Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 15, 2017

Most shorted ahead of earnings

We reveal how short sellers are positioning themselves in companies announcing earnings in the coming week

- Consumer focused firms make up three quarters of this week's top North American short targets

- Easyjet sees short double down in the face of recent rally

- Ofx Group most shorted firm announcing earnings in Asia

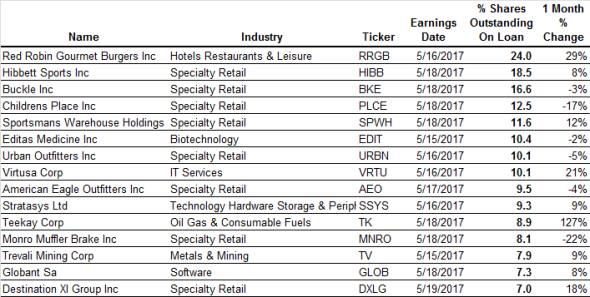

North America

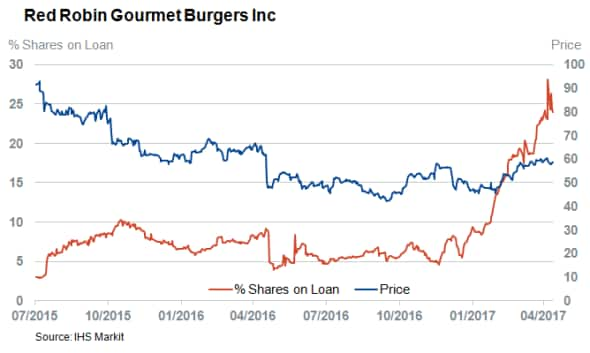

The high conviction short among North American firms announcing earnings this week is Red Robin Burgers which has just under a quarter of its shares out on loan at the moment. Short sellers started to target the company in earnest over the last few months after it announced a 3.3% fall in same store sales over 2016. Analysts are expecting the sales slump to continue over the first half of the year. Short sellers have been emboldened by this slide in sales given that demand to borrow the firm's shares is now five times higher than when it last reported earnings. Red Robin isn't the only burger firm to be scrutinized by short sellers. Shake Shack has recently seen short interest climb to the highest level since its IPO. This could be an indication that the market is generally turning cold on the "better burger" casual dining investment.

Red Robin isn't the only consumer focused firm to see high short interest in the run-up to earnings as eight retailers join the firm in the list of this weeks' heavily shorted stocks. While US consumer spending has remained buoyant in recent months, short sellers are targeting the change in consumer shopping habits as shoppers turn to online retailers at the expense of specialty bricks and mortar stores. This conviction was vindicated last week when both JC Penney and Macy's announced a worse than expected results driven by falling same store sales.

This week's high conviction retail shorts include sports retailers Hibbett Sports and Sportsmans Warehouse, fashion retailers Buckle, American Eagle and Urban Outfitters.

Short sellers will also be keeping a close eye on 3D printing firm Stratasys which also features on the list of this week's high conviction shorts. Stratasys has seen demand to borrow its shares nearly double over the last couple of months. This rise in bearish sentiment has yet to pay off however, as Stratasys shares have rallied strongly over the last few days after competitor 3D Systems posted better than expected results.

Europe

The most shorted European company announcing results this week is payment processing firm Wirecard which has 15% of its shares out on loan. Wirecard continues to see residual short interest after becoming the target of an activist short campaign last year. The campaign accused the firm of fraud - something which it vigorously refuted. The market has since moved on as evidenced by the fact that Wirecard share have doubled from their post accusation lows to a new all-time high. Short sellers were initially willing to ride the tally, however the appetite to short Wirecard has waned in recent weeks as demand to borrow the firm's shares has fallen by 13% in the last month.

UK firms, led by Dairy Crest and Easyjet make up several of the high conviction short targets announcing earnings this week. Both firms have come under pressure from short sellers in recent weeks as they have to contend with shrinking margins due to rising input costs. Easyjet has seen its shares surge recently although short sellers have been willing to double down as evidenced by the fact that demand to borrow its shares has jumped by a fifth in the last month.

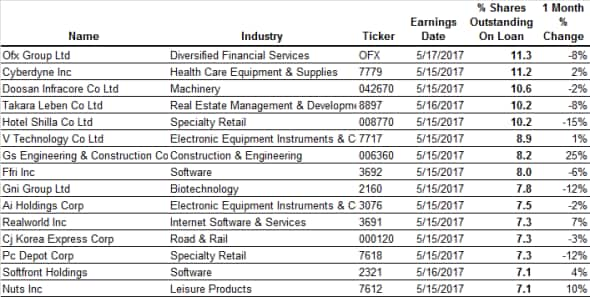

Asia

Ofx Group is the highest conviction Asian short of this week as it has over 11% of the forex provider's shares out on loan to short sellers. The company has by and large disappointed investors since its stock market flotation back in 2013 as its shares have fallen to less than half of their original value in over the last four years. The company's woes have accelerated in the wake of the Brexit referendum as the pound's slump since the referendum has lowered the Australian Dollar value of commissions derived from one its most popular FX "crosses". These woes led the firm to issue a profits warning back in February which took over a quarter off the value of its shares. Short sellers are bracing for more pain ahead for the company as demand to borrow its shares has nearly doubled in the last four months.

Japanese exoskeleton manufacturer Cyberdyne sees nearly the same short interest as Ofx after the firm was targeted by activist short selling firm Citron Research. They claimed the firm was overvalued relative to its peers and failing behind its competition in the race to commercialise products.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15052017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15052017-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15052017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15052017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15052017-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}