Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 13, 2015

Emerging market malaise drags global business confidence to post-crisis low

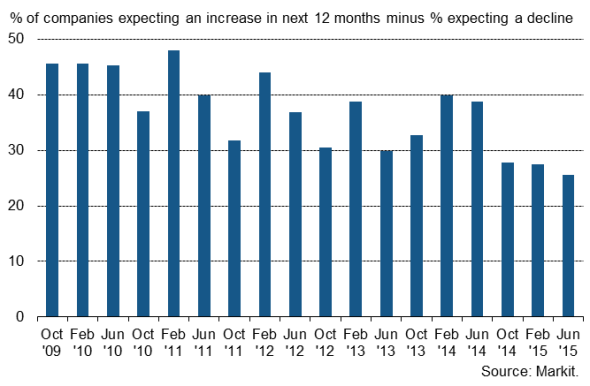

The Markit Global Business Outlook Survey, which looks at expectations for the year ahead across 6,500 companies, found corporate optimism to have dipped to a post-financial crisis low in June.

The number of companies expecting their business activity levels to rise over the coming year outnumbered those expecting a decline by 26%, but that's down from a net balance of +39% this time last year, with optimism having steadily waned over the course of the past 12 months.

Global business activity future expectations

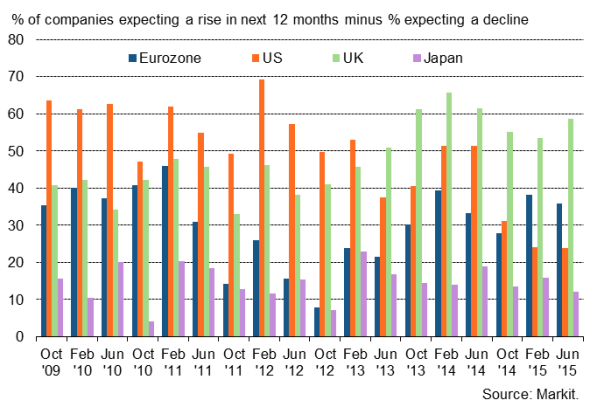

Confidence among the largest emerging market economies sank to a new low in the survey's six-year history, and held at a post-recession low in the US. In the developed world, only the UK saw improved sentiment about the year ahead.

US optimism stuck at post-recession low

Optimism in the US - which has been a major driver of the global economic recovery in recent years - remained stuck at the post-recession low seen in the prior (February) survey, with a net balance of +24%. Confidence picked up slightly in services but fell to a new low in manufacturing, where firms expect to continue to be hit by the strong dollar. The prospect of rising interest rates and increased government regulation were also commonly cited threats for business over the coming year.

UK optimism highest of all major countries

Of the major economies, UK firms remained the most buoyant about the year ahead, with optimists exceeding pessimists by some 59%, the highest reading for a year. Service sector firms saw a particular upturn in confidence, largely reflecting an easing of uncertainty following the general election result. However, UK firms cited concerns over 'Brexit', 'Grexit', higher interest rates, government spending cuts and the exchange rate as key threats to the outlook.

Eurozone confidence wanes

In fact, of all the countries surveyed, only Ireland saw greater optimism than the UK (a net balance of +67%, unchanged on earlier in the year), highlighting the likelihood of Ireland's economy continuing to boom in 2015. However, although confidence improved in France, to the highest since February 2014 (with a net balance of +23%), optimism fell in Germany, Italy and Spain (net balances of +37%, +37% and +50% respectively), causing the overall level of confidence across to the eurozone to slip from February's one-year high (down from +38% to +36%).

Uncertainty linked to Greece's future in the Eurozone, and the spread of political instability to other countries, rising costs associated with a weakened euro and the ongoing political situation with Russia were seen as key risks to the single currency's outlook.

Japan sees optimism fade to two-and-a-half year low

Business confidence also fell in Japan, down to one of the weakest levels since the financial crisis. The survey net balance of +12% was the lowest seen since late-2012. Sentiment deteriorated in both manufacturing and services, the former sliding to a two-and-a-half year low despite the competitive boost provided by the weakened yen. In fact, the weak yen was commonly cited as a major threat to business over the coming year as costs would be boosted via rising import prices, especially for energy.

