Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 13, 2015

Week Ahead Economic Overview

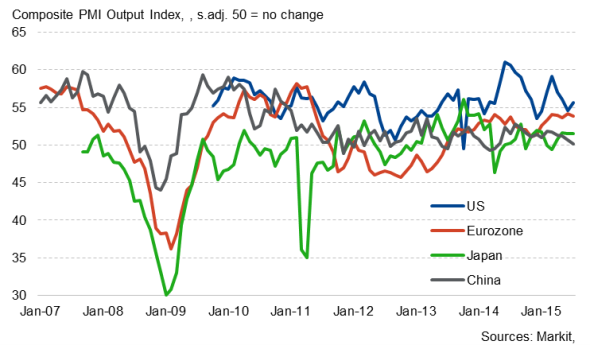

Flash PMI results for August will provide data watchers and policy makers with insights into global economic trends in the middle of the third quarter. Moreover, Japan sees the release of second quarter GDP, while inflation data are out in the UK and the US.

Composite PMI Output Index

There will be a big focus on Japan during the week, with second quarter GDP numbers, flash manufacturing PMI results and trade data released in Asia's second-largest economy.

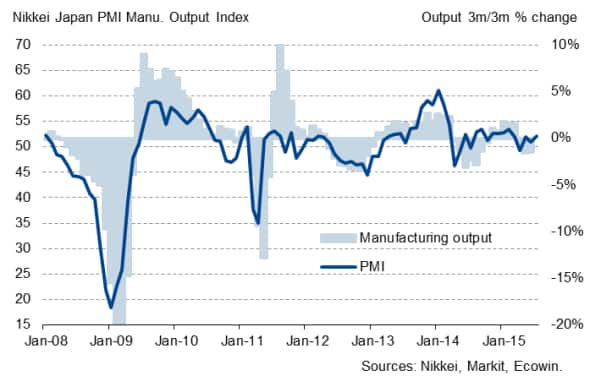

GDP numbers are published on Monday, with economists polled by Reuters anticipating a decline of 0.5%, paying-back some of the 1.0% growth surge seen in the first quarter. Business survey data have pointed to a smoother, more moderate rate of growth so far this year amid the poor performance of the manufacturing sector, and the government has already trimmed its growth forecast for the current fiscal year from 2.0% to 1.7%. However, there were some signs of renewed life in Japan's goods-producing sector in July, with the manufacturing PMI hitting a five-month high. Flash PMI data for August will be released on Friday.

Japan manufacturing output and the PMI

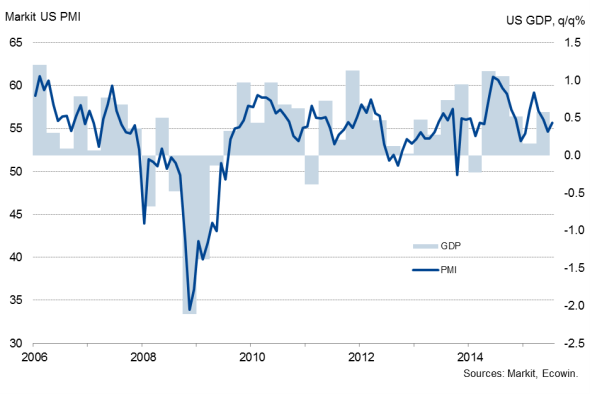

Flash manufacturing PMI data are also released in the US, and will add to the policy debate. July's employment report and solid survey data would suggest that a first rate hike in September is a strong possibility if the economy remains robust. The release of business survey data will therefore be watched closely for first insights into manufacturing growth trends in August, with the most recent data consistent with GDP growing at an annualised rate of around 2.1%.

US GDP and the PMI

However, low inflation and subdued wage growth remain powerful arguments against a tightening of US monetary policy, meaning Wednesday's inflation and real earnings data will be an important steer to policy making. Core inflationary pressures remained weak amid disappointingly modest wage growth and falling commodity prices. Although wage growth picked up in July, it is hardly surging. Average pay is currently just 2.1% higher than a year ago.

