Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 13, 2014

Commodities and equities hit by signs of deepening economic malaise in China

Chinese equities and commodities have been hit after official data showed the country's recent lacklustre economic performance is spilling over into the fourth quarter. Trends in industrial output and retail sales are the weakest since 2009 and 2004 respectively.

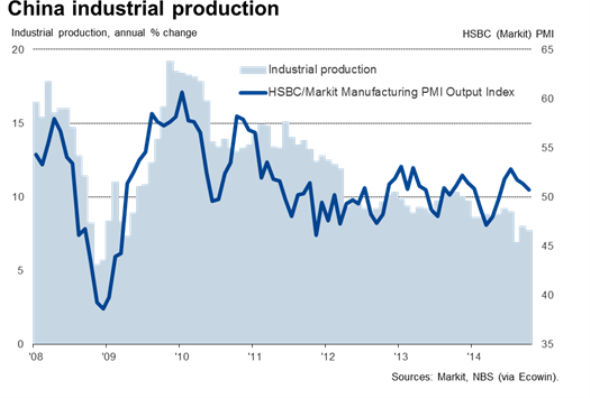

Industrial production disappoints

Industrial production was up 7.7% on a year ago in October, down from the 8.0% rise recorded in September. The rate of increase was the second-slowest seen since 2009, the weakest having been the 6.9% rise seen in August. Clearly China's factories have been going through a tough period in recent months. We estimate that, at 7.5%, the average rate of growth over the latest three months has been the weakest since January 2009, once historical data have been adjusted for holiday closures arising from Lunar Year celebrations.

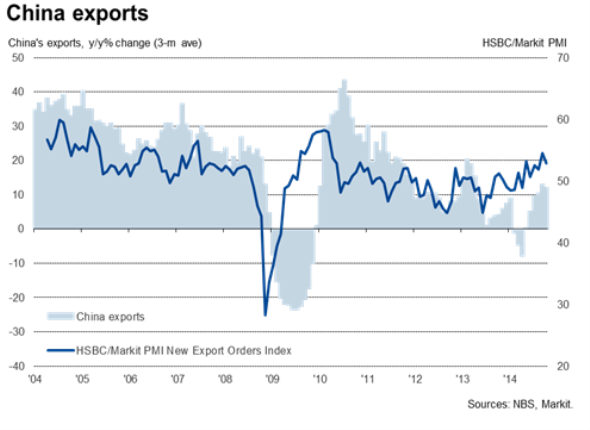

The sluggish trend in industrial production largely reflects weak domestic demand, which has offset a modest revival in export growth. Exports rose at an annual rate of 12.1% on average in the three months to October, matching a similar improvement signalled by PMI data.

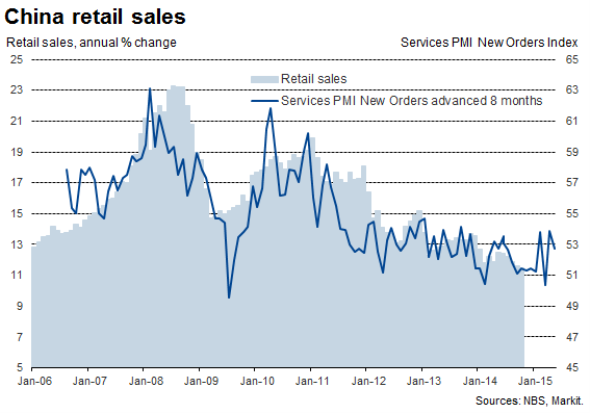

Weakest retail sales growth for a decade

The weakness of domestic demand has been further highlighted by recent retail sales data. Sales were up 11.5% on a year ago in October, down from 11.6% in September. Excluding distortions to the historical data caused by events such as New Year holidays, that was the weakest rate of increase since early-2004.

Sales growth has been on a downward trend since early-2011, which many have linked to the cooling of the domestic property market as well as a clampdown on conspicuous consumption by Chinese officials. So far this year, property sales have been running 7.9% lower than last year.

