Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 12, 2016

Brexit trading update

The sinking pound and domestic uncertainty has lifted UK stocks with overseas revenue profiles and short sellers taking notice.

- UK stocks with overseas revenue exposure have outperformed domestically exposed peers

- Poor value fundamental, low momentum stocks with domestic exposure favoured by shorts

- Short interest across FTSE 350 has jumped by 15% since the referendum

To get a full copy of our Brexit trading update please email Comms@markit.com

The one silver lining to come out of the first post Brexit Markit UK Manufacturing PMI survey was a slight pickup in export orders as overseas buyers took advantage of the plunging pound. This delivered little in the way of relief however, as both services and manufacturing indicated that economic growth stalled in the wake of the referendum. While the relative resilience of exports was ultimately unable to jolt the UK from a post Brexit slump, the phenomenon is helping lift UK shares which derive a high proportion of their business overseas past their domestically exposed peers.

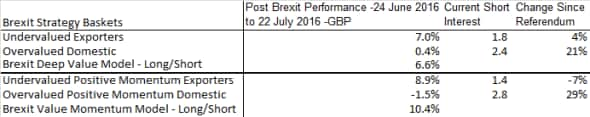

Back in early June, we posted that investors would be best protected from the worst of the post referendum volatility by positioning themselves in baskets of UK shares which derive a high proportion of their revenues from outside the UK and European Union. This strategy is playing out in the weeks since the referendum as the export baskets of both the deep value and value momentum strategies have outperformed the domestically exposed UK peers.

Most of the post Brexit performance on both strategies has been delivered by surging exporters as the undervalued exporters basket surged by 7% in the month since the vote, while undervalued positive momentum exporters were up by an even more impressive 8.9% over the same period of time.

Short sellers pile in

The underperformance of domestically exposed firms has not gone unnoticed from short sellers as the domestically exposed basket of shares across both strategies has seen a large rise in shorting activity in the six weeks since the referendum. Exporters on the other hand have seen little in the way of shorting activity with short sellers covering their positions among the firms that make up the strong momentum undervalued basket.

Overvalued firms with poor share price momentum have proved to be the short favourite as this basket of shares has seen a 29% jump on average shorting activity since the referendum. These firms include heavily shorted retailers such as Sainsbury's and Tesco as well as service providers such as Whitbread and the AA who now have 2.8% of their shares shorted on average.

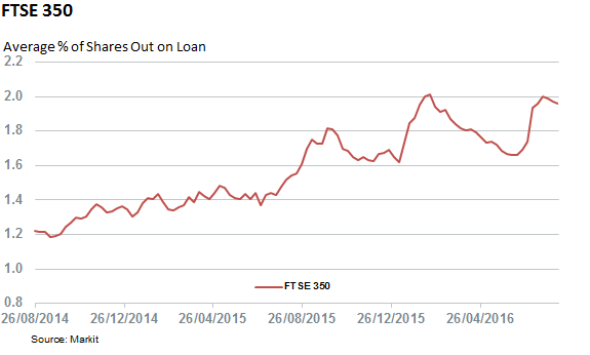

This surge in demand to short domestically exposed UK firms now means that short sellers were more active in the FTSE 350 index in the weeks following the referendum than at any time in the last two years.

While the average short interest across the index has tapered off somewhat in the last two weeks, the current demand to sell the index short is still over 15% higher than on the eve of the referendum which indicates that short sellers are not going anywhere.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082016-equities-brexit-trading-update.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082016-equities-brexit-trading-update.html&text=Brexit+trading+update","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082016-equities-brexit-trading-update.html","enabled":true},{"name":"email","url":"?subject=Brexit trading update&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082016-equities-brexit-trading-update.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Brexit+trading+update http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082016-equities-brexit-trading-update.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}