Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 14, 2015

UK inflation falls back to zero

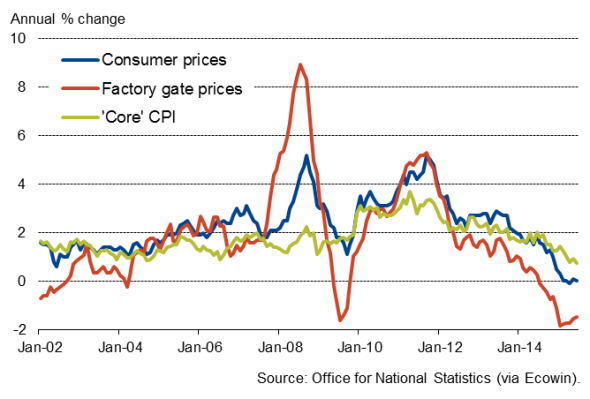

UK consumer price inflation fell back to zero in June, according to the Office for National Statistics, down from 0.1% in May. Inflation continues to run at its lowest for half a century, but all eyes turn to tomorrow's wage data to see if longer term underlying price pressures are building, which could prompt a policy response later in the year.

Core inflation (excluding energy, food, alcohol and tobacco) also fell, down back to 0.8% from 0.9% in May, its joint-lowest since 2001. Oil prices fell during the month, supermarkets continued to compete aggressively on prices and June saw the start of summer clothing sales.

Inflation trends

The data therefore raise questions over whether the underlying price pressures are really picking up to the extent than the Bank of England is anticipating. The Bank expects inflation to start rising in earnest later this year, primarily due to the impact of low oil prices phasing out of the annual comparisons, and reaching its 2.0% target by 2017.

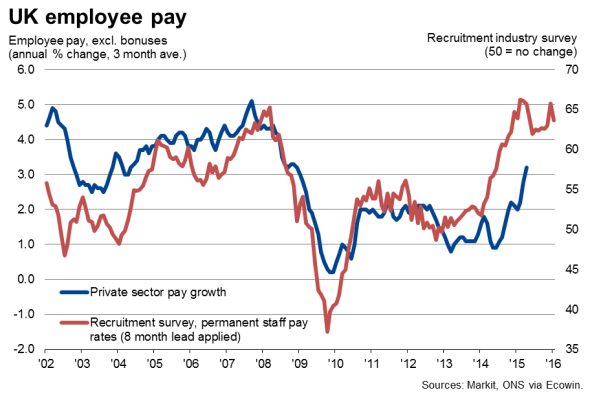

Attention therefore now turns to what's arguably the more important wage growth data, published tomorrow. The Bank of England needs to determine whether pay growth will continue to accelerate as firms compete for staff, or whether low inflation will keep the overall rate of increase below levels that would normally worry the Monetary Policy Committee into hiking interest rates. Regular wage growth is showing signs of picking up as the labour market continues to tighten, rising to 2.7% according to the data in the three months to April, its highest since early-2009. Private sector pay is rising even faster, increasing at an annual rate of 3.2%, its highest since 2008. Survey data indicate that difficulties in finding suitable staff mean employers have to offer higher salaries to recruit new workers. However, this upward pressure on wages is being offset by weak annual pay reviews for incumbent employees, linked in turn to the absence of inflation seen in recent months.

With monetary policy focusing on where inflation is likely to be in one to two years' time, tomorrow's pay data will therefore be instructive in gauging the extent to which a wage-price spiral may develop in coming months, and when the Bank of England is likely to pull the trigger on hiking interest rates.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072015-Economics-UK-inflation-falls-back-to-zero.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072015-Economics-UK-inflation-falls-back-to-zero.html&text=UK+inflation+falls+back+to+zero","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072015-Economics-UK-inflation-falls-back-to-zero.html","enabled":true},{"name":"email","url":"?subject=UK inflation falls back to zero&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072015-Economics-UK-inflation-falls-back-to-zero.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+inflation+falls+back+to+zero http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072015-Economics-UK-inflation-falls-back-to-zero.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}