Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 16, 2015

UK bonds benefit from ECB QE

UK corporate bonds have offered the best returns among advanced economies as the search for yield intensifies.

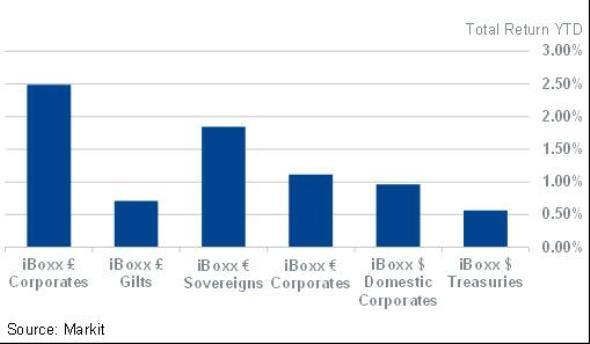

- GBP denominated corporate bonds have returned 2.5% since the start of the year, leading all western bond asset classes

- 10 year gilt yields have tightened in the wake of ECB QE

- Despite their strong recent run, GBP corporate bonds still offer twice the extra yield over Euro listed corporate debt

This year has started where 2014 left off, with credit markets continuing their bull run. Conditions remain favourable for bond investors, with the BoJ and the ECB providing further QE stimulus, and global credit markets have benefitted as investors search for yield. One market to benefit from the phenomenon has been the UK, with the country's corporate bonds leading developed bond markets, according to Markit's iBoxx data.

UK corporate bonds have posted a strong 2.5% total return since the start of the year, which is more than twice the figures posted by corporate bonds issued in EUR and USD.

However on the sovereign side, EUR denominated sovereign bonds have returned 1.85%; this strongest performance putting them well ahead of their British and US peers.

UK gilts have returned 0.71% YTD, and US treasuries just over 0.5%. Paradoxically these lagging returns were mainly due to bullish economic data as US jobs data and optimistic UK growth figures have contributed to a selloff in gilts and treasuries over the last two weeks. The looming prospect of a rate rise in both the US and UK seems to have overturned much of the strong gains seen in the wake of the ECB's QE action.

The IMF recently reported that the UK experienced the highest growth among its G7 peers in 2014, at 2.6%. This strong growth, coupled with positive rhetoric from the BoE, has sparked rumours that interest rates rises may come sooner rather than later. Sterling has since started to appreciate just as the dollar did towards the back end of last year amid improving economic conditions.

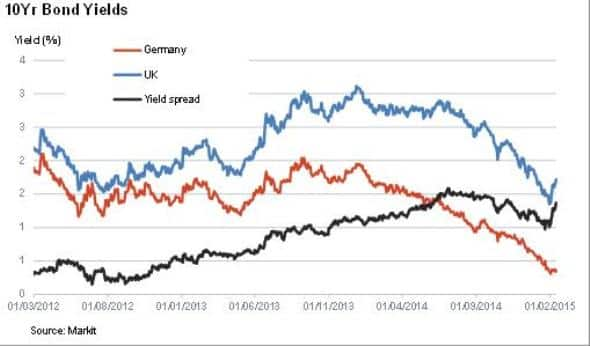

This relative strength marks a stark contrast to the diverging economies of the UK and the eurozone. QE and deflation continues to suppress bond yields in Europe with 10Year bund yields continuing to slide and currently standing at near all-time lows of 0.35%. The spread between UK and German 10Year bonds stands at 136bps, up from 119bps at the start of the year.

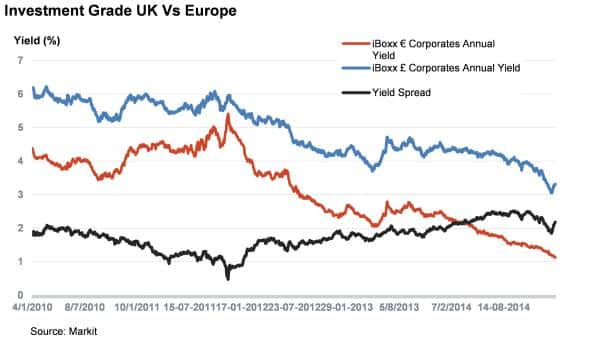

This drop has also translated into corporate bonds (which are priced off sovereigns). In high quality credit, the iBoxx GBP Corporates index yields 2.17% over the iBoxx EUR Corporates index, up from post QE lows of less than 2% but well above levels seen from 2010 to 2014. With sterling also gathering momentum, UK credits offer an attractive proposition as the extra yield offered by sterling denominated corporate bonds now sits at over twice the level it did at the start of 2012.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022015-credit-uk-bonds-benefit-from-ecb-qe.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022015-credit-uk-bonds-benefit-from-ecb-qe.html&text=UK+bonds+benefit+from+ECB+QE","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022015-credit-uk-bonds-benefit-from-ecb-qe.html","enabled":true},{"name":"email","url":"?subject=UK bonds benefit from ECB QE&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022015-credit-uk-bonds-benefit-from-ecb-qe.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+bonds+benefit+from+ECB+QE http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022015-credit-uk-bonds-benefit-from-ecb-qe.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}