Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 12, 2015

CMBS bounce back with steady returns

The market for Commercial Mortgage Backed Securities (CMBS) has rebounded strongly from the financial crisis both in terms of issuances and trading.

- CMBS issuance has jumped seven fold in the last five years; forecast to exceed $100bn in 2015

- The CMBS Current AAA index tranche of the Markit iBoxx Trepp CMBS index family has performed in line with AAA corporates, but seen lower volatility

- CMBS is relatively untapped in the ETF space, but the one fund that tracks the asset class has seen its AUM jump

CMBS are bonds which are backed by mortgages ranging from retail properties, office blocks, apartment blocks and hotels. They are poised to witness another strong year of issuance as investors continue to be drawn to the asset class' strong track record in the wake of the financial crisis.

Resurgence

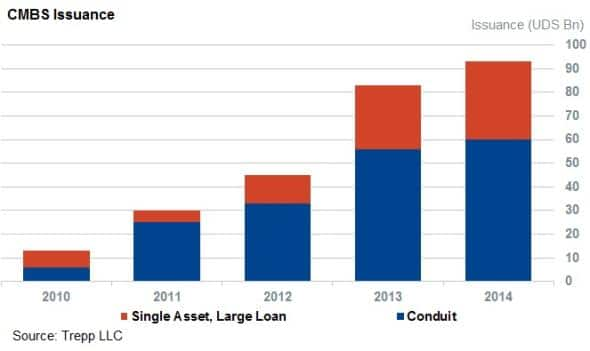

The low interest rate environment has made these asset backed securities attractive to yield starved investors. Issuances all but halted in 2009, but last year's total of $93bn marked a seven fold increase from the 2010 levels. This strong momentum is expected to continue in the coming year according to Trepp, the leading provider of information and analytics to the global CMBS market, which is forecasting issuance to reach $130bn in 2015.

The health of the current market is evidenced by the resurgence in conduit CMBS issuances which are packaged deals made up of pooled loans. Conduit issuances are expected to jump by more than 50% this year when compared to 2014 levels. While the market initially relied on large single borrower loans, there has been a resurgence of loans which are packaged into investments conduits. These were responsible for the majority of issuances prior to the recession and made up over half of all new issuances last year.

Despite the increased complexity associated with conduit issuance, their popularity in today's rejuvenated CMBS market highlights the resilience of the origination and underwriting process which practically halted in the three years following the financial crisis.

Market performs strongly

The CMBS markets' strength is also reflected in the performance of the Markit iBoxx Trepp CMBS Index family. While CMBS were negatively impacted by the financial crisis, the asset class managed to regain all of the lost ground over 2009 and has since gone on to outperform dollar denominated investment grade corporate credit.

The recent performance has seen AAA rated CMBS issues provide investors with the same total return as AAA rated corporate debt, but in a much less volatile way. The deviation of daily returns of the AAA rated portion of the Markit iBoxx Trepp CMBS Index has been a third lower than that of USD AAA Corporate since 2010.

This low volatility reflects the fact that current CMBS benchmarks have a lower duration than reference corporate bond indexes. The benchmark CMBS index has a modified duration of 3.4 years as opposed to 5.9 years for the reference investment grade index.

It is worth highlighting that this lower annualised duration does not come at the expense of yield, which trades at 3.13% against 2.6% for the reference investment grade benchmark.

ETF potential

While the CMBS market is still largely the remit of specialist market participants, the one ETF exposed to the asset class has proved popular since its launch in 2012. The iShares CMBS ETF (CMBS) saw its AUM surpass the $100m mark last summer.

In terms of performance, the CMBS ETF has provided similar returns to the iShares Aaa-A Rated Corporate Bond ETF since 2012, but with much less volatility in daily total return.

While the lone CMBS fund remains niche, the emergence of representative transparent benchmarks, such as the Markit iBoxx Trepp CMBS Index family, will no doubt make the asset class more accessible for ETF issuers and market participants.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12032015-Credit-CMBS-bounce-back-with-steady-returns.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12032015-Credit-CMBS-bounce-back-with-steady-returns.html&text=CMBS+bounce+back+with+steady+returns","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12032015-Credit-CMBS-bounce-back-with-steady-returns.html","enabled":true},{"name":"email","url":"?subject=CMBS bounce back with steady returns&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12032015-Credit-CMBS-bounce-back-with-steady-returns.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=CMBS+bounce+back+with+steady+returns http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12032015-Credit-CMBS-bounce-back-with-steady-returns.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}