Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 16, 2015

UK pay growth fall gives policymakers room to hold interest rates low

The UK labour market remained something of an enigma in October. Unemployment fell to a seven-year low but pay growth also fell, once again confounding expectations that a tightening labour market will inevitably drive wages and salaries higher. As such, the data give the Bank of England scope to keep interest rates at their record low of 0.5% for longer.

The rate of unemployment fell to 5.2% in the three months to October, its lowest since 2006. On a single moth basis, the rate fell to 5.1% in October, suggesting the headline three-month rate could dip further in November.

Unemployment has fallen from 6.0% over a year ago and there are now just 2.4 unemployed people per vacancy. That's down from a peak of 5.9 four years ago and the lowest since mid-2005. But this tightening of the labour market has yet to translate into higher wage growth. In fact, wage growth is slowing rather than accelerating. Average weekly earnings excluding bonuses rose just 2.0% on a year ago in the three months to October, the slowest rate seen since February and down from 2.4% in the three months to September. Even if bonuses are included, the annual rate fell from 3.0% in the three months to September to 2.4%.

Bank of England policymakers continue to stress how pay growth remains central to policymaking, and the lack of wage inflation sends a very dovish signal. When looked at alongside the recent oil price slide, the renewed weakness of the wage data greatly reduces the likelihood of the Bank hiking interest rates in the first half of 2016.

Pay puzzle

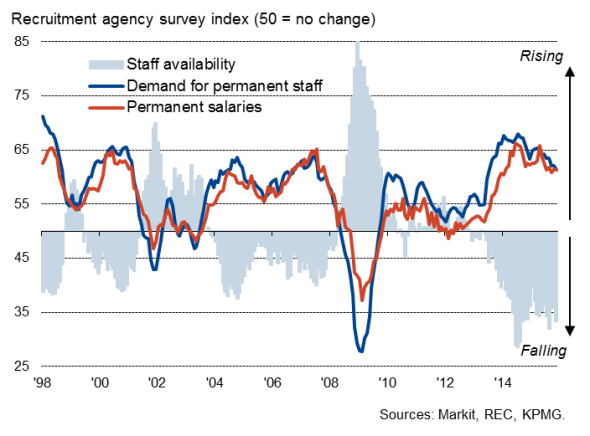

Survey evidence indicates that skill shortages are driving up pay rates, though this effect is clearly limited to the new hires that manage to negotiate the higher pay. The KPMG/REC recruitment industry survey clearly shows how the availability of staff is dwindling rapidly: the availability of suitable candidates to fill permanent jobs in fact deteriorated at the fastest rate in 18 years in November. Pay rates awarded to these new hires (and contract and temporary staff for that matter, probably for the same reason) continued to rise at a strong rate as a result.

Labour market tightness

So why isn't headline pay growth accelerating? It's not because the average worker who stays in their job feels too insecure to ask for a pay rise. A survey of households in December showed job insecurity at the lowest since data were first collected in 2009.

The possible answer is that the renewed weakness of pay growth reflects annual pay reviews that are linked to inflation. With inflation around zero, and even negative in some recent months, it's not surprising that pay reviews are having a dampening effect on average wage growth. This effect will of course linger for as long as inflation stays low.

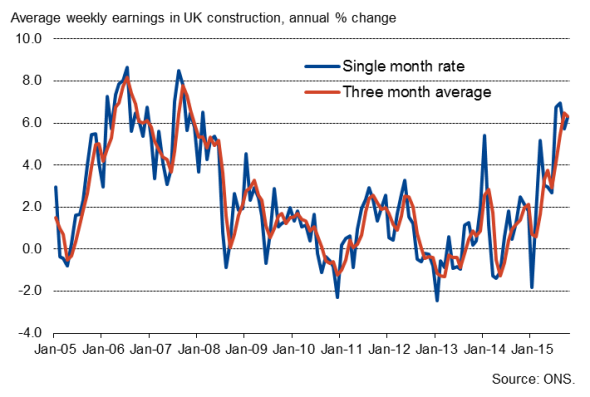

However, in some sectors, notably construction where there tends to be a high turnover of staff and where skill shortages are acute, the effect of the tightening labour market is more than offsetting the weakness of annual pay reviews, and average pay growth has accelerated in recent months.

UK pay growth (excluding bonuses)

Construction

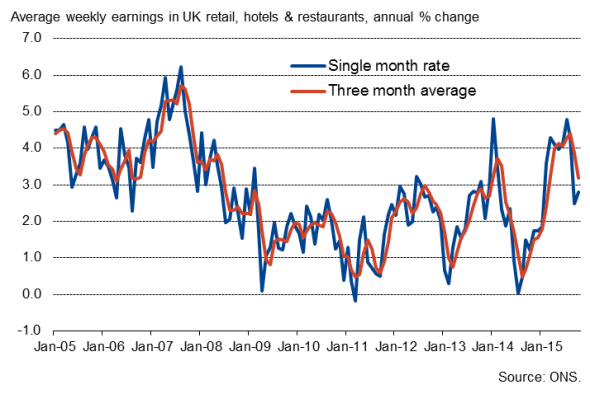

Retail & leisure

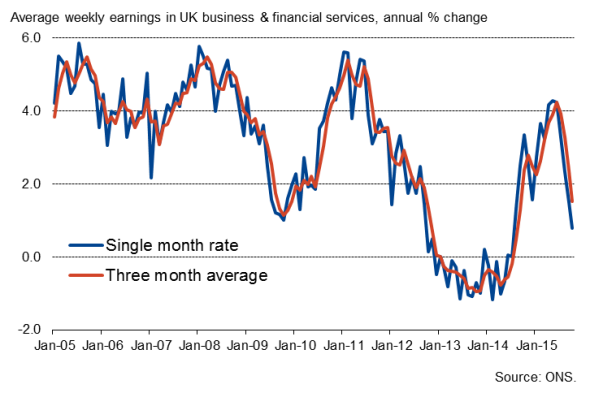

Business & financial services

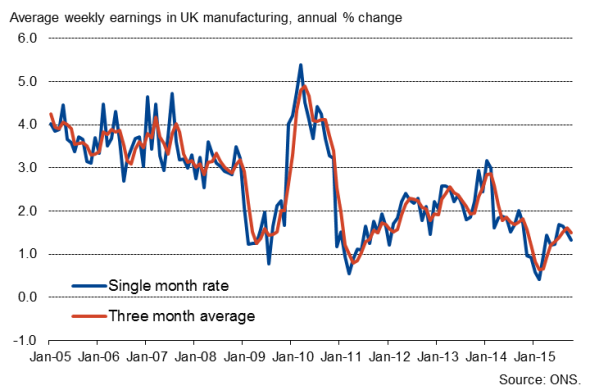

Manufacturing

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122015-Economics-UK-pay-growth-fall-gives-policymakers-room-to-hold-interest-rates-low.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122015-Economics-UK-pay-growth-fall-gives-policymakers-room-to-hold-interest-rates-low.html&text=UK+pay+growth+fall+gives+policymakers+room+to+hold+interest+rates+low","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122015-Economics-UK-pay-growth-fall-gives-policymakers-room-to-hold-interest-rates-low.html","enabled":true},{"name":"email","url":"?subject=UK pay growth fall gives policymakers room to hold interest rates low&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122015-Economics-UK-pay-growth-fall-gives-policymakers-room-to-hold-interest-rates-low.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+pay+growth+fall+gives+policymakers+room+to+hold+interest+rates+low http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122015-Economics-UK-pay-growth-fall-gives-policymakers-room-to-hold-interest-rates-low.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}