Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 14, 2016

Using the Japan PMI as an alternative measure of economic growth

Doubts continue to be raised regarding the quality of GDP data in Japan, highlighting the role that business surveys such as the PMI can play in monitoring the economy and policymaking.

A new alternative version of GDP has been calculated by the Bank of Japan which paints a considerably different picture of economic growth in recent years than current official GDP data. However, the new series corresponds more closely with PMI survey data than official GDP.

The close relationship between the new GDP series and the PMI also highlights the value of the monthly PMI in providing a timely and accurate indication of actual current economic conditions in Japan.

GDP quality concerns

Concerns over the quality of official GDP statistics and ensuing policy errors has prompted the Bank of Japan to produce an experimental alternative GDP series.

The concern is that response rates are believed to have fallen in the surveys currently used in the calculation of official GDP, which may affect the accuracy of the data. Japan's GDP data are also notorious for being both excessively volatile and prone to substantial revision after initial publication, meaning policymakers and analysts have low confidence in the numbers as a gauge of economic growth or even in identifying turning points in the economy.

The new series compiled by the Bank of Japan uses actual tax returns to calculate economic growth rather than the existing system of estimating GDP via the surveys of companies chosen by the Cabinet Office. The new alternative series can therefore be considered an "income" based measure of the economy which should, in theory, equate closely to the current expenditure based GDP numbers. However, the differences are at times striking.

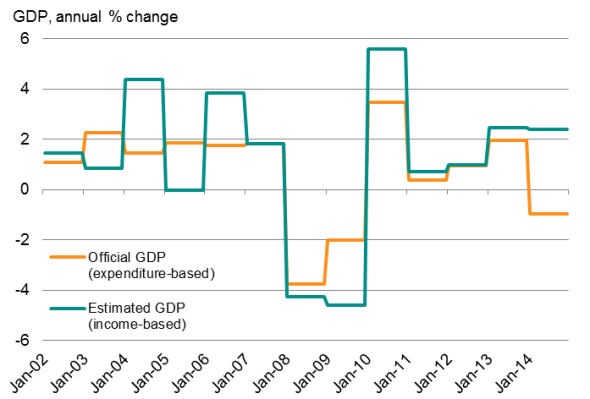

Fig 1: Official v new estimated GDP

Sources: Cabinet Office, Bank of Japan.

Most notable is the discrepancy in 2014, for which official GDP data indicate that the introduction of a higher sales tax rate tipped the economy into recession. In contrast, the new data suggest that the economy in fact grew at a robust pace in 2014.

Survey-based reality check

Problems arise in that we do not know which GDP series is correct, or whether both are in fact wrong. Some insight in this respect can be provided by conducting a cross-check whereby the GDP data are compared with PMI business surveys.

National PMI survey data are widely used to provide valuable advance indications of official economic data. In Japan, the Nikkei PMI survey data compiled by IHS Markit are produced using an identical methodology to other economies such as the UK and Eurozone, where the surveys are highly regarded as providing accurate advance estimates of official GDP.

Somewhat tellingly, in Japan the PMI survey data have at times diverged from the official GDP data calculated by the Cabinet Office. The PMI in fact appears to correlate more closely with the new GDP numbers, suggesting that the new income-based data offer a more accurate picture of economic history in Japan.

Most significantly - especially in terms of policymaking - the PMI data corroborate the new GDP numbers in indicating that there was no recession in 2014.

Using the PMI to track GDP

The following analysis uses monthly Nikkei PMI data to compare the track record of current official GDP data from the Cabinet Office alongside the new alternative estimates of GDP. Note that the new GDP data are only available on an annual basis up to 2014.

