Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 11, 2014

Russia's economic outlook darkens as central bank hikes interest rates

Russia's central bank raised interest rates by 1%, seeking to help stem an alarming slide in the ruble which currency market intervention has so far failed to arrest. However, the concern is that the rate hike is unlikely to halt the currency's decline, and may merely worsen an already escalating economic downturn.

Rate rise

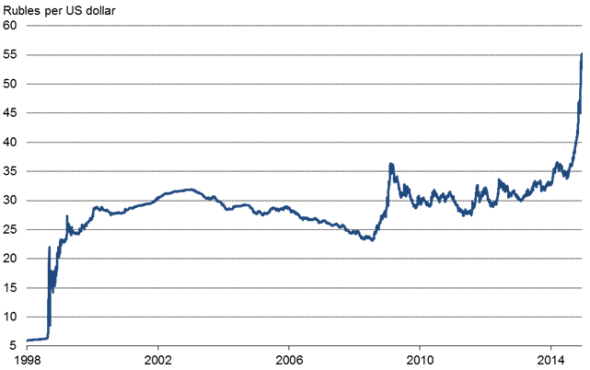

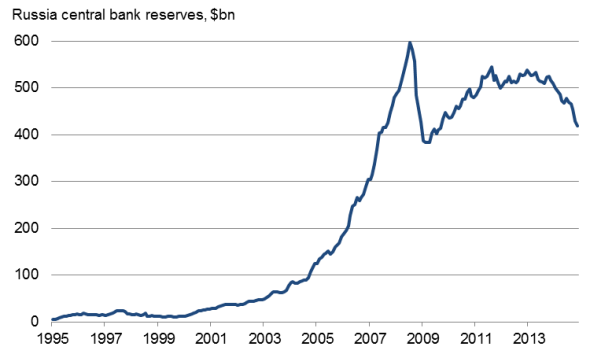

The central bank's main policy rate has now risen from 5.5% at the start of the year to 10.5% as the authorities seek to halt the plunging currency. The ruble has lost around half of its value against the US dollar so far this year, down 20% in the last month alone as worries have grown regarding the crisis in Ukraine, economic sanctions imposed by the West and the impact of falling oil prices. The fall has come despite the central bank taking a $90bn hit to its foreign currency reserves as it intervened in the markets.

Initial reaction to the rate hike does not look promising. The exchange rate took a historic slide past the 55 rubles to the dollar just prior to the announcement and continued to trend lower afterwards, suggesting the markets do not see the action as sufficiently aggressive to change the outlook.

Exchange rate

Inflation set to spike higher

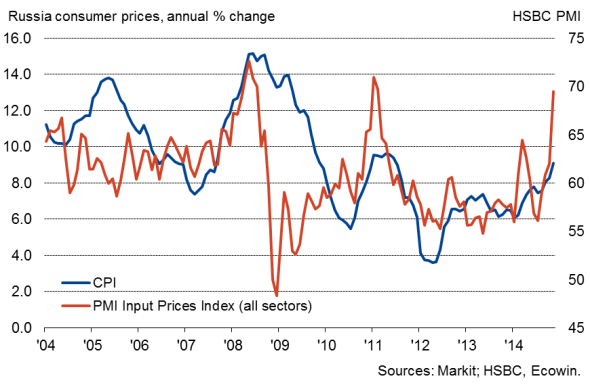

Inflation is spiking higher as a result of increased import costs arising from the ruble's decline. Consumer price inflation rose to 9.1% in October, its highest since June 2011. A further marked upturn in inflation is likely in November, with the HSBC PMI surveys, compiled by Markit, showing a steep increase in firms' costs.

The composite PMI survey index of input costs jumped from 62.0 in October to 69.5, its highest since February 2011. Manufacturers' input costs showed the largest monthly jump since the currency crisis of 1998. The central bank expects inflation to rise to 10% in Q1 2015, but the PMI suggests it could go even higher.

Inflation

Heightened recession risk

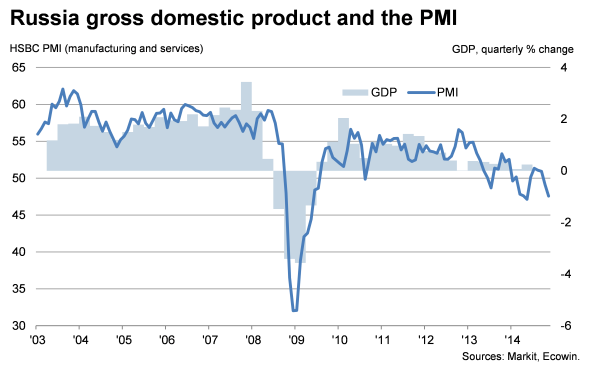

The danger is that the hike in interest rate will not stem the currency's decline, while also exacerbating an economic downturn. Russia's economy ministry is expecting the economy to move into recession next year, but it is clear that a downturn is already becoming entrenched. PMI data showed the service sector contracting at the steepest rate since 2009, reflecting weakened domestic demand. Manufacturing output rose, largely due to import substitution, but not enough to offset the service sector downturn.

The PMI readings for the fourth quarter so far indicate that the economy could contract by as much as 1%. The most recent GDP data showed the annual pace of economic growth sliding to 0.7% in the third quarter, the slowest since 2009. Markit's Business Outlook survey also showed companies' optimism about the year ahead hitting a post-global financial crisis low, boding ill for business prospects in 2015.

The outlook is further darkened by the collapse in oil prices. Oil prices have dropped from a peak of $115 per barrel earlier in the year to $63. The energy sector accounts for 16% of Russia GDP and more than two-thirds of its export revenue.

