Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 12, 2014

Bank of England retains upbeat economic outlook but cuts inflation forecast

The Bank for England downgraded its outlook for inflation over the coming year, pushing sterling lower as investors digested the message from the latest quarterly Inflation Report that there is less chance of any interest rate hikes happening until the second half of next year.

Inflation projections revised down

In a major downward revision to the Bank's projections, inflation is now expected to dip below 1% in coming months, forcing the Bank's governor Mark Carney to write a letter to the Chancellor explaining why the rate has fallen more than 1% below the 2% target. That letter will attribute the decline mainly to lower global commodity prices, which are currently running 10% lower than a year ago, with oil down 20%, as well as lower import costs arising from sterling's appreciation, weak wage costs and intense price competition among UK supermarkets.

The Bank estimates that inflation is likely to remain close to 1% over the course of the next year, only rising to 2% at the end of the three-year forecast horizon.

Robust growth outlook

The Bank left its economic growth forecasts largely unchanged, but only because a more benign outlook for interest rates will offset weakness caused by slower growth abroad.

Since the August report, market projections for interest rates have fallen (with five-year real rates down by around 0.5%). The additional stimulus implied by the looser policy scenario is expected to counter what Carney described as the "spectre of economic stagnation that is now haunting Europe". The Governor's sombre assessment of eurozone prospects was confirmed by data also published today showing euro area industrial production fell 0.4% in the third quarter. PMI data point to the malaise extending to the wider economy, and into the fourth quarter.

A faster than expected slowing in the domestic housing market and weaker than previously anticipated growth of investment will act as additional factors offsetting the boost from the Bank not having to raise interest rates as much as the markets had previously estimated.

GDP is consequently expected to rise by 3.5% this year, 2.9% in 2015 and 2.6% in each of the following two years.

Global PMI surveys

Too rosy?

The lack of any downward revisions to the growth outlook is somewhat surprising, and is perhaps an area where the Bank's projections may prove too optimistic.

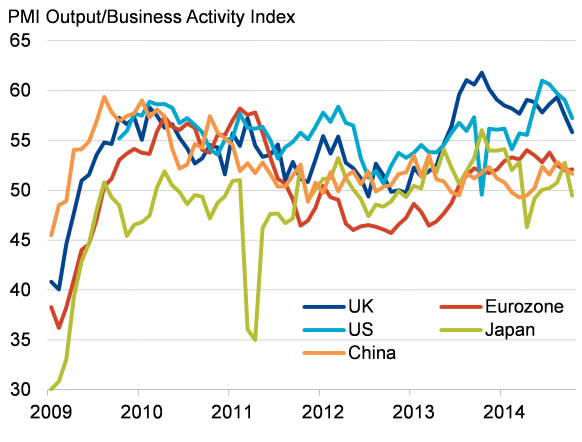

First, signs of weakening economic growth are by no means confined to the euro area. PMI survey data showed global economic growth slowing sharply to a six-month low in October, reflecting weakening trends in all major developed and emerging markets with, ironically, the sole exception of the eurozone, where the rate of growth was largely unchanged on September's 10-month low.

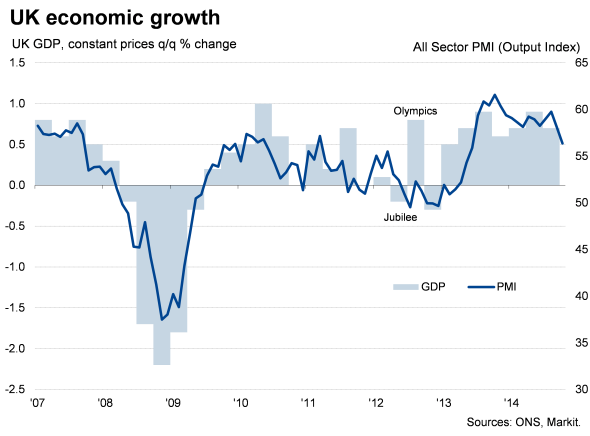

Second, UK economic growth is also showing signs of slowing sharply. The Markit/CIPS UK PMI surveys showed the slowest rate of expansion for 16 months in October. Importantly, this was not only due to the knock-on effect of weak overseas demand hitting exports, but was also due to a significant slowing in the services economy.

