Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 14, 2014

Most shorted of the week

We review how short sellers are reacting to companies due to announce earnings in the upcoming week.

- October US retails sales grow 0.3%

- US online and food speciality retailers have high levels of short interest ahead of earnings and the holiday season

- In Europe, short sellers may be betting against a dry bulk shipping merger

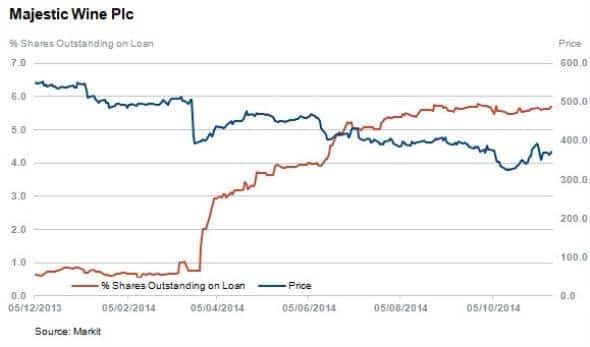

- UK wine retailer Majestic sees increased short selling

- Top shorts in Asia are Taiwanese and Japanese technology firms along with Australian mining and agricultural suppliers

North America

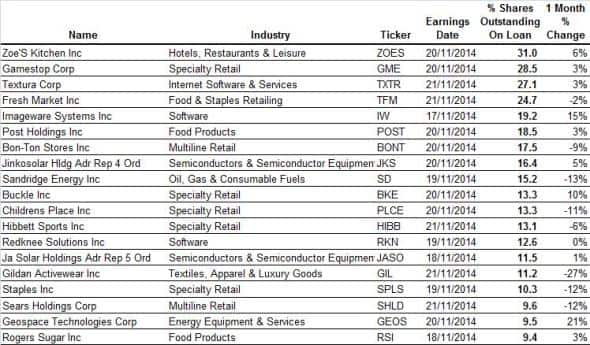

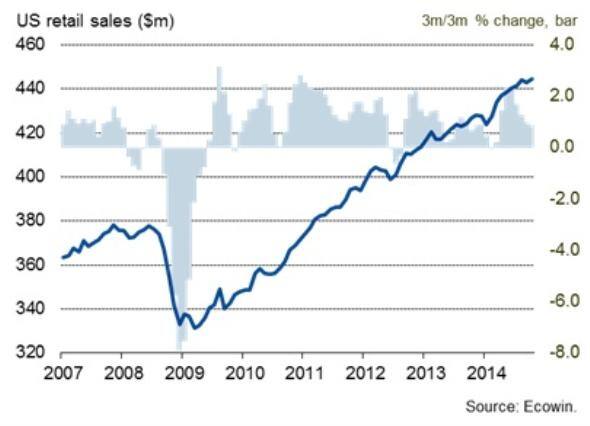

A number of speciality retailers have high levels of short interest ahead of earnings in the coming week as positive US sales numbers were released on Friday. Retail sales in the US picked up 0.3% in October (4.1% up year on year) after a decline of the same amount was reported in October, which sent fears of a subdued festive trading season into the equity markets.

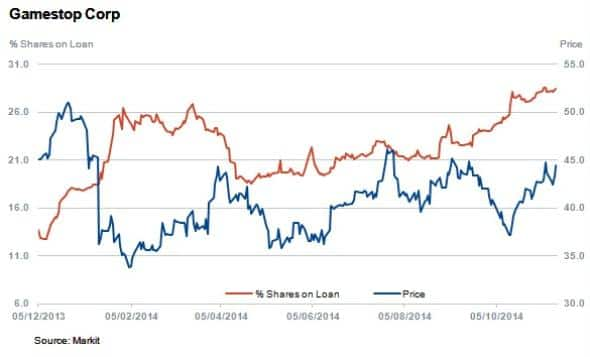

Gamestop, the online gaming retailer, has 29% of shares outstanding on loan and the company's shares are down 10% year to date. This may be due to the market continuing to take a negative view on the evolution of online console and game sales amid increased competition and digital distribution.

Console makers are going straight to digital release with new titles and consumers are changing their buying habits. Additionally, as reported earlier in the year, Gamestop's refurbished console business does quite well over holiday periods. However, the increase in digital release and uptake has eroded the primary market for second hand sales.

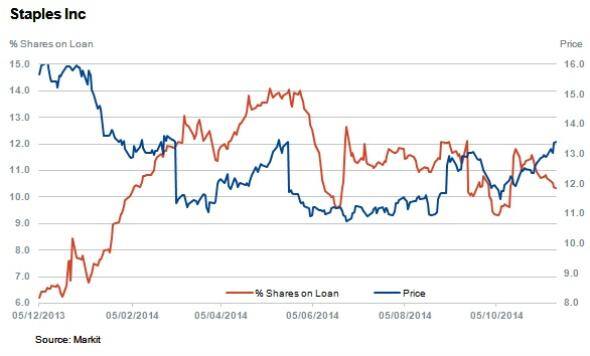

Office products and online retailer Staples share price is down 17% year to date and currently has 10% of shares outstanding on loan.

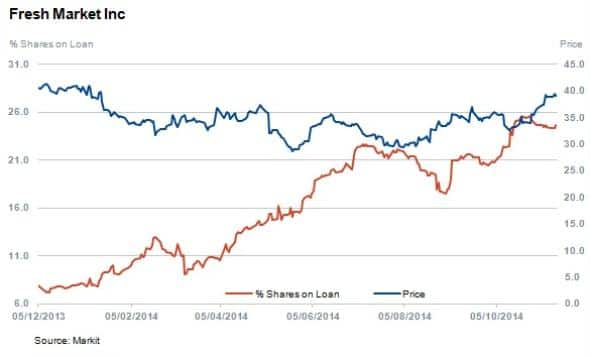

Food retailer Fresh Market has 25% of shares outstanding on loan. The share price is relatively flat year to date however, it is down 23% over the last twelve months tracking competitor Whole Foods Market whose share price has declined 21%. In comparison, Whole Foods short interest is lower at 6%.

