Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 12, 2015

Employment fall casts shadow over UK labour market outlook

The latest official labour market report brought a raft of disappointing news, with unemployment remaining unchanged, employment falling and headline pay growth slipping lower. Sterling has consequently taken a hit as expectations of when the Bank of England will hike rates have been pushed back.

However, regular pay growth remains on a firm upward trend as the labour market continues to tighten. Rising skill shortages are pushing pay higher, with the second quarter seeing upturns in pay growth compared to the first quarter in all major business sectors.

With the Bank of England firmly focused on pay growth in coming months with regards to when to start tightening policy, the MPC may become increasingly worried that pay is rising faster than anticipated.

Employment falls

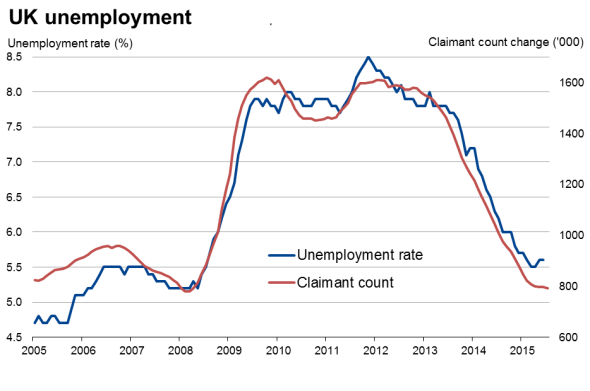

UK unemployment held steady at 5.6% in the three months to June, having risen in May for the first time in one-and-a-half years.

Employment meanwhile fell 63,000 in the second quarter, and looks set to slip further in July, with the latest recruitment industry survey showing the number of people placed in permanent jobs hitting a 26-month low at the start of the third quarter. Moreover, the Markit/CIPS PMI business surveys showed employment rising at the slowest rate for almost two years in July.

The doves at the Bank of England will therefore see the labour market data as confirmation that the economy has started to slow. However, some of the weakening in the employment trend is simply due to companies being unable to find suitable staff as skill shortages are becoming increasingly prevalent.

Source: ONS via Ecowin

Pay growth and vacancies

Recruitment agencies continue to report a marked worsening of staff availability. Note also that the official data showed job vacancies rising in June to one of the highest levels on record, hardly a sign of weakening demand for staff. The problem is that, at 2.5, the number of unemployed people per vacancy is running at its lowest level since 2008.

A drop in the number of people claiming jobless benefits in July also suggests that worries about the economy slowing again are premature at this stage, and instead the UK economy remains in good health at the start of the third quarter. PMI data point to a 0.6% quarterly rate of GDP expansion.

Pay growth accelerates in the second quarter

Ignore one-off bonuses, and the data show that this tightening of the labour market has been accompanied by an increase in pay pressures. Regular pay was 2.8% higher than a year ago in the three months to June, unchanged on the rate seen on the three months to May but there's an upward trend clearly evident in the data. By comparison, wages were just 2.3% higher than a year ago in the first quarter, and wind the clock back a year and pay was rising at a miserable rate of 0.7%.

Private sector pay growth was up 3.3% in the three months to June, down from 3.4% in May but still an impressive improvement by recent standards.

The three months to June has been the strongest calendar quarter for pay growth (for all employees and the private sector) in since 2008.

There are pockets of especially strong pay growth, notably in the business & financial services sector, which is also leading the economic upturn, where regular pay rose 4.3% on a year ago in the second quarter, up from 3.2% in the first quarter.

In fact, pay growth accelerated between the first and second quarters in all major sectors of the economy with the exception of the public sector, where it held steady at 1.3%. Retail, hotels & restaurants saw a +4.0% increase (+3.2% in Q1), construction pay was up +2.7% (+1.6% in Q1), and even the struggling manufacturing sector saw a +1.3% rise (+0.7% in Q1).

Once we take account of compositional effects, whereby the addition of more lower paid workers into the labour market via mechanisms such a migration are estimated to have reduced average wage growth by almost 1% in recent months, it's easy to see why some policymakers are getting nervous about pay growth.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082015-Economics-Employment-fall-casts-shadow-over-UK-labour-market-outlook.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082015-Economics-Employment-fall-casts-shadow-over-UK-labour-market-outlook.html&text=Employment+fall+casts+shadow+over+UK+labour+market+outlook","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082015-Economics-Employment-fall-casts-shadow-over-UK-labour-market-outlook.html","enabled":true},{"name":"email","url":"?subject=Employment fall casts shadow over UK labour market outlook&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082015-Economics-Employment-fall-casts-shadow-over-UK-labour-market-outlook.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Employment+fall+casts+shadow+over+UK+labour+market+outlook http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082015-Economics-Employment-fall-casts-shadow-over-UK-labour-market-outlook.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}