Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 16, 2017

UK pay growth wanes despite lowest jobless rate since 1975

Signs of UK wage growth cooling add to warning signs that the economy is slowing and suggest that policymakers will take an increasing dovish stance in coming months.

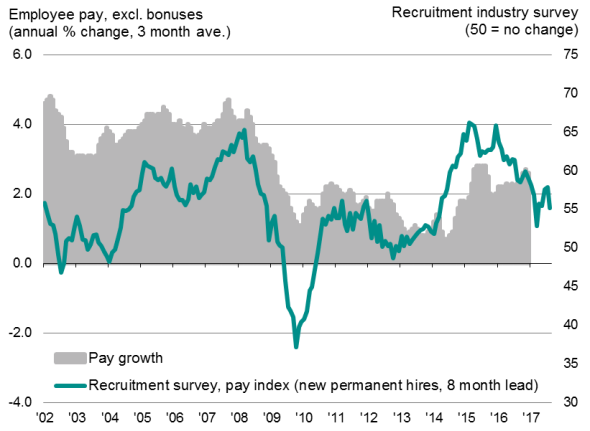

Pay growth indicators

Better news on unemployment and hiring will meanwhile help bolster confidence in the economy's resilience as the UK heads closer to invoking Article 50, but the combination of record employment yet weaker pay growth remains a major concern.

In the current environment of high employment, low unemployment and rising inflation, we should be seeing upward pressures on wages, not falling pay growth.

Slowing pay growth

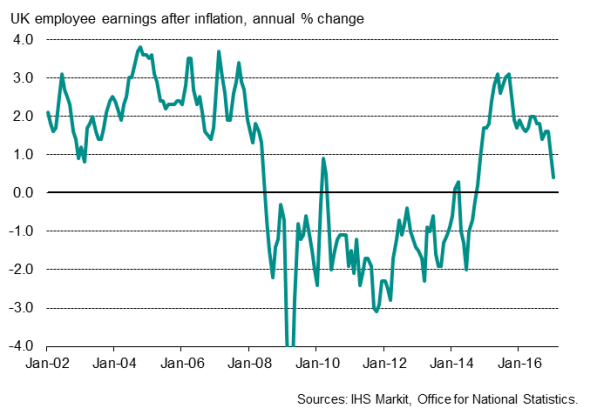

Employee earnings including bonuses rose 2.2% in the three months to January, down from 2.6% in the prior three months, according to the Office for National Statistics. Underlying pay, excluding bonuses, meanwhile rose a mere 2.3%, also down from 2.6%. By comparison, inflation has risen to 1.8% from just 0.3% a year ago, and looks set to rise to 3% in coming months, meaning real pay could soon start to fall.

Real pay growth

Sources: IHS Markit, CIPS, ONS.

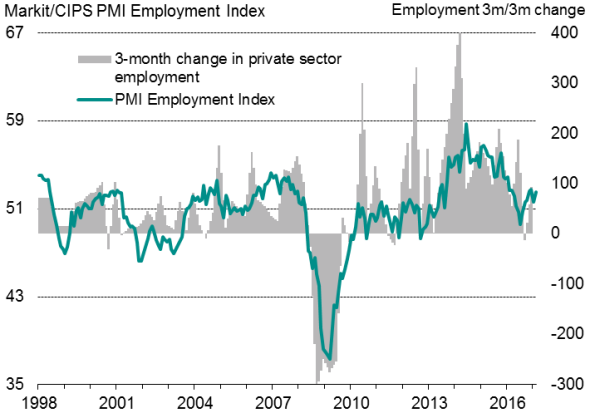

PMI survey and employment

Policymakers are watching the pay data closely, as the economy is reliant on rising consumer spending to sustain a robust rate of expansion. However, there are already signs that households appear to be curbing their expenditure. Our February survey of households showed finances being squeezed to one of the greatest extents for over two years amid low pay and rising prices. Households reported the sharpest increase in their living costs for almost four years.

