Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 15, 2017

UK inflation holds steady, but further squeeze on households likely

A steadying of inflation in July further dents prospects of a rate rise by the Bank of England any time soon, but does little to allay worries about the current squeeze on household budgets and the potential impact on the economy.

Inflation steady, for now

Inflation was unchanged at 2.6% in July, according to the Office for National Statistics' consumer prices index. The retail price index showed a 3.6% increase, up from the 3.5% rate seen in June.

Falling fuel prices - a reflection of global oil prices - helped keep the rate of inflation steady, offsetting upward pressure from the higher cost of clothing, food and household goods.

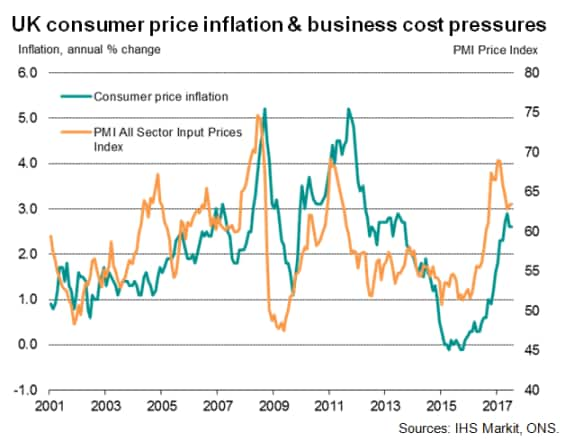

Risks remain skewed towards inflation rising in coming months. Although official data showed producer input price inflation cooling from 10.0% to 6.5%, more recent gauges of commodity prices, such as the IHS Markit Materials Price Index, have been rising again in recent weeks. Although oil prices remain volatile, commodity prices have generally shown signs of recovering over the past month.

Higher costs are translating into higher selling prices. PMI data showed average prices charged for goods and services rose at a sharper pace in July, contrasting with slower rates of increase seen in prior months, as inflationary pressures in supply chains intensified again. With higher energy prices also hitting households in coming months, it's clear that there are a number of factors that could send inflation higher.

Wage growth is meanwhile likely to have remained below 2% when the latest numbers are updated, highlighting how earnings continue to be squeezed.

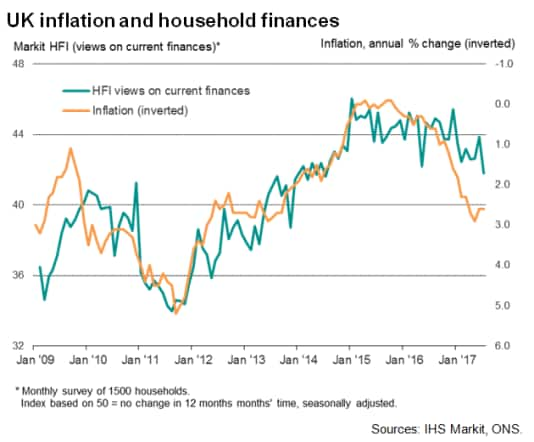

Real earnings are likely to continue falling for some time as inflation exceeds pay growth. While inflation is expected to edge up further in coming months, there's little sign of pay growth accelerating meaningfully. Although recent surveys of recruitment agencies show that salaries negotiated by new staff are rising amid widespread skill shortages, overall pay growth appears to be being muted by low annual pay reviews for workers not changing jobs.

Squeezed households

Households are feeling the pinch more than any time in the past three years. Recent survey data showed household finances deteriorated last month at the sharpest rate since July 2014, linked to low earnings and rising debt, with higher prices piling additional pressure on to already-squeezed budgets. The survey's measure of inflation perceptions remained among the highest recorded since the start of 2014. A deterioration in spending is likely to follow: the same survey found consumers' appetite to make major purchases (such as cars, holidays and large appliances such as TVs) took the biggest hit since 2013.

Dovish policy bias

The lower than expected inflation rate for July adds to the belief that the majority of policymakers at the Bank of England will be more worried about economic growth than inflation in coming months. Risks remain biased towards the economy slowing further after a weak first half of 2017, with consumer spending dampened at the same time as business spending is hit by rising anxiety about Brexit. Survey data showed the economy continued to grow at a modest pace in July, but business optimism about the year ahead remained at a level that has previously been indicative of the economy stalling or even contracting.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15082017-economics-uk-inflation-holds-steady-but-further-squeeze-on-households-likely.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15082017-economics-uk-inflation-holds-steady-but-further-squeeze-on-households-likely.html&text=UK+inflation+holds+steady%2c+but+further+squeeze+on+households+likely","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15082017-economics-uk-inflation-holds-steady-but-further-squeeze-on-households-likely.html","enabled":true},{"name":"email","url":"?subject=UK inflation holds steady, but further squeeze on households likely&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15082017-economics-uk-inflation-holds-steady-but-further-squeeze-on-households-likely.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+inflation+holds+steady%2c+but+further+squeeze+on+households+likely http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15082017-economics-uk-inflation-holds-steady-but-further-squeeze-on-households-likely.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}