Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 15, 2016

Small caps are top trumps in post-election rally

Small cap US stocks are soaring at the fastest pace since the financial crisis and investors are rushing to grab a piece of the action.

- Smallest third of US stocks have rallied most strongly in post-election trading

- November on track to be best month for small cap stocks since 2008

- US small cap ETFs enjoy largest weekly haul on record

One week on from the election and widely reported forecasts that a Trump presidency would lead to a sharp selloff in equities have failed to materialize with some indices actually surging to new all-time highs in the three trading days since the election. More surprisingly and perhaps fitting for a candidate whose victory was seen as a triumph for the "little guy", small cap stocks are enjoying a disproportionate share of the post-election rally as the market digests the domestically focused, low regulation rhetoric to come out of Trump's campaign in recent months.

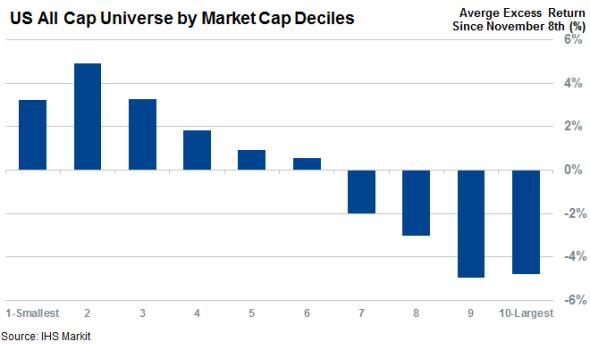

Grouping the Markit Research Signals US total cap universe into 10 groups sorted by market capitalization highlights this trend as the constituents which make up the smallest three decile groups have each outperformed the average market return by more than 3% over the three post-election trading days.

This outperformance has come at the expense of their largest peers as the two largest market groups which have trailed the wider US stock universe by over 4% over the same period of time.

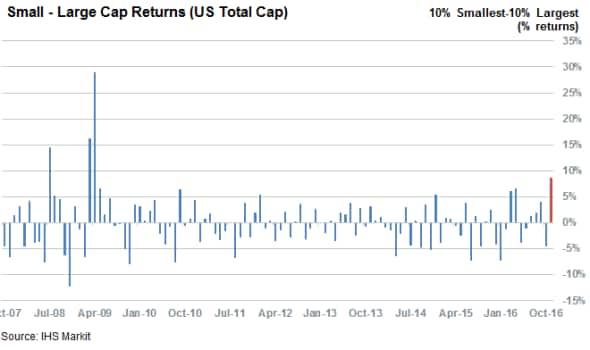

The post-election small cap rally means that the smallest 10% of US stocks have returned 8.6% more than their peers on the opposite end of the market cap spectrum for the opening two weeks of November. This puts November on track to deliver the widest return gap between the two groups of shares since the financial crisis in 2008.

Investors rush to small cap ETFs

The large outperformance delivered by stocks on the smaller end of the size spectrum has lifted the small cap focused Russell 2000 index past its large cap exposed S&P 500 peer in the days immediately preceding the election. While the latter is still up 1.6% since the election, its performance pales in comparison to the massive 7.2% rally seen by the Russell 2000 in the wake of Donald Trump's unexpected election win.

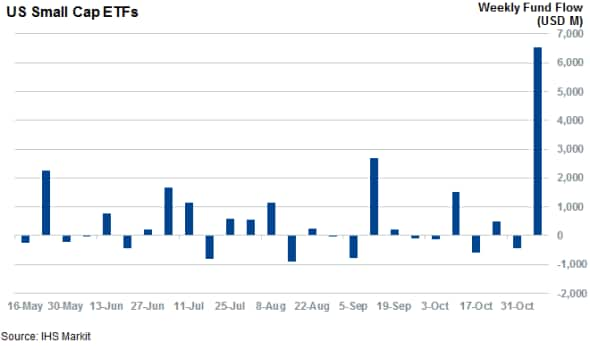

Investors have caught onto this trend as ETFs which invest in the smaller end of the US market cap spectrum enjoyed their largest weekly inflows on record last week when US based investors ploughed over $6.5bn of assets into these funds. The great majority of these record shattering inflows, $5.5bn, came in the three trading days since the election which highlights the growing appeal of small cap shares in the post Trump market.

Whether this trend continued in the coming weeks and months is anyone's guess, but for now the euphoria felt by the "little guy" holds true for Wall Street as well as Main Street.

Simon Colvin, Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15112016-Equities-Small-caps-are-top-trumps-in-post-election-rally.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15112016-Equities-Small-caps-are-top-trumps-in-post-election-rally.html&text=Small+caps+are+top+trumps+in+post-election+rally","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15112016-Equities-Small-caps-are-top-trumps-in-post-election-rally.html","enabled":true},{"name":"email","url":"?subject=Small caps are top trumps in post-election rally&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15112016-Equities-Small-caps-are-top-trumps-in-post-election-rally.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Small+caps+are+top+trumps+in+post-election+rally http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15112016-Equities-Small-caps-are-top-trumps-in-post-election-rally.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}