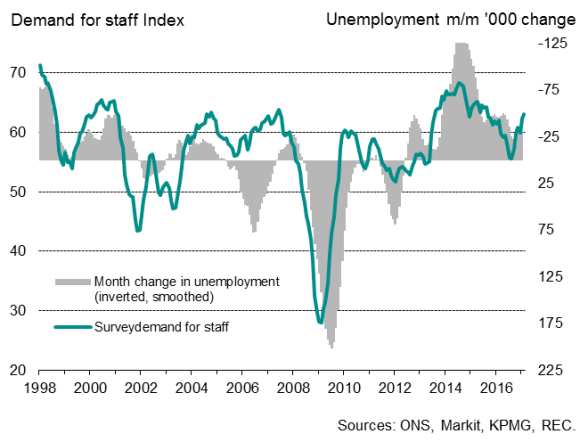

REC survey and unemployment

Sources: IHS Markit, CIPS, REC, ONS.

Today's labour market data will add to suspicions that weak pay means that household incomes are going to come under increasing pressure in coming months.

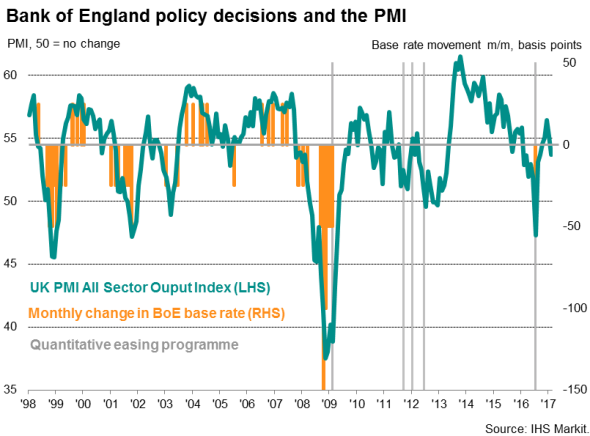

The official data also come on the heels of survey data which indicate that the pace of economic growth is likely to have slowed to 0.4% in the first quarter, linked to weakness in consumer-facing sectors. The February PMI survey readings have in fact already slipped to levels that have historically been more consistent with the Bank of England adding more stimulus than hiking interest rates.

Falling unemployment

There was brighter news on employment. The unemployment rate fell from 4.8% to 4.7%, its lowest since 1975, with the number without work dropping by 31,000 in the three months to January. Over the same period, employment rose by 92,000. This represents a marked improvement from the 5,000 decline seen in the three months to October, when it seems businesses pulled-back on hiring in the aftermath of the shock Breixit vote. That had been the first decline in employment for over three years, but the subsequent return to growth signalled by today's data suggest firms have regained an appetite to expand workforce numbers.

Cautious hiring sustained in February

Both the PMI and the REC survey of the recruitment industry have meanwhile indicated that hiring continued to pick up in February compared to the lows seen mid to late last year.

However, the survey responses indicate that the overall rate of employment growth remains far below that seen on average in the previous three years, as firms' appetite to take on extra staff has waned in the face of growing uncertainty about the economic outlook. This uncertainty is widely linked to Brexit, with the government's imminent invoking of Article 50 focusing attention on the reality of the UK leaving the EU.

The additional concern is that the combination of record employment (at 74.6%, the employment rate is the joint highest since records began in 1971) and weakening pay growth raises further questions about the quality of the jobs that are being created.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032017-economics-uk-pay-growth-wanes-despite-lowest-jobless-rate-since-1975.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032017-economics-uk-pay-growth-wanes-despite-lowest-jobless-rate-since-1975.html&text=UK+pay+growth+wanes+despite+lowest+jobless+rate+since+1975","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032017-economics-uk-pay-growth-wanes-despite-lowest-jobless-rate-since-1975.html","enabled":true},{"name":"email","url":"?subject=UK pay growth wanes despite lowest jobless rate since 1975&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032017-economics-uk-pay-growth-wanes-despite-lowest-jobless-rate-since-1975.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+pay+growth+wanes+despite+lowest+jobless+rate+since+1975 http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032017-economics-uk-pay-growth-wanes-despite-lowest-jobless-rate-since-1975.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}