resilience of China's domestic economy, and any drop in property prices alongside the recent slide in share prices would add to concerns about a hard landing.

Japan, meanwhile, see updates to industrial production and trade data, with the Bank of Japan hoping to see the goods producing sector benefitting from the weakened yen.

Monday 14 September

England & Wales regional PMI surveys are released.

Revised Japanese industrial output data are published.

Wholesale and consumer price numbers are out in India.

Eurozone industrial production data are issued.

In Italy, inflation numbers are updated.

Tuesday 15 September

Russia sees the release of industrial output data.

In the US, retail sales, industrial production and business inventories figures are published.

Trade and employment data are updated in the Eurozone.

Consumer price data are published in France and the UK, with the latter also seeing the release of producer, retail and house price figures.

ZEW economic sentiment and current conditions data are issued in Germany.

Wednesday 16 September

In South Africa, retail sales data are out.

Eurozone sees the release of inflation, labour costs and wages numbers.

Retail sales data are, meanwhile, released in Brazil.

A labour market update is issued in the UK.

Canada sees the release of the latest manufacturing sales data.

Consumer prices data are announced in the US.

Markit releases the latest UK Household Finance Index.

Thursday 17 September

Trade data are published in Japan and Italy.

Greece sees the release of unemployment numbers.

UK retail sales data are out.

Russian inflation, unemployment, retail sales and wages figures are published.

In the US, export sales, jobless claims and house starts figures are out. Moreover, the Fed will announce its latest policy decision.

Friday 18 September

China house prices numbers are issued.

Consumer price inflation data are published in Canada.

Eurozone sees the publication of current account figures.

Knight Frank/Markit UK House Price Sentiment Index is, meanwhile, released.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11092015-economics-week-ahead-tension-builds-ahead-of-fed-rate-meeting.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11092015-economics-week-ahead-tension-builds-ahead-of-fed-rate-meeting.html&text=Week+Ahead%3a+Tension+builds+ahead+of+Fed+rate+meeting","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11092015-economics-week-ahead-tension-builds-ahead-of-fed-rate-meeting.html","enabled":true},{"name":"email","url":"?subject=Week Ahead: Tension builds ahead of Fed rate meeting&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11092015-economics-week-ahead-tension-builds-ahead-of-fed-rate-meeting.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead%3a+Tension+builds+ahead+of+Fed+rate+meeting http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11092015-economics-week-ahead-tension-builds-ahead-of-fed-rate-meeting.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}