Beyond retailers, short interest in solar energy company Jinkosolar has increased by 5% to 16.4% of shares outstanding and Ja Solar also sees significant short interest with 11.5%. Solar and renewable energy firms have come under pressure as energy prices globally have declined and the short term viability of projects comes into question at reduced prices.

Europe

The largest short in the European market at the moment is Dutch technical services company Royal Imtech who had to revise accounts post fraudulent activity in Germany and Poland.

The company recently executed a rights offer with that received low demand from investors. The offer was fully underwritten by Dutch banks Rabobank, ABN Amro and ING, who now own 47% of the firm.

Second most shorted ahead of earnings is dry bulk carrier Golden Ocean, after controlling shareholder John Fredriksen proposed to merge the company with Knightsbridge Shipping in October. Continued short interest may indicate that a portion of the market thinks the deal may not materialise.

Another interesting stock announcing earning this week is Majestic Wine whose shares have fallen by 32% year to date and has 5.7% of shares outstanding on loan ahead of earnings. The based UK wine retailer reported marginally contracting sales in June after worse than expected sales in March caused by a surprise slowdown in post Christmas sales.

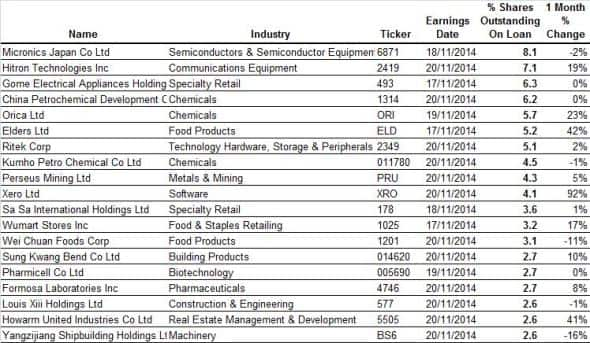

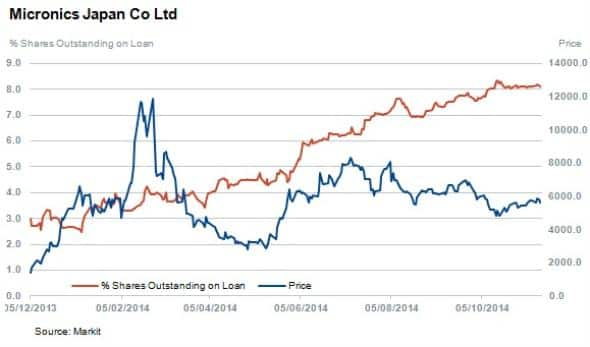

Most shorted in Asia ahead of earnings is Micronics Japan with 8% of shares outstanding on loan. The company is involved in the design and manufacture of probe cards that inspect semiconductors and LCD displays. The share price is flat year to date but is trading at five year highs.

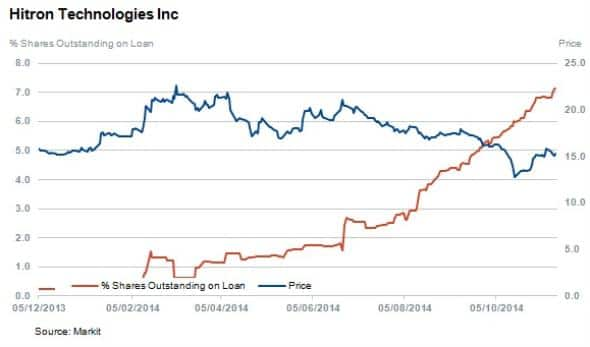

Second most shorted in Asia is Hitron Technologies with 7.1% of shares outstanding on loan, a number that has increased at a steady pace throughout the year. The firm manufactures communication and telecommunication equipment.

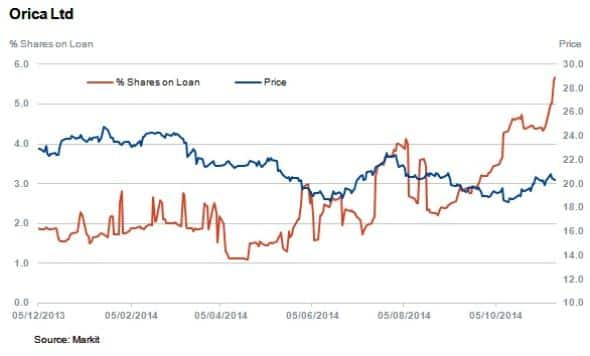

Diversified speciality industrial chemicals producer Orica has 5.6% of shares outstanding on loan. The group's revenue is mainly derived from sales into the mining industry. With depressed energy and commodities prices crimping capital investment in that space, short interest may indicate a difficult period ahead.

Elders Ltd with a total of 5.2% of shares outstanding on loan is up 104% year to date. The company is predominantly exposed to the agricultural industry and went through a restructuring in 2013.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112014-equities-most-shorted-of-the-week.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112014-equities-most-shorted-of-the-week.html&text=Most+shorted+of+the+week","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112014-equities-most-shorted-of-the-week.html","enabled":true},{"name":"email","url":"?subject=Most shorted of the week&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112014-equities-most-shorted-of-the-week.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+of+the+week http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112014-equities-most-shorted-of-the-week.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}