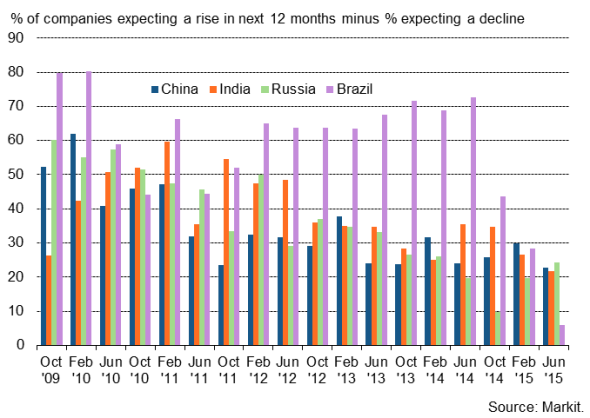

Emerging market malaise deepens

Business confidence among the four largest ('BRIC') emerging markets fell to the lowest seen since survey data were first collected in early-2009. Russia bucked the trend, with optimism reaching its highest since early-2014, as companies sought to gain from import substitution and some signs of the economy stabilising, but new post-crisis lows were seen in China, India and Brazil.

China sentiment at new low

Optimism in China meanwhile slid to a post-crisis low, led by a drop manufacturing sentiment to its weakest since late-2011. Service sector confidence also deteriorated, hitting a one-and-a-half year low. Companies reported sluggish demand, tough competition, weak pricing power and instability due to recent financial market stress as major threats to the outlook.

Business confidence collapses in Brazil

The lowest degree of optimism anywhere in the world was recorded in Brazil, where the number of optimists exceeded pessimists in terms of business activity over the coming year by just 6%, down sharply from +28% in February and an average of 61% over the prior six year survey history. The biggest collapse in confidence was seen in the services sector, though manufacturers' optimism remained stuck at the lowest seen since the height of the global financial crisis in early-2009.

Long-term trends in expected future business activity levels in key economies

Key developed economies

Key emerging markets

Commenting on the latest survey results, Chris Williamson, Chief Economist at Markit, says:

"The downturn in business confidence about the year ahead highlights how numerous headwinds are acting as drags on the global economy, and hitting the emerging markets in particular.

"A key concern is that the US is playing a reduced role as the main global growth engine. US companies have failed to revive from the weak levels of optimism seen at the start of the year, suggesting the US economy remains in a slower growth phase in 2015.

"Alongside slower US growth, the emerging markets are clearly struggling to an extent not seen since the height of the global financial crisis.

"China sits at the heart of the emerging market malaise, with companies less optimistic than at any time since the financial crisis as the economy adjusts to a slower growth trajectory and financial markets show worrying volatility.

"However, the steepest drop in optimism was seen in Brazil, where the commodity slump has hit the economy hard and threatens a deep recession.

"The UK looks set to outperform its peers, with a post-election upturn in business confidence bucking the wider global trend of deteriorating business sentiment. However, much will of course depend on the fate of Greece, with 'Grexit' worries dampening business optimism across the Eurozone. Although the Greek crisis has so far had little impact on the economies of Europe, companies are citing Grexit as their greatest threat to the outlook."

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072015-Economics-Emerging-market-malaise-drags-global-business-confidence-to-post-crisis-low.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072015-Economics-Emerging-market-malaise-drags-global-business-confidence-to-post-crisis-low.html&text=Emerging+market+malaise+drags+global+business+confidence+to+post-crisis+low","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072015-Economics-Emerging-market-malaise-drags-global-business-confidence-to-post-crisis-low.html","enabled":true},{"name":"email","url":"?subject=Emerging market malaise drags global business confidence to post-crisis low&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072015-Economics-Emerging-market-malaise-drags-global-business-confidence-to-post-crisis-low.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Emerging+market+malaise+drags+global+business+confidence+to+post-crisis+low http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072015-Economics-Emerging-market-malaise-drags-global-business-confidence-to-post-crisis-low.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}