Any further slowing in the rate of growth from October, for which the PMI data were consistent with GDP growth of around 0.5%, represents a downside risk to the Bank's growth outlook.

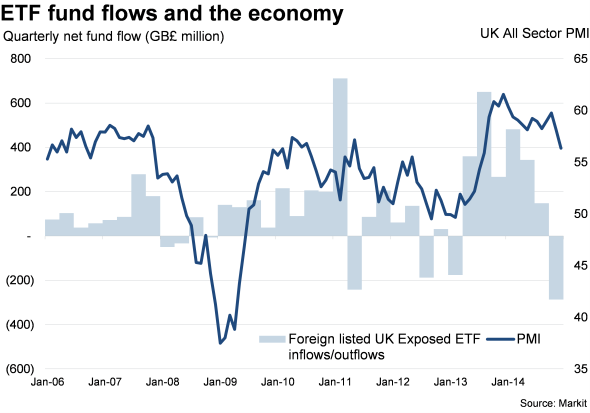

The fact that UK-focused exchange traded funds have seen record outflows from other countries suggests that many investors are taking a more pessimistic view of the UK's economic outlook than the Bank of England.

Note Q4 2014 based on data only to 6 November.

Don't underestimate the hawks

However, while the possibility of the Banks' economic growth projections proving too optimistic paints an even more dovish picture for interest rates, the possibility of increasing numbers of the Monetary Policy Committee voting for higher interest rates in coming months cannot be ruled out, especially given recent labour market trends.

Carney notes that there remains a wide range of views among the MPC members in relation to the amount of unused capacity that exists in the economy. Two of the nine members have already voted to hike rates in recent meetings, worried in particular that wage growth could soon spike higher and leave the Bank behind the curve in tightening policy, ultimately requiring higher interest rates in the future.

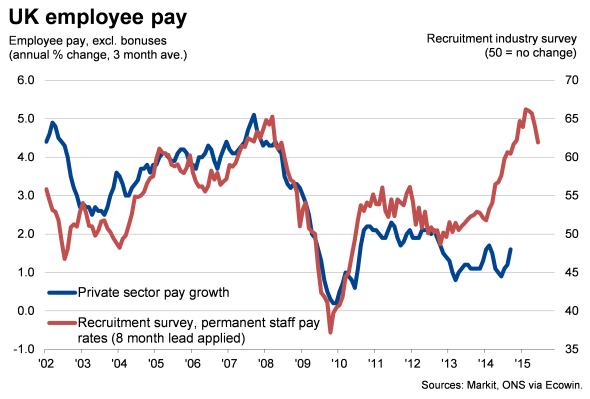

While worries about rising wage growth have proved unfounded so far in the recovery, the hawks will be worried by data showing wage growth picking up to 1.3% in the three months to September, fuelled by a 1.6% rise in the private sector. Regular pay in fact rose 1.8% on a year ago in September alone. While still subdued by historical standards, the upturn in pay growth makes the Bank's projections of pay not rising at an annual rate of 2% until the end of next year look too complacent.

With the Bank unable to explain quite why pay growth has remains so low, despite the rate of unemployment tumbling over the past year, suggests that the Bank's projections for wage growth should be treated with extra caution. In particular, a lack of understanding as to why pay growth faded again after showing signs of life earlier in the year, and whether this was due to temporary or longer-term structural factors, leaves nagging worries that a spike in pay growth next year, as signalled by survey data, remains a distinct possibility.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12112014-Economics-Bank-of-England-retains-upbeat-economic-outlook-but-cuts-inflation-forecast.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12112014-Economics-Bank-of-England-retains-upbeat-economic-outlook-but-cuts-inflation-forecast.html&text=Bank+of+England+retains+upbeat+economic+outlook+but+cuts+inflation+forecast","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12112014-Economics-Bank-of-England-retains-upbeat-economic-outlook-but-cuts-inflation-forecast.html","enabled":true},{"name":"email","url":"?subject=Bank of England retains upbeat economic outlook but cuts inflation forecast&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12112014-Economics-Bank-of-England-retains-upbeat-economic-outlook-but-cuts-inflation-forecast.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bank+of+England+retains+upbeat+economic+outlook+but+cuts+inflation+forecast http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12112014-Economics-Bank-of-England-retains-upbeat-economic-outlook-but-cuts-inflation-forecast.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}