Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 15, 2014

UK household incomes rise on back of increased workplace activity

Households reported some encouraging news in relation to incomes and pay at the start of the fourth quarter, according to survey data providing the first indication of consumer trends in October.

However, the data, compiled by Markit from a survey of 1,500 households conducted by IPSOS Mori, also show that households continued to eat into their savings or take on more debt to support their spending. Although there was some improvement in optimism about future finances, current finances were seen to have deteriorated further.

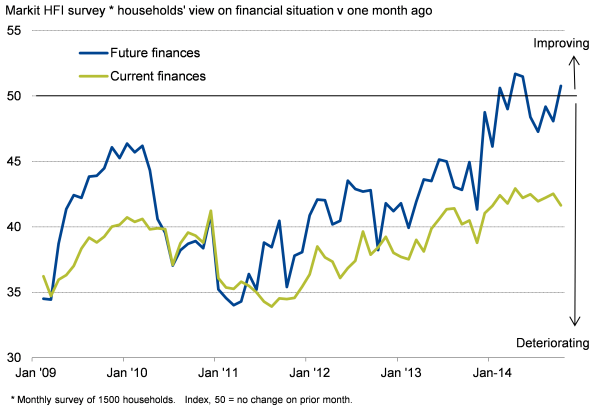

Optimism about future finances

On average, households were optimistic about their financial situation over the next year in October. It was the first time that optimists have outnumbered pessimists since May, and only the fourth time since the financial crisis.

This optimism was primarily driven by workplace activity rising strongly again in October. The survey has signalled a robust increase in workplace activity over the past year-and-a-half, which has provided a reliable advance indication of the upturn in economic growth (GDP) over this period.

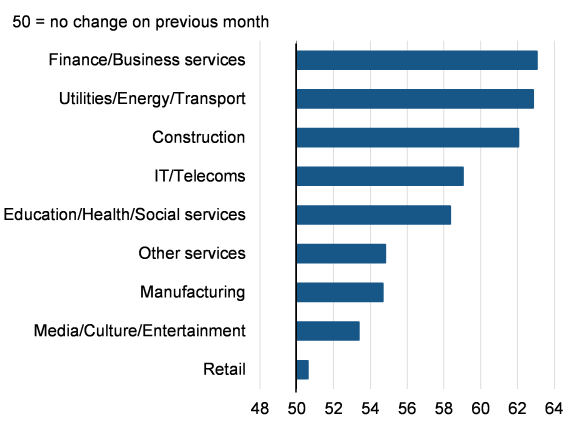

People employed in the services sector, and notably financial services, reported the largest upturn in workplace activity in October, alongside construction workers. Retail, media and manufacturing workers saw the smallest upturns in activity, though nevertheless still saw ongoing growth.

The overall increase in workplace activity therefore bodes well as a sign that economic growth remained robust at the start of the fourth quarter.

Income from employment on the rise

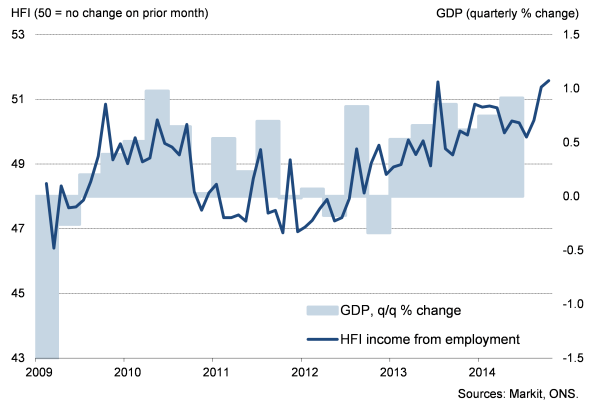

Especially reassuring was a rise in the HFI survey's index of incomes received from employment.

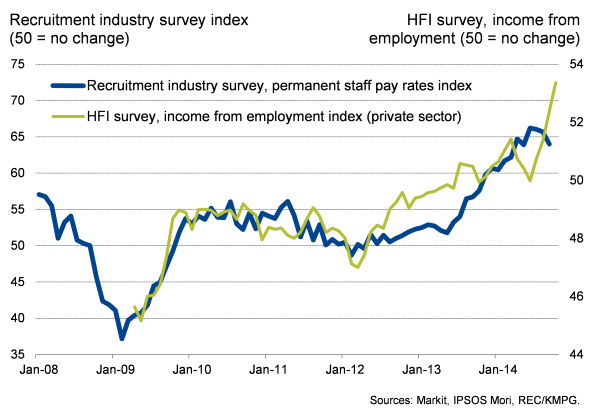

Households reported the largest rise in income from employment since the financial crisis in October, building on a similar increase in September and more modest, marginal, improvements in prior months. Households in the private sector reported an especially marked improvement in growth of income compared to prior months, a series which correlates well with data on pay from the UK recruitment industry. Both the HFI and recruitment industry data therefore suggest that official [pay data, which are only available with a considerable lag, are likely to turn up in coming months.

The upturn in incomes suggest that the strong economic growth seen in the UK since the middle of last year is at last starting to feed through to workers' pay packets, either through higher average pay rates, more working hours or a combination of both.

HFI and recruitment industry survey pay indices

HFI income from employment v GDP

Deteriorating current finances

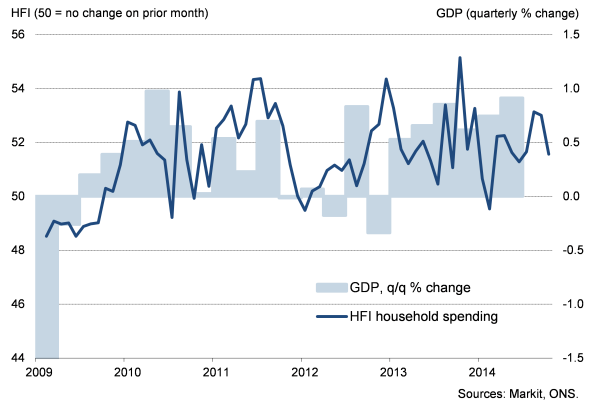

Higher incomes have in turn fed through to increased household spending, which rose again in October, albeit with households once again having to reduce their savings on average. Overall debt also increased marginally.

The broad message from the survey is therefore that incomes are starting to rise, but as yet remain insufficient to sustain household spending without people having to either eat into savings or take on more debt. Not surprisingly, therefore, the survey found that households viewed their overall current financial situation to have deteriorated again in October, and at the fastest rate since January.

It is notable that, despite the economy growing strongly over the past year, households have seen a continual deterioration in their finances since the financial crisis.

Households views on current and future finances

HFI household spending v GDP

HFI activity at work (50 = no change on September)

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-Economics-UK-household-incomes-rise-on-back-of-increased-workplace-activity.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-Economics-UK-household-incomes-rise-on-back-of-increased-workplace-activity.html&text=UK+household+incomes+rise+on+back+of+increased+workplace+activity","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-Economics-UK-household-incomes-rise-on-back-of-increased-workplace-activity.html","enabled":true},{"name":"email","url":"?subject=UK household incomes rise on back of increased workplace activity&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-Economics-UK-household-incomes-rise-on-back-of-increased-workplace-activity.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+household+incomes+rise+on+back+of+increased+workplace+activity http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-Economics-UK-household-incomes-rise-on-back-of-increased-workplace-activity.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}