Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 12, 2015

Uncovering sector returns

Passive indexing has been the way to play the recent bull market, but a one size fits all investment strategy has missed key market shifts as evident by the findings of the Markit Research Signal Sector Rotation model.

- The model highlighted how Energy, Materials and Cyclical goods were the sectors to avoid ahead of the recent oil price and natural resources rout

- It delivered returns spreads ranging from 0.50% monthly to 8.05% annually, with favourable performance continuing in recent months Sector investing has surged in popularity with ETF AUM surpassing $300bn last year after record inflows

Sector investing affords investors a compromise between the passive indexing strategies and active stock picking by expressing a market view through buying groups of shares which stand to benefit most from market circumstances, while still retaining the diversification afforded by investing in many shares at once. While passive indexing has proved the popular way to play the recently rebounding bull markets, having a uniform view of the market is a hard compromise for many investors to make.

This holds especially true in the wake of the recent collapse in oil prices, which is arguably the largest single "alpha" event since the financial crisis. Energy shares have tumbled while the likes of industrials and consumer focused shares have surged ahead.

The varying fortunes of differing sectors are evident by the consistent performance of the recently launched Markit Research Signal Sector Rotation model, a multi factor model which selects sectors on a variety of fundamental, economic and sentiment factors to select the European sectors which have historically performed well in given market circumstances (see appendix for further details).

The model's strong performance over the last few years does take some of the shine off passive indexing as it demonstrates that consistent alpha can be found in broad based sector allocation.

Model performs strongly

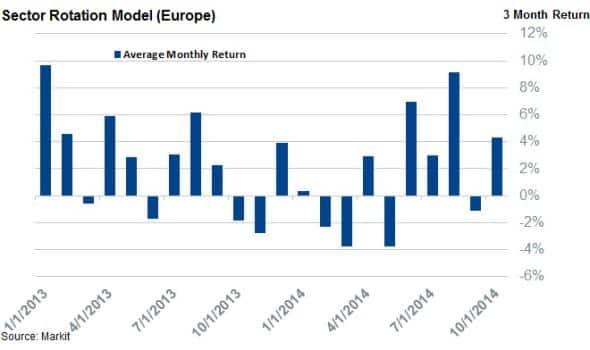

Since the start of 2013, the sector rotation model has performed strongly with a three month average spread between favourable and unfavourable sectors of 2.15%.

All four modules have had positive performance since then, with the economic and sentiment modules performing better than the overall model with a 2.34% and 2.59% return spread respectively between the long and short portfolios.

At a sector level, energy and basic materials currently rank unfavourably on a mix of metrics, while financials and tech display favourable characteristics.

Energy prices drive recent returns

Most recently, the model picked out energy as a sector poised for potential underperformance in October 2014. The sector scored poorly on momentum, sentiment and fundamental modules making it the worst ranked sector among the European universe.

This would have paid out for investors, as the oil price collapse seen in the last few months has seen these shares severely underperform the rest of the market. In the ETF space, the Lyxor Stoxx 600 Oil and Gas ETF has seen its performance over the last three months fall 9.5% below that of the overall index.

Industrials on the other hand have largely benefitted from the fall in oil prices, something that the model looks to have correctly picked out as these shares scored strongly in the sentiment and fundamentals modules. The Lyxor Industrial Goods and Services ETF outperformed its oil and gas peer by over 11.5% in the last three months.

Utilities have also managed to outperform oil and gas names in the last three months in the wake of falling input costs.

Investors have grown to embrace sectors

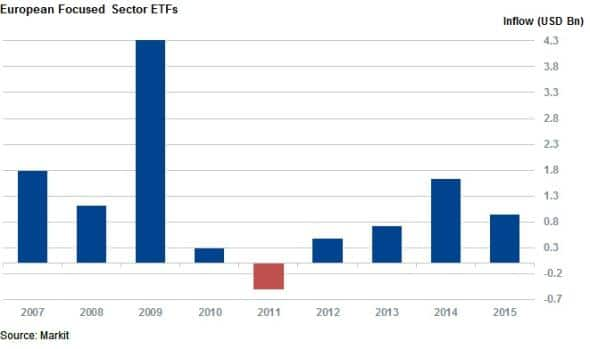

Investor sentiment also looks to favour a sector approach as evidenced by Europe focused sector funds having experienced their strongest yearly inflows since 2009 in 2014. This trend looks set to continue as the 163 sector products focused on Europe have seen just under $1bn of inflows in the opening five weeks of the year.

Apendix: Model description

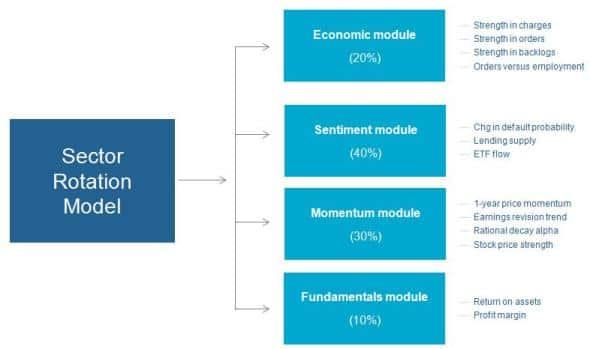

The Sector Rotation Model is driven by four sub-modules which gauge current Economic, Sentiment, Momentum and Fundamental forces currently experienced by companies in a sector. The model picks out the three best and worst sectors based on a variety of top-down and bottom-up signals.

While investors will largely be familiar with the momentum and fundamental indicators, the sentiment and economic modules are innovative in that they use proprietary datasets to gain valuable insights.

The economic module uses the Markit sector PMI surveys; among the most closely watched business surveys in the world which provide up-to-date, accurate and often unique monthly indicators of economic trends. The surveys are aggregated to the sector level to identify trends.

The sentiment module draws on ETF flows and institutional ownerships collated by Markit.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022015-Equities-Uncovering-sector-returns.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022015-Equities-Uncovering-sector-returns.html&text=Uncovering+sector+returns","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022015-Equities-Uncovering-sector-returns.html","enabled":true},{"name":"email","url":"?subject=Uncovering sector returns&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022015-Equities-Uncovering-sector-returns.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Uncovering+sector+returns http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022015-Equities-Uncovering-sector-returns.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}