Bond market stress

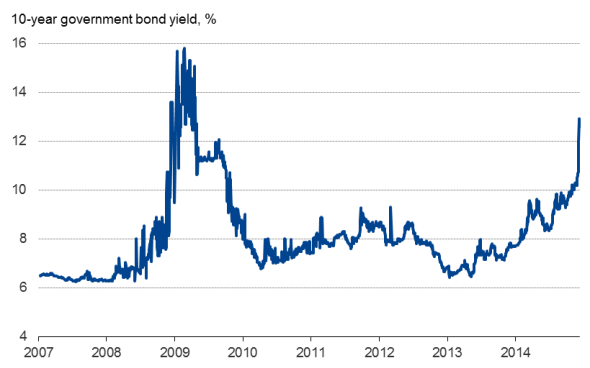

The damage to the economy is being reflected across the bond market, and is also holding down equities. Russia's borrowing costs have risen alongside growing worries about its ability to repay its debt, given weak oil revenues and the collapse of the ruble. Some three quarters of which is dollar denominated. The yield on 10-year government bonds has almost doubled over the past year, leaping from under 7% at the start of 2014 to a five-year high of almost 13%.

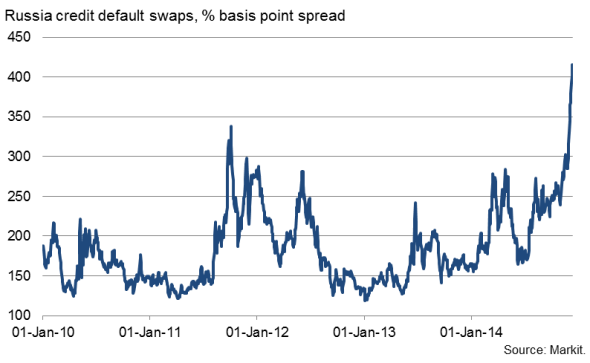

The cost of insuring against Russia defaulting on its debt has also risen. Spreads on Russian credit default swaps have jumped by almost 200 basis points since October, according to Markit, and trading volumes in Russian CDS have been among the highest of all countries in recent weeks.

Government borrowing costs

Equities underperform

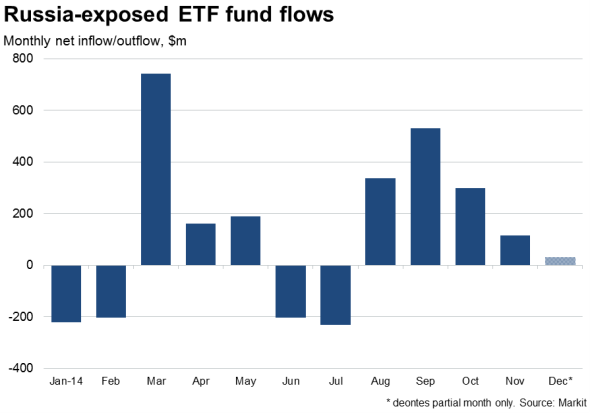

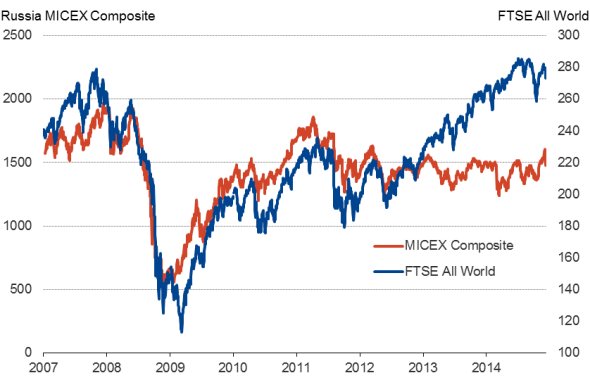

The Moscow stock market has held up reasonably well, given the headwinds facing the Russian economy, though the MICEX Composite Index has lagged well behind global equities on average over the past two years. While investors have been nervous about Russia's relationship with the West, sentiment has improved on the back of Russia's ties to the East. However, inflows into exchange-traded funds exposed to Russia have almost dried up as investors appear to have grown increasingly nervous. December has so far seen inflows of just $30m. Although 2014 as a whole has seen inflows of $1.5bn, net outflows were recorded in four months, highlighting the level of investor uncertainty around the situation in Russia.

Markit's dividend forecasting team is also expecting a disappointing year for Russian companies' pay-outs, with barely any increase in dividend payments among MICEX50 companies compared to a 32% increase last year. Next year could easily be far worse for Russian companies, if the economic climate continues to deteriorate.

Facing numerous headwinds which include a recession, spiralling prices, a weakened currency, ongoing sanctions and a sharp reduction in oil revenues, Russia poses one of the major risks to the stability of the global economy in 2015.

CDS market

Equities

Central bank foreign currency reserves

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122014-Economics-Russia-s-economic-outlook-darkens-as-central-bank-hikes-interest-rates.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122014-Economics-Russia-s-economic-outlook-darkens-as-central-bank-hikes-interest-rates.html&text=Russia%27s+economic+outlook+darkens+as+central+bank+hikes+interest+rates","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122014-Economics-Russia-s-economic-outlook-darkens-as-central-bank-hikes-interest-rates.html","enabled":true},{"name":"email","url":"?subject=Russia's economic outlook darkens as central bank hikes interest rates&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122014-Economics-Russia-s-economic-outlook-darkens-as-central-bank-hikes-interest-rates.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Russia%27s+economic+outlook+darkens+as+central+bank+hikes+interest+rates http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122014-Economics-Russia-s-economic-outlook-darkens-as-central-bank-hikes-interest-rates.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}