In the UK, economic data will be closely watched by policymakers for signs that the economy is ready for a tightening of monetary policy, with early next year currently looking most likely for a first rate hike.

Retail sales are expected to rebound after dipping in June, painting a picture of consumer-led economic growth, fuelled in turn by low prices and steady wage growth. However, if retail sales numbers continue to surprise on the downside and labour market data disappoint further, the first rise in interest rates could be pushed back. The minutes from the latest Bank of England Monetary Policy Committee meeting suggest that the first rate hike is unlikely to take place before early next year, despite the UK economy expanding by 0.7% in the second quarter.

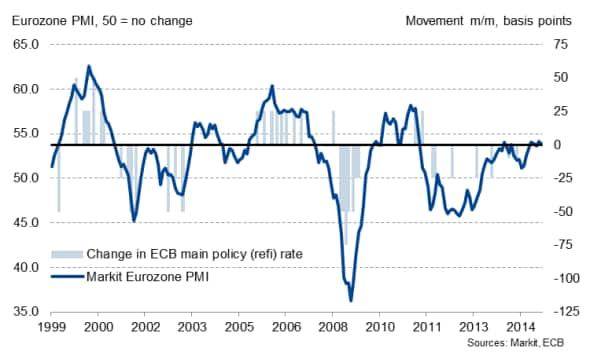

With the eurozone economy showing resilience amid Greek worries, data watchers will be interested to see how the region's economy is faring in August and will therefore be awaiting the release of flash PMI results. The Markit Eurozone PMI posted 53.9 in July, little-changed from June's 54.2 and thereby supporting the view that the economy looks set to grow by at least 1.5% in 2015. The survey data therefore suggest that the ECB sees the economic recovery of the region firmly on track and that the Governing Council will see no need to adjust the ECB's asset purchase programme. Further insight into the health of the eurozone economy will be provided by consumer confidence and trade data.

ECB monetary policy and the PMI

The Chinese economy started the third quarter on a low note, with the Caixin PMI Composite Output Index posting only fractionally above the neutral 50.0 threshold. The weak performance of the private sector was driven by the steepest downturn in manufacturing since November 2011. The disappointing start to Q3 will put further pressure on a Chinese government struggling to achieve an economic growth target of 7% for the year. Flash manufacturing PMI results, released on Friday, will therefore be eyed for signs that the goods-producing sector has hopefully recovered at least some of the ground it has lost recently.

Monday 17 August

Second quarter GDP numbers are released in Japan.

Russia sees the publication of industrial output data.

Eurostat issues trade data for the currency union.

The Bank of Scotland Report on Jobs is published.

In Brazil, payroll job growth data are issued.

The NAHB Housing Market Index and NY Fed manufacturing data are issued in the US.

Tuesday 18 August

China sees the release of house price figures.

The Bank Indonesia and the Central Bank of Turkey announce their latest interest rate decisions.

Meanwhile, inflation numbers are updated in Russia and the UK.

In the US, housing starts numbers and building permit data are out.

Wednesday 19 August

In Japan, trade data are published.

Meanwhile, M3 money supply information are issued in India.

Russia sees updates on labour market and retail sales data.

In South Africa, inflation and retail sales numbers are released.

Current account data are published for the eurozone.

The UK Household Finance Index is out.

Iceland's Central Bank announces its latest interest rate decision.

Consumer price and real earnings numbers are issued in the US.

Thursday 20 August

The Reuters/Tankan Diffusion Index is released in Japan.

Meanwhile, Germany sees the publication of producer price numbers.

Current account data are issued for Greece.

In the UK, retail sales and CBI orders figures are out.

Unemployment figures are released in Brazil.

Canada sees the publication of wholesale trade numbers.

Initial jobless claims data and the Philly Fed Business Index are out in the US.

Friday 21 August

Flash PMI results are released in China, Japan, the eurozone and the US.

Consumer confidence data are out in the euro area.

Brazil sees the release of inflation numbers.

In Canada, retail sales and inflation data are updated.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13082015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13082015-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13082015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13082015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13082015-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}