The Markit-compiled HSBC Services PMI provides a useful advance steer to retail sales growth, due to its focus on the domestic markets and the inclusion of consumer services in its coverage. Like retail sales, the services PMI has fallen from high levels back in 2011, running at near post-crisis lows earlier this year. The PMI has risen from these lows in recent months, however, providing some hope that retail sales growth will also revive somewhat. However, the rate of growth clearly remains subdued by historical standards.

Policy stimulus

The disappointing data raise the prospect that gross domestic product growth could weaken further in the fourth quarter after rising 7.3% in the third quarter, which was the worst performance seen since the first quarter of 2009. Speculation has therefore intensified that the authorities may undertake further mini- stimulus measures, targeted at specific areas of the domestic market, to prop up growth. Relaxing restrictions on property purchases or boosting spending on infrastructure projects are widely cited possibilities.

However, there seems to be little appetite to indulge in any major stimulus along the lines seen in 2008-9. Instead, the authorities seem content to accept slower economic growth, raising the likelihood that the country's growth target for 2015 could be lower than the 7.5% expansion pencilled in for 2014.

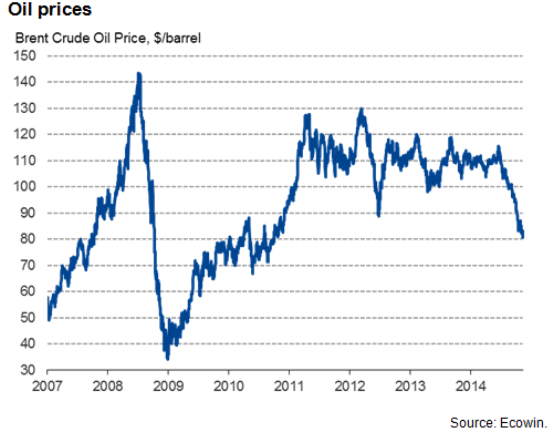

Oil price falls to lowest since 2010

The prospect of growth slowing in China pushed equities down 0.3% and also drove many commodity prices lower, on the basis that demand for key inputs at factories will continue to weaken in coming months. Brent crude slipped below $80 per barrel for the first time since September 2010.

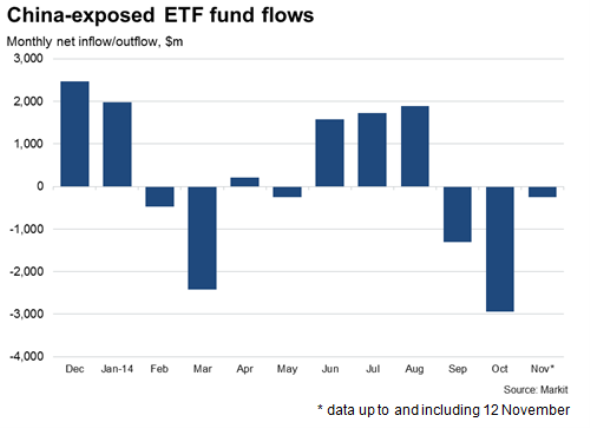

Outflows from China-exposed ETF accelerate

China-focused exchange traded funds have also seen net outflows as investors have become disappointed with growth prospects. November looks set to be the third consecutive month of net outflows, contrasting with steady inflows into ETFs in the three months to August.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112014-Economics-Commodities-and-equities-hit-by-signs-of-deepening-economic-malaise-in-China.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112014-Economics-Commodities-and-equities-hit-by-signs-of-deepening-economic-malaise-in-China.html&text=Commodities+and+equities+hit+by+signs+of+deepening+economic+malaise+in+China","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112014-Economics-Commodities-and-equities-hit-by-signs-of-deepening-economic-malaise-in-China.html","enabled":true},{"name":"email","url":"?subject=Commodities and equities hit by signs of deepening economic malaise in China&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112014-Economics-Commodities-and-equities-hit-by-signs-of-deepening-economic-malaise-in-China.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Commodities+and+equities+hit+by+signs+of+deepening+economic+malaise+in+China http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112014-Economics-Commodities-and-equities-hit-by-signs-of-deepening-economic-malaise-in-China.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}