Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 15, 2016

UK inflation set to pick up as producers see record rise in input costs

UK consumer prices rose less than expected in October, but inflation looks set to creep higher in coming months as rising costs eventually feed through to consumers.

Consumer prices rose 0.9% on a year ago in October, according to the Office for National Statistics, below expectations of a 1.1% rise and down from 1.0% in September.

However, the easing in inflation looks likely to be swiftly reversed in coming months, as prices paid by factories for their inputs surged 4.6% in October, the largest monthly rise on record. Producers pushed these higher costs onto their customers, many of whom are retailers, with prices charged for goods leaving the factory gate up 2.1% in October. That was the largest increase since April 2012.

The upturn in producers' costs is coming from a combination of higher global commodity prices and the weakened exchange rate. These forces are pushing factory costs higher, notably for imports of oil and many metals, as well as raising the cost of transport and energy.

Mid-October saw the price of oil hit a one-year high and the exchange rate slump to a record low on a trade-weighted basis.

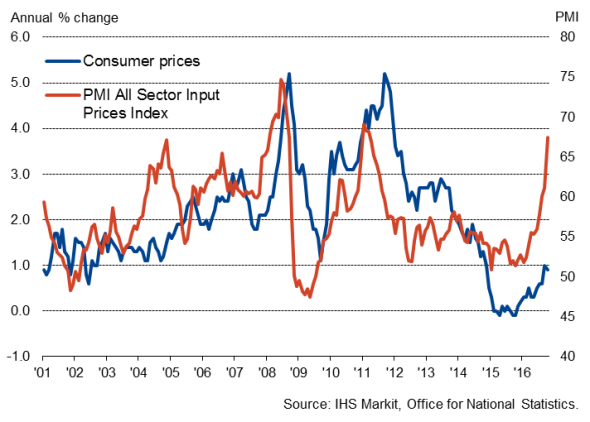

The marked extent to which companies costs are rising has also been clearly illustrated by the business surveys. IHS Markit's PMI surveys found the rate of increase of companies' costs to have accelerated in October to the greatest extent in nearly 20 years of data collection, rising to its highest since March 2011. In their survey responses, companies put the blame squarely on the higher cost of imports resulting from the fall in the exchange rate and higher energy costs.

The October business surveys also signalled the largest monthly rise in average prices charged by companies for their goods and services since May 2011.

UK inflation and companies' costs

Consumer concern

It's therefore likely to be only a matter of time before price hikes in retailers' supply chains start feeding through to the customer, as retailers seek to protect margins.

The concern is that consumers are driving the economy at the moment, and higher inflation is starting to eat into people's spending power, subduing consumer spending. Surveys have already started to indicate that worries about rising inflation are hitting households' current finances and fuelling concerns about future financial well-being.

At the same time, uncertainty about the outlook appears to be curbing firms' appetite to hire, meaning wage bargaining power may fall more on the employer than the employee. Wage growth may therefore disappoint in 2017, acting as a further dampener on consumer spending.

Inflation outlook

The upside to weak wage growth is that the absence of steep pay rises will in turn help curb consumer price inflation in 2017, as consumers remain price conscious.

Furthermore, oil has already fallen in price since October. Oil and other commodity prices are expected to rise only gradually on average over the next couple of years, helping subdue wider inflationary pressures.

While we see inflation breaching the Bank of England's 2.0% target in early 2017, and rising to 3.0% by the end of the year, the rate of increase is expected to peak at 3.5% in 2018.

More hawkish Bank of England

The steep increase in costs means the Bank of England is likely to retain a hawkish stance. The central bank has moved away from raising expectations regarding the possibility of more stimulus towards a more neutral policy stance. This has been due to both the recent rise in price pressures and signs that the economy is showing better than expected resilience in the face of 'Brexit' uncertainties. However, today's dip in the headline rate of inflation is perhaps a reminder that any raising of interest rates is likely to be only very gradual.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15112016-Economics-UK-inflation-set-to-pick-up-as-producers-see-record-rise-in-input-costs.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15112016-Economics-UK-inflation-set-to-pick-up-as-producers-see-record-rise-in-input-costs.html&text=UK+inflation+set+to+pick+up+as+producers+see+record+rise+in+input+costs","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15112016-Economics-UK-inflation-set-to-pick-up-as-producers-see-record-rise-in-input-costs.html","enabled":true},{"name":"email","url":"?subject=UK inflation set to pick up as producers see record rise in input costs&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15112016-Economics-UK-inflation-set-to-pick-up-as-producers-see-record-rise-in-input-costs.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+inflation+set+to+pick+up+as+producers+see+record+rise+in+input+costs http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15112016-Economics-UK-inflation-set-to-pick-up-as-producers-see-record-rise-in-input-costs.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}