Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 14, 2014

GDP data confirm survey signals of modest third quarter economic growth in the Eurozone

The Eurozone enjoyed slightly stronger than expected economic growth in the third quarter, providing welcome news that fears of a renewed recession look exaggerated. However, the data will diminish hopes that the ECB will feel the need to take further action to stimulate growth.

Official data from Eurostat showed that's gross domestic product rose by 0.2% in the three months to September. The region is also now estimated to have grown 0.1% in the second quarter rather than having stagnated, as previously estimated.

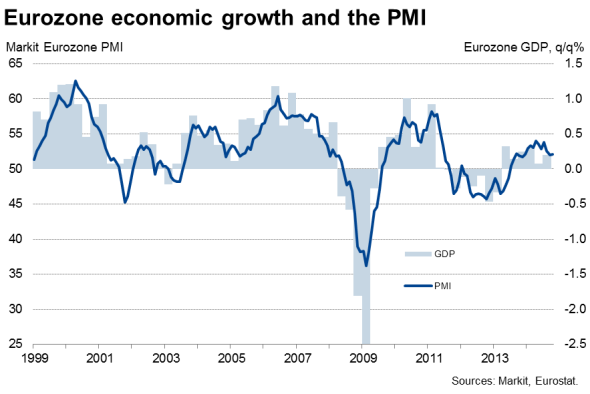

The official data confirm business survey data which show the eurozone economy struggling to expand in the face of numerous headwinds but nevertheless managing to eke out modest growth and avoid recession. High levels of unemployment continue to hold back consumer spending, while businesses in the core countries of France and Germany continue to cut back on investment in a sign of increased economic uncertainty and widespread pessimism about the outlook.

The surveys point to further malaise extending into the fourth quarter, adding to the impression that there are few signs of the region pulling out of this torpor. The headline Markit Eurozone PMI recorded 52.1 in October, down slightly from an average of 52.8 in the third quarter and running at a level signalling another modest 0.2% expansion of GDP in the fourth quarter.

Policymakers will at least be reassured that fears of a renewed recession look overplayed, for the time being at least. The better than expected GDP reading (analysts were on average anticipating a mere 0.1% rise) means the ECB looks even less likely to announce any further measures to boost growth until it can assess the impact of the additional €1 trillion of liquidity it already plans to inject into the economy.

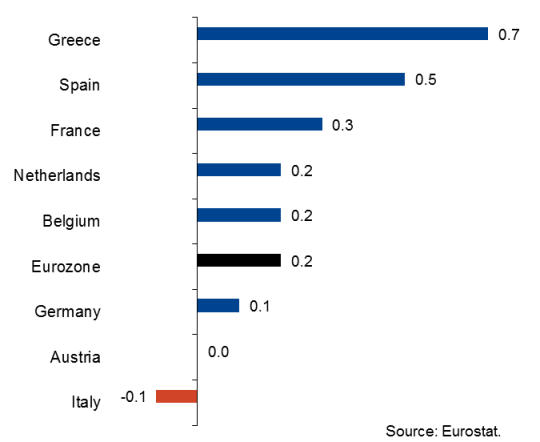

Third quarter GDP growth

Germany skirted recession by the narrowest of margins, with GDP rising 0.1% in the three months to September after a 0.1% decline in the second quarter (which was revised up from a 0.2% contraction). The stagnation seen over the past two quarters as a whole is a major concern, especially after Germany provided such a strong contribution to growth in the region at the start of the year. GDP had surged by 0.8% in the first quarter. Both households and exporters helped boost the German economy in the third quarter, but capital expenditure suffered a worryingly sharp decline.

France reported 0.3% growth of GDP, likewise rebounding from a 0.1% decline in the second quarter to thereby avoid falling back into a technical recession. France's performance was flattered, however, by a 0.8% jump in government spending, the largest rise since the second quarter of last year. Once a 0.3% contribution from inventories to GDP in the third quarter is also taken into account, the French economy's performance suddenly looks a lot worse than indicated by the headline GDP number. As in Germany, a sharp decline in capital expenditure also raises worries about business confidence and points to weak future growth.

Signs of growth reviving in some peripheral countries was confirmed, with Spain's economy growing by 0.5% and Greece by 0.7%, leading the euro area growth table. Italy, however, suffered a 0.1% drop in GDP as its slid back into its third recession since the financial crisis struck.

In other countries, the Netherlands and Belgium GDP growth came out in line with the euro area average of 0.2% but Austria's economy was stagnant.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112014-Economics-GDP-data-confirm-survey-signals-of-modest-third-quarter-economic-growth-in-the-Eurozone.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112014-Economics-GDP-data-confirm-survey-signals-of-modest-third-quarter-economic-growth-in-the-Eurozone.html&text=GDP+data+confirm+survey+signals+of+modest+third+quarter+economic+growth+in+the+Eurozone","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112014-Economics-GDP-data-confirm-survey-signals-of-modest-third-quarter-economic-growth-in-the-Eurozone.html","enabled":true},{"name":"email","url":"?subject=GDP data confirm survey signals of modest third quarter economic growth in the Eurozone&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112014-Economics-GDP-data-confirm-survey-signals-of-modest-third-quarter-economic-growth-in-the-Eurozone.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=GDP+data+confirm+survey+signals+of+modest+third+quarter+economic+growth+in+the+Eurozone http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112014-Economics-GDP-data-confirm-survey-signals-of-modest-third-quarter-economic-growth-in-the-Eurozone.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}