Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 15, 2016

Investors position for less volatility

Volatility has returned in earnest in 2016, encouraging investors to rush to volatility ETFs. But a closer look at fund flows reveals that investors are positioning for volatility to abate over the near term.

- S&P 500 implied 90 implied volatility at 21.3, up from 16 at the start of the year

- Volatility ETFs manage $4bn of AUM, but one-quarter is in inverse funds

- Flows into volatility ETFs show that investors use these products in mean reversion trades

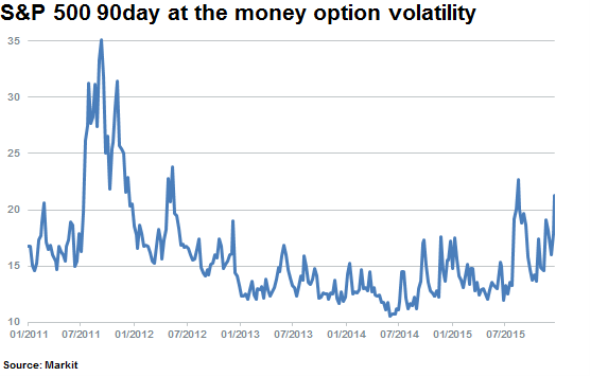

While some volatility is to be expected when investing in equity markets, investors have seen more than their fair share of price swings in the opening weeks of 2016. Equity volatility in the US market, as tracked by 90 day at the money options written against the S&P 500 index, is up by a third since the start of the year to 21.3.

While some investors are cashing out of equities altogether and heading to golden hills, it's worth noting that the current levels of volatility have yet to breach those seen in 2011 during initial 'Grexit contagion' fears - let alone those seen during the financial crisis.

Another subset of investors is doing the opposite and taking the volatility head on in the hope of profiting from a return to calmer times, using volatility ETFs. While the implied volatility of the S&P500 as tracked by the VIX index itself is not directly investable, investors can mirror its movements by investing in one of 59 ETF products that track it. While relatively niche, these funds still manage a not insignificant $4.3bn that positions for volatility on the positive and negative side. In fact one of the most popular volatility ETFs is an inverse product; the VelocityShares Daily Inverse VIX Short Term ETN (XIV). The ETF has just over $1.1bn in AUM, just over one-quarter of all assets managed by volatility ETFs.

The purchase of units of inverse volatility ETFs implies that the buyer expects recent increases in volatility to decrease, reverting lower towards its mean level. Thus increased volatility in markets induces investors who are confident in calmer markets prevailing, to direct funds towards products providing returns as volatility decreases.

Taking a broad view

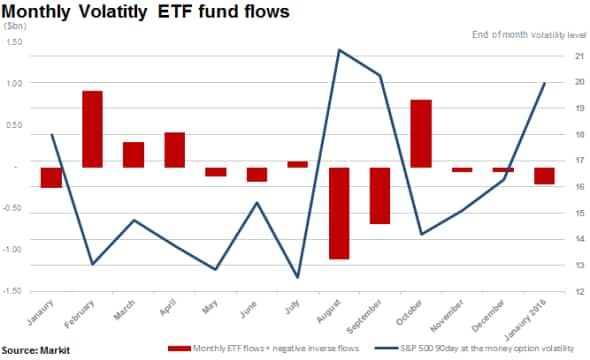

Just five products (out of 59) hold almost 80% of AUM categorised under volatility. Using Markit's Exchange Traded Products analytics and fund flows across these five products reveals that investors are increasingly using volatility ETFs to profit from mean reversion trades which pay out when market volatility subsides.

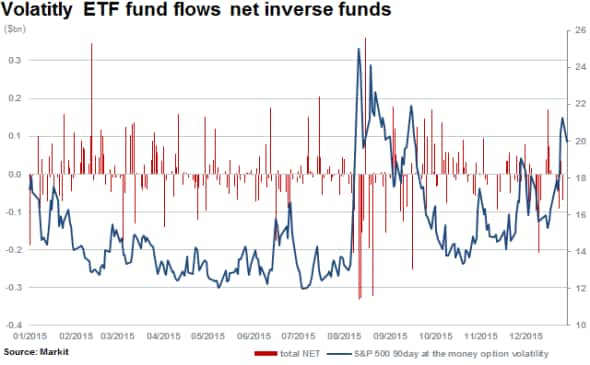

Aggregating out fund flows and combining the negative of inverse flows, reveals that the 'mean reversion volatility trades' are increasingly driving fund flows in volatility ETFs during times of increased volatility.

The above occurs as investors pull funds from 'long' volatility funds (as those long take profits), while 'short' volatility funds see investors pile in in order to profit from decline in market volatility.

This was evidenced over the last volatility spike last summer, when the emerging market selloff fuelled falling Chinese markets; sending shockwaves through equity markets. In fact, investors pulled over $50m of net exposure out of volatility ETFs during the four days following "black Monday" on August 24th last year.

These trades proved well timed given that volatility largely settled back in the subsequent days and weeks.

The volatility witnessed so far this year has seen a return of the mean reversion trend, with the net value of expectations of lower volatility seeing $208m of notional outflows. In fact the most active fund this year in terms of inflows has been the previously mentioned Velocity Shares Daily Inverse VIX Short Term ETN, which has seen $325m of inflows in the first two weeks of the year.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15012016-Equities-Investors-position-for-less-volatility.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15012016-Equities-Investors-position-for-less-volatility.html&text=Investors+position+for+less+volatility","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15012016-Equities-Investors-position-for-less-volatility.html","enabled":true},{"name":"email","url":"?subject=Investors position for less volatility&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15012016-Equities-Investors-position-for-less-volatility.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+position+for+less+volatility http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15012016-Equities-Investors-position-for-less-volatility.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}