Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 13, 2015

Global investment swings in early 2015 follow divergent policy outlooks

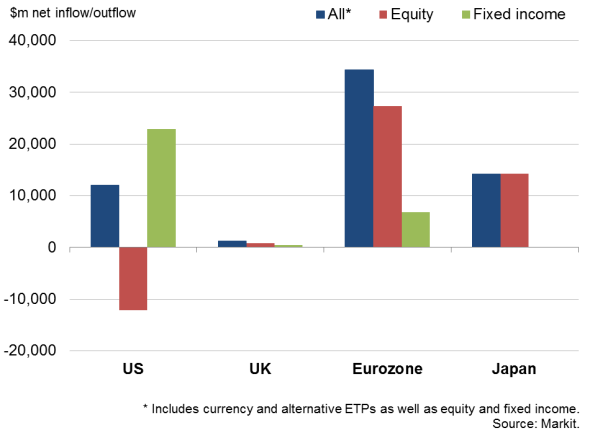

The year to date has seen major shifts in investor sentiment as outlooks diverge among the world's main economies. Investors have piled into the eurozone, as well as Japan and the UK, but have pulled out of US equities.

Investors seek eurozone exposure

The investment flows are following economic policymaking. Most notable has been the change in sentiment towards the eurozone. With inflation falling negative in early 2015, the European Central Bank has finally fired up its printing press, with a target of buying at least €1.1 trillion of assets. The new stimulus has come at a time when the economy is already showing some signs of life. The eurozone PMI surveys signalled a pace of expansion not exceeded since the first half of 2011 in March. Suddenly the region is seen as the next big opportunity for the markets. Whereas investors had shunned the eurozone in 2014, exchange-traded funds exposed to the region have seen record inflows in 2015, according to Markit.

Exchange-traded fund flows, Q1 2015

Japan ETFs see biggest inflows since advent of Abenomics

In Japan, last year's bungled sales tax rise has also meant central bank money printing looks set to last longer than previously anticipated, boosting the corporate outlook, especially for exporters, who are benefitting from the falling yen. Japan is showing few signs of meaningful recovery from the recession induced by the tax rise, with PMI survey data showing a renewed decline in March. Increasing numbers of analysts think the authorities will need to do more to meet the government's goal of beating deflation.

ETFs exposed to Japan have therefore seen the biggest inflows since early 2013, when the markets surged on the announcement of the government's new 'Abenomics' stimulus.

Inflows return to UK funds

In the UK, the policy picture is not quite so straightforward. Last year, strong economic growth led to increased expectations of a hike in interest rates by the Bank of England. ETFs consequently saw record net outflows in the fourth quarter as investors worried about the corporate outlook. However, while underlying economic growth appears to have remained robust so far this year, inflation in the UK has fallen to zero, an all-time low, and pay growth remains disappointingly weak. UK policymakers are no longer making noises about an imminent hike in interest rates. Cheered by the 'Goldilocks' outlook of robust economic growth and record-low interest rates, investors have ploughed back into UK-exposed ETFs, with record inflows from abroad so far this year.

US equity ETFs post record outflow

It's a different story in the US, however, where central bankers are split on when to hike interest rates. Some have already stated a preference for a rise in June while others consider it better to wait, citing low inflation. However, US rate setters are unanimous in believing is that the next move in rates will be up; it's just the timing that's uncertain, and expectations have risen that it will be this year. Forward-looking survey data indicate that growth is reviving, the slowdown at the start of the year most likely the result of temporary factors including extreme weather and port strikes.

The prospect of higher US interest rates has consequently pushed up the dollar. However, a stronger dollar hits overseas earnings by US companies, denting investor appetite for US equities. ETFs designed to give investors an exposure to US equities saw their biggest quarterly net outflow on record in the first three months of 2015 as a result.

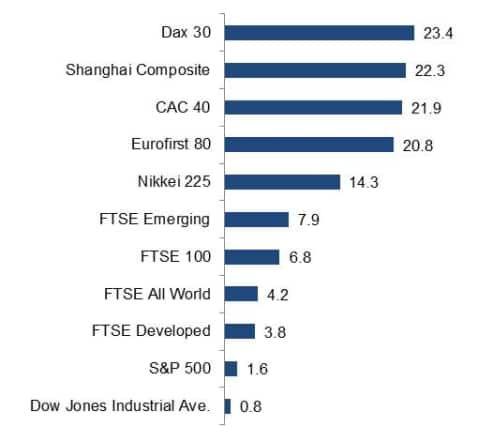

These investment flows mean European and Japanese equity markets have been pushed to their highest for around 15 years, catching up with US markets. The German Dax, for example, is up 23% so far this year, while the Nikkei is up 14%. The Dow Jones Industrial Average, in contrast, is not even up 1%.

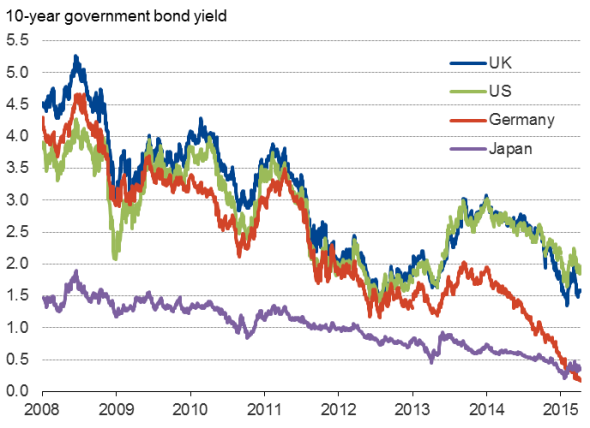

Bond markets are also at record highs in many cases, with yields (inversely related to price) falling negative for increasing varieties of European debt, according to Markit's bond data.

Equity index movements in 2015

Government borrowing costs

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042015-Economics-Global-investment-swings-in-early-2015-follow-divergent-policy-outlooks.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042015-Economics-Global-investment-swings-in-early-2015-follow-divergent-policy-outlooks.html&text=Global+investment+swings+in+early+2015+follow+divergent+policy+outlooks","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042015-Economics-Global-investment-swings-in-early-2015-follow-divergent-policy-outlooks.html","enabled":true},{"name":"email","url":"?subject=Global investment swings in early 2015 follow divergent policy outlooks&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042015-Economics-Global-investment-swings-in-early-2015-follow-divergent-policy-outlooks.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+investment+swings+in+early+2015+follow+divergent+policy+outlooks http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042015-Economics-Global-investment-swings-in-early-2015-follow-divergent-policy-outlooks.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}