Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 15, 2016

Falling US retail sales add to signs of weak start to 2016

A weaker than previously thought retail sales trend so far this year puts further pressure on US policymakers to hold off hiking interest rates.

Official data showed US retail sales falling for a second successive month in February. Sales were down 0.1% last month, and a previously-reported rebound in January was revised away to show a 0.4% decline, according to official data from the Commerce Department.

After rising 1.1% and 0.3% in the third and fourth quarters, respectively, retail sales are running on average 0.2% lower so far in the first quarter compared to the final three months of last year.

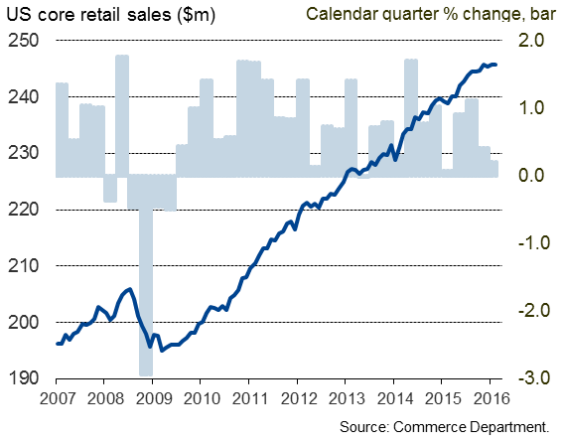

More worrying was the news that core sales were flat after a mere 0.2% increase in January, which was revised down from a robust 0.6% rise. The January expansion in core sales had been cheered by the markets as a reassuring sign of consumers' resilience in the face of worries about stock market volatility, but the state of the retail sector is now starting to look shakier. Core sales so far in the first quarter are running just 0.2% higher than in the fourth quarter, which would be the weakest rate of increase seen for a year (see chart).

US 'core' retail sales*

* excludes gasoline, food services, building materials and auto sales.

The data will inevitably lead to a raft of downward revisions to analysts' predictions for first quarter GDP growth. The weaker than expected picture will also add to suspicions that Fed officials, about to gather for their March policy meeting, will no doubt also err towards caution and avoid hiking interest rates again until the economy shows signs of renewed resilience.

The sales data come on the heels of business survey data showing a worrying loss of growth momentum in the economy in February. Markit's PMI surveys showed one of the weakest expansions of business activity seen since the financial crisis, pointing to GDP growth slowing sharply towards stagnation.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15032016-Economics-Falling-US-retail-sales-add-to-signs-of-weak-start-to-2016.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15032016-Economics-Falling-US-retail-sales-add-to-signs-of-weak-start-to-2016.html&text=Falling+US+retail+sales+add+to+signs+of+weak+start+to+2016","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15032016-Economics-Falling-US-retail-sales-add-to-signs-of-weak-start-to-2016.html","enabled":true},{"name":"email","url":"?subject=Falling US retail sales add to signs of weak start to 2016&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15032016-Economics-Falling-US-retail-sales-add-to-signs-of-weak-start-to-2016.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Falling+US+retail+sales+add+to+signs+of+weak+start+to+2016 http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15032016-Economics-Falling-US-retail-sales-add-to-signs-of-weak-start-to-2016.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}