Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Sep 14, 2017

Harvey's Impact on Credit Risk Transfer

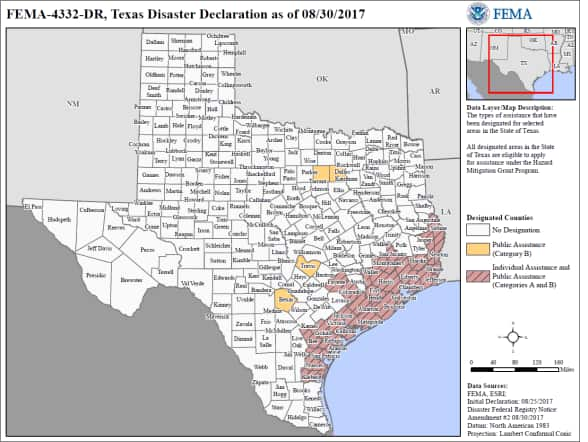

Initial reports coming through are that Hurricane Harvey could leave parts of southeast Texas uninhabitable for months. The FHA, Fannie Mae, and Freddie Mac have announced that they are suspending evictions and foreclosures on homes in eligible disaster areas.

Fannie Mae guidelines state that the mortgage servicers may suspend or reduce a borrower's mortgage payment for up to 90 days if the servicer believes a natural disaster has adversely impacted the value or habitability of the property. The servicer may offer forbearance for up to six months, and this can be extended for an additional six months for those borrowers who were 90 days or less delinquent when the disaster occurred. Freddie Mac offers similar short term forbearance programs that eliminate any late charges and fees associated with the forbearance.

Spread Widening

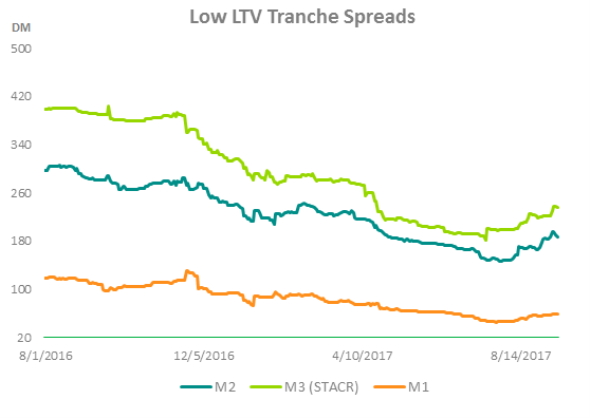

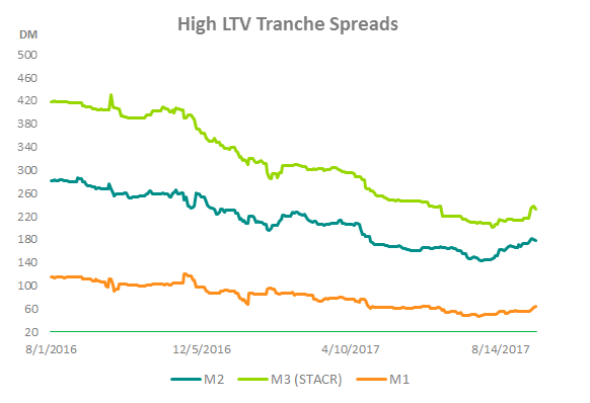

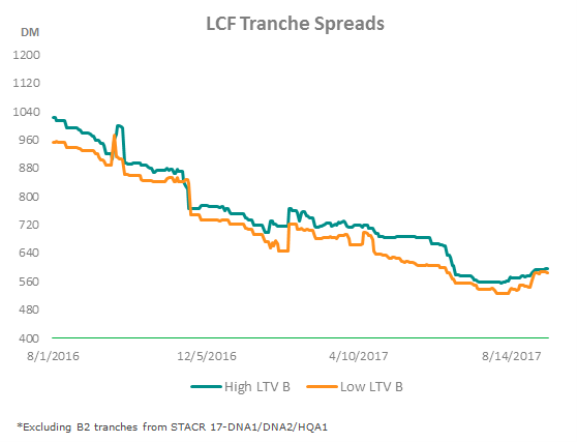

Hurricane Harvey has exacerbated an already turbulent month within the Credit Risk Transfer (CRT) space. Spread measurements have been volatile throughout the month and are now trending significantly wider since the news of the storm was made public in mid-August.

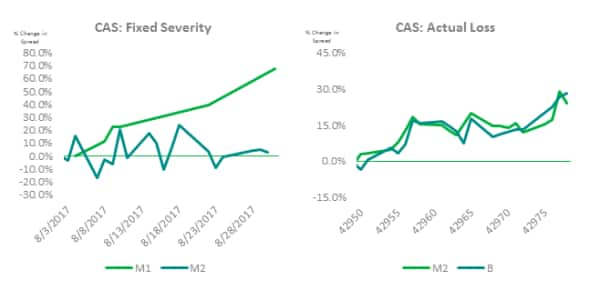

Per the graphs below, spread measurements have been widening out consistently throughout the month however we are observing significant widening from Actual Loss and Fixed Severity Connecticut Avenue bonds.

Our IHS Markit Weekly Mortgage Snapshot shows the movement in M1, M2, and B tranches have widened approximately 6, 34, and 29 bps, respectively, over the past month. This widening in spread is inconsistent with what we have observed over the past year in a sector that has experienced a trend of steady tightening. See our IHS Markit CRT sector spreads in the graphs below.

As a result of this storm, we expect increased modifications and severities in areas impacted by Harvey as a low share of properties have flood insurance in these areas versus prior incidents. With the additional impact of Hurricane Irma in Jacksonville and other parts of Florida, we expect continued widening in the sector and possible credit rating downgrades depending on the severity of the two storm's impact.

IHS Markit's Securitized Products Pricing service provides independent evaluated pricing, sector level time series and transparency metrics across Agency Pass-Through, Agency CMO, Non-Agency RMBS, Consumer ABS, European ABS, CMBS, TruPS, CDO and CLO asset classes. For further information please email: USABSPricing@Markit.com

Adam Mauro, Assistant Vice President, Securitized Products

Tel: +1 646 679 3433

adam.mauro@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14092017-Credit-Harvey-s-Impact-on-Credit-Risk-Transfer.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14092017-Credit-Harvey-s-Impact-on-Credit-Risk-Transfer.html&text=Harvey%27s+Impact+on+Credit+Risk+Transfer","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14092017-Credit-Harvey-s-Impact-on-Credit-Risk-Transfer.html","enabled":true},{"name":"email","url":"?subject=Harvey's Impact on Credit Risk Transfer&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14092017-Credit-Harvey-s-Impact-on-Credit-Risk-Transfer.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Harvey%27s+Impact+on+Credit+Risk+Transfer http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14092017-Credit-Harvey-s-Impact-on-Credit-Risk-Transfer.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}