Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 13, 2015

New India leads Brics' credit prospects

Nearly one year into the tenure of India's new government, growing forecasts of economic success have helped the country jump ahead of its emerging market peers.

- Indian government ten year rates have fallen by 114bps since Modi's inauguration

- iBoxx GEMX India index has seen 16 consecutive months of positive total return

- Indian US dollar corporate debt continues to outperform emerging market peers

This May will mark the one year anniversary of Narendra Modi as Prime minister of India. The leader of the BJP party has a stellar economic record as chief minister of Gujarat and investors, buoyed by the prospect of these results being translated on a national level, have reacted positively. As a result India's benchmark equity index, the Sensex, is up 30% over the past 12 months.

India's sovereign bonds are also reflecting this increased investor appetite as yields have fallen since the start of Modi's tenure. The BBB rated nation has seen its ten year government bonds tighten by 114bps to yield 7.86% since he entered office.

Modi's government has promised to make India's business environment more accommodating and this new approach has started to filter through into credit markets. Policies proposed so far include simplifying the process of foreign investment, loosening the regulatory regime for investors and promoting infrastructure development.

Prospects for further credit strengthening remain strong. India's growth remains positive, with the government forecasting GDP growth to top 8% in 2016. Inflation has fallen to below 6% from over 13% in 2013. Expectations for additional action from policy makers and room for further monetary easing also bolster India's sovereign credit prospects.

Leading the Bric pack

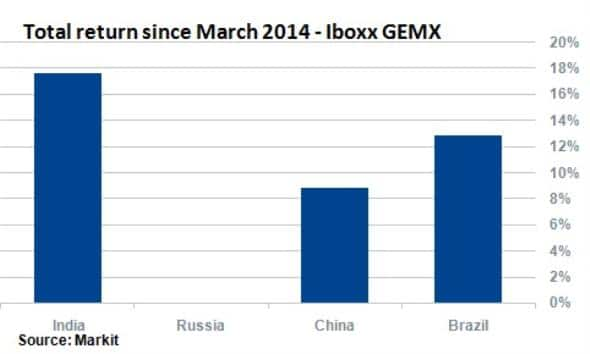

This bullish run sets India apart from the rest of its Bric peers. This is evident in the returns gained, and can be seen in the iBoxx GEMX Index family, which incorporates bonds issued by central governments in local currency.

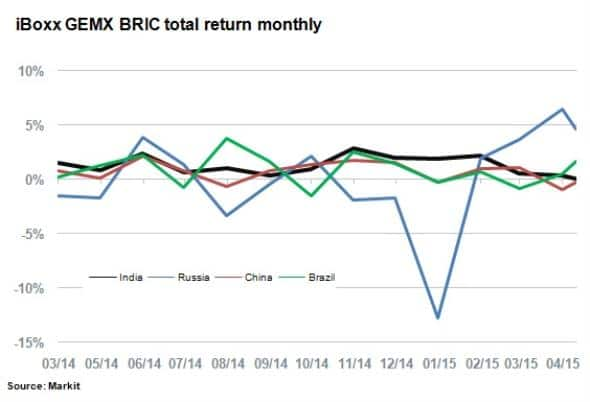

Indian bonds have generated positive returns for 16 consecutive months. Indian bonds had an especially strong run from October to January 2014, when monthly total returns averaged 2.2%. This was in sharp contrast to fellow Bric nations, whose investors experienced far greater volatility, often seeing negative monthly returns over the period.

Indian bonds have been the top performers among the Bric nations, returning 17.6% over the last 12 months compared to 8.9% and 12.9% for China and Brazil respectively. Russia, which has so far seen resurgence in 2015, is still only flat overall over the last 12 months.

Some of this disparity can be attributed to declining commodity prices, with major exporters like Russia and Brazil seeing their fiscal positions and associated credit rating come under threat as commodities prices fall. India on the other hand is a net importer of oil so stands to gain from an improved fiscal position. India has outperformed due to its improved macro outlook and pro-growth reforms, while China has seen its growth outlook slashed.

Corporate outlook positive

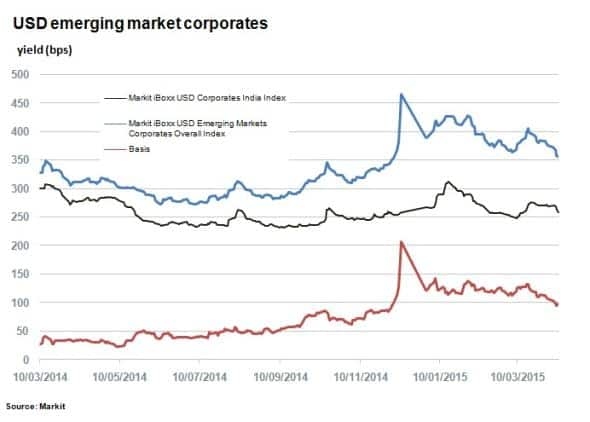

The Modi effect has also been positive for corporations, as their credit spreads have come down.

The Markit iBoxx USD Corporates India Index has declined from yielding 300bps over US treasuries in March 2014 to 257bps at present. Over the same period, the Markit iBoxx USD Emerging Markets Corporates Overall Index has widened from 327bps to 255bps over US treasuries. The basis between the indices stands at three times the number of bps compared to one year ago.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042015-credit-new-india-leads-brics-credit-prospects.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042015-credit-new-india-leads-brics-credit-prospects.html&text=New+India+leads+Brics%27+credit+prospects","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042015-credit-new-india-leads-brics-credit-prospects.html","enabled":true},{"name":"email","url":"?subject=New India leads Brics' credit prospects&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042015-credit-new-india-leads-brics-credit-prospects.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=New+India+leads+Brics%27+credit+prospects http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042015-credit-new-india-leads-brics-credit-prospects.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}