Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 13, 2014

Growth areas for investment managers

Amid the growing popularity of ETFs among investors, Strategy ETFs are increasingly seen as an attractive alternative to passive index-tracking strategies.

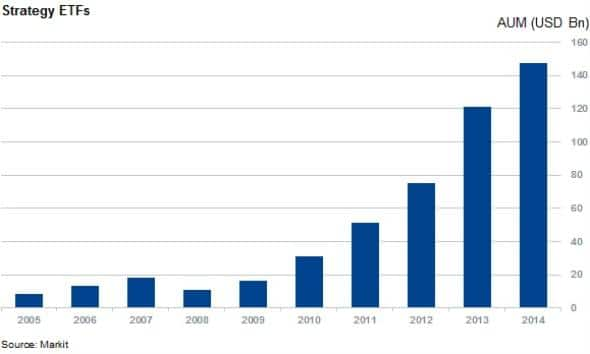

- Strategy ETF AUM has grown to almost $150bn to date

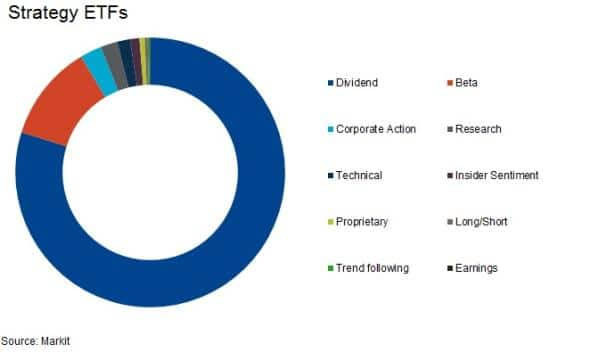

- Dividend-focused funds account for over 75% of Strategy ETFs

- Europe is another growth area for the industry, but challenges remain to be overcome

To view our interview with WisdomTree on Smart Beta, click here.

To view our interview with WisdomTree on the future of ETFs, click here.

One of the undeniable growth stories of the asset management world in the last few years has been ETFs, which have seen their AUM surge to $2.7trillion as of latest count. This growth hides the fact that the ETF pasture is getting increasingly crowded, especially among passive index tracking strategies which have rung so well with investors. This has seen several industry players cut fees on some of their most popular products. In light of these developments, we sit down with WisdomTree's head research, Jeremy Schwartz, to analyse the type of products that have resonated with investors.

Strategy products come to life

According to Schwartz: "You don't need another five basis point S&P 500 fund." While relatively low cost beta funds are still the most popular part of the ETF world, strategy funds which aim to outperform the market and provide investors "value over the market, excess returns and better risk adjusted traits" by increasing exposure to such instruments such as dividends and other easily observable traits.

Strategy focused funds have resonated well with investors over the last few years, and this once niche investment product has seen its assets grow to just under $150bn to date.

This trend looks to have a lot of room to grow as dividend focused funds make up over three-quarters of the strategy focused funds which, given the historically low interest rates, quest for income has been "one of the key success for investors" and, in extension, the ETF issuers which cater to that need.

While dividends will no doubt continue to prove popular among investors, strategy funds have the possibility to exploit factors such as momentum, value and quality - have proven to provide long term consistent value according to academic reports

European opportunities

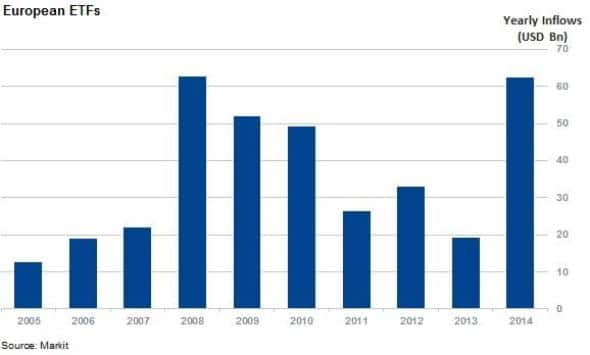

Another opportunity for both investors and ETF issuers is growing the European market. The industry is very much in the same position that the US saw in 2006 according to Schwartz, with the asset class experiencing growing adoption among fund managers.

Despite the opportunities, there are still challenges that lie in the way of a broader uptake of European ETFs, mainly educating investors and raising awareness of the products amongst entrenched constituents. Trading and liquidity was also highlighted as an issue as too much volume occurs off market and "only a fraction of the trades that actually happen are shown on the tape".

Schwartz stated that these issues largely mirror the ones faced in the US in the early days of ETF investing, and once overcome we will see a broader uptake of ETFs among European investors. This looks to be playing out as European funds are on track for a banner year after more than tripling last year's haul.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112014-equities-growth-areas-for-investment-managers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112014-equities-growth-areas-for-investment-managers.html&text=Growth+areas+for+investment+managers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112014-equities-growth-areas-for-investment-managers.html","enabled":true},{"name":"email","url":"?subject=Growth areas for investment managers&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112014-equities-growth-areas-for-investment-managers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Growth+areas+for+investment+managers http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112014-equities-growth-areas-for-investment-managers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}