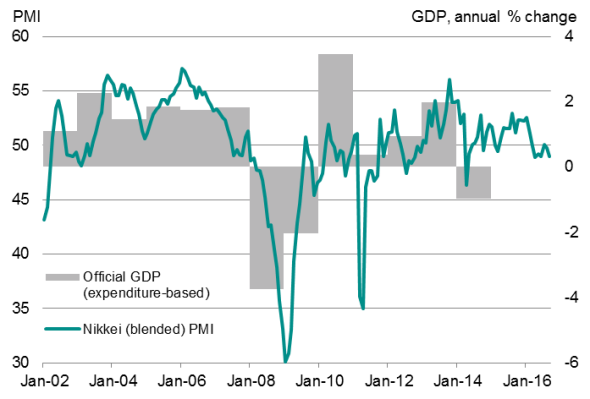

Fig 2: PMI v official GDP

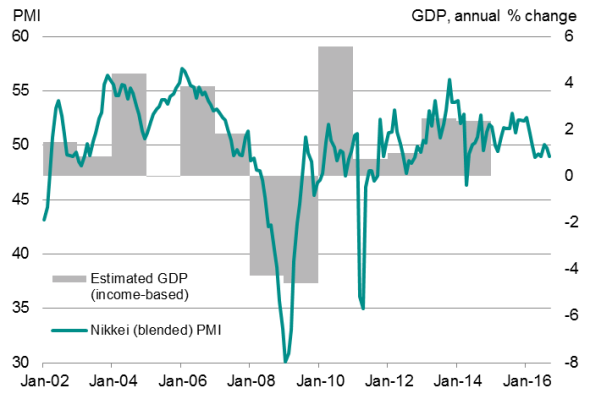

Figure 2 tracks the PMI against the annual percentage change in the current official GDP series. Figure 3 compares the PMI against the annual percentage change in the new estimated GDP measure.

Fig 3: PMI v new estimated GDP

Notes: The blended PMI shown uses the Nikkei Manufacturing PMI for months prior to September 2007, after which the introduction of the services PMI has enabled us to use the composite PMI (an index derived from weighting the output indices from manufacturing and services together using relative contributions to total GDP).

Sources: IHS Markit, Nikkei, Cabinet Office, Bank of Japan.

The more notable differences in the two GDP series (see figure 1) are as follows:

2014

Official data show the economy contracting 1.0% in 2014, sliding into a recession that appears to have been caused by the increase in the sales tax in April of that year. However, the new estimates suggest that the economy in fact grew by 2.4% as consumers and businesses continued to spend at solid rates.

The new estimates are corroborated by the PMI. Although the PMI indicated that spending fell in the immediate aftermath of the sales tax hike, this in part reflected payback after consumers brought forward spending in advance of the tax rise. Growth also soon picked up again, with the composite PMI (covering both manufacturing and services) rising above 50 again by July. At 50.9, the average PMI reading for 2014 was down on the 52.6 average seen in 2013, but still indicated modest economic growth rather than recession.

2003-2006

The new estimates data show the economy rebounding solidly (+4.4%) in 2004 after a weak 2003, before sliding into stagnation in 2005, then reviving again in 2006 (+3.9%). This contrasts with the Cabinet Office GDP data which show a far steadier growth pattern over these years.

The more volatile picture presented by the new GDP data over this period matches the PMI data more closely (especially the monthly PMI profile, which showed in particular the impact of the strong yen in late 2004 and early 2005). However, we note that the PMI annual average suggests that the stagnation signalled by the new data possibly overstates the extent of the 2005 slowdown.

An alternative view of the economy

The new GDP estimates are based on more comprehensive data than existing GDP numbers and therefore offer an alternative and arguably more accurate view of Japan's recent economic history. Importantly, the new data corroborate the PMI surveys in signalling that there was no recession in 2014.

The new research also highlights the value of the PMI as a timely monthly indicator of actual economic conditions and a reality check on Cabinet Office GDP data. The correlation between the PMI and GDP in Japan may be weaker at times than in other countries, but evidence suggests that this reflects deficiencies in the GDP numbers for Japan rather than false signals from the PMI.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102016-Economics-Using-the-Japan-PMI-as-an-alternative-measure-of-economic-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102016-Economics-Using-the-Japan-PMI-as-an-alternative-measure-of-economic-growth.html&text=Using+the+Japan+PMI+as+an+alternative+measure+of+economic+growth","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102016-Economics-Using-the-Japan-PMI-as-an-alternative-measure-of-economic-growth.html","enabled":true},{"name":"email","url":"?subject=Using the Japan PMI as an alternative measure of economic growth&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102016-Economics-Using-the-Japan-PMI-as-an-alternative-measure-of-economic-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Using+the+Japan+PMI+as+an+alternative+measure+of+economic+growth http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102016-Economics-Using-the-Japan-PMI-as-an-alternative-measure-of-economic-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}