Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 14, 2015

Covered bonds shunned amid low yields

With the ECB's third covered bond purchase programme in full swing, investors flee to alternative asset classes as spreads tighten to unappealing levels.

- Covered bond ETFs saw first quarterly outflow since 2012 in Q1

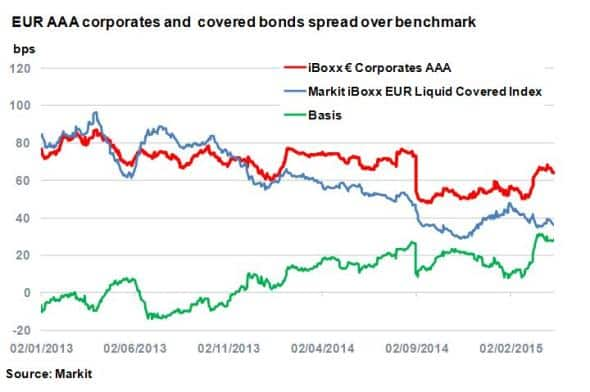

- Basis between covered bonds and AAA corporates stands at 28bps; a two year high

- Prime Euro RMBS provides a 7bps premium over single A rated covered bonds

Covered bonds lose their charm

Covered bonds have long been the go to asset for the ECB to stoke liquidity in Europe's struggling financial markets. An appealing cross between a securitised product and a vanilla bond, the ECB restarted covered bond purchases for the third time last October.

With a guaranteed bidder in the market and the European quantitative easing in full swing, covered bond spreads have been on a steady decline since 2012. The latest ECB intervention further tightened spreads and the asset class is now yielding less than 40bps over German bunds, according to the iBoxx EUR Liquid Covered Index. They have also outperformed the highest quality corporate bonds in the iBoxx € Corporates AAA, which has created a spread of 28bps between the two asset classes as of latest count.

These low yields have seen some ETF investors head to the exit. Covered bond ETFs saw outflows of $193m during the first quarter; the first negative quarter since Q4 2012. With spreads being hovering at five year lows, investors searching for yield appear to have lost their patience with the asset class.

It is worth mentioning that income is not the only motive for holding covered bonds. They are an important funding instrument in Europe and hence are looked at favourably by regulators. They have a low risk weighting under the Capital Requirements Regulation, are marked as liquid assets according to the Liquidity Coverage Requirement and provide secured liabilities under Bank Recovery and Resolution Directive. These attributions keep demand strong among credit institutions.

RMBS

With covered bond spreads near all time lows, income investors have started to look at alternative assets, in particular residential mortgage backed securities (RMBS).

RMBS provide the closest alternative asset in terms of underlying collateral. Some differences, aside from the regulatory treatment, are that covered bonds offer recourse on the issuer and hence added protection whereas RMBS deals are off balance sheet. It is therefore no surprise covered bonds generally offer investors lower returns.

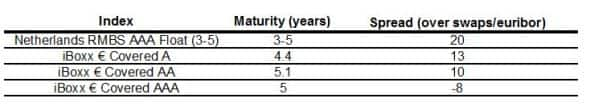

The highest rated covered bonds provide 28bps less yield than the highest rated RMBS, as represented by the yield difference of the iBoxx € Covered AAA index and the Netherlands RMBS AAA Float (3-5) sector curve. The latter contains some prime RMBS which is also eligible for ECB ABS purchase under the terms of the latest program.

Even when reducing the covered bond rating to single A, RMBS still provides 7bps extra return compared to covered bonds even though the quality of the collateral and/or institution is inferior to that of the RMBS, according to credit rating agencies.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14042015-credit-covered-bonds-shunned-amid-low-yields.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14042015-credit-covered-bonds-shunned-amid-low-yields.html&text=Covered+bonds+shunned+amid+low+yields","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14042015-credit-covered-bonds-shunned-amid-low-yields.html","enabled":true},{"name":"email","url":"?subject=Covered bonds shunned amid low yields&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14042015-credit-covered-bonds-shunned-amid-low-yields.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Covered+bonds+shunned+amid+low+yields http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14042015-credit-covered-bonds-shunned-amid-low-yields.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}