Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 17, 2016

UK households grow dovish on interest rate outlook

Households are feeling less downbeat about their finances, but this appears to be largely a reflection of expectations of interest rates staying low for longer and subdued inflation rather than any pick-up in pay growth. However, modest growth of incomes in recent months also meant households' need for credit has stabilised for the first time since the recession, leading to a further winding down of debt.

Rate hike expectations pushed back

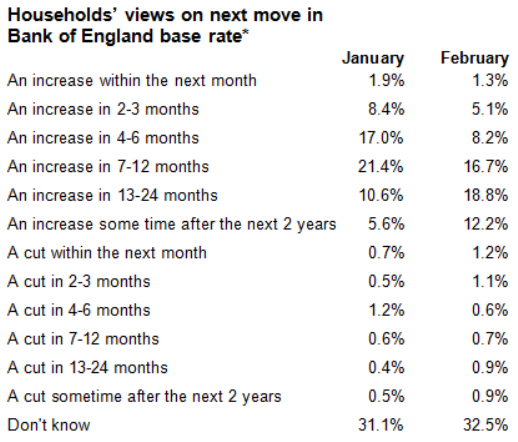

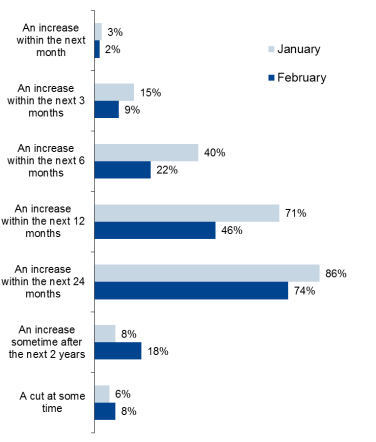

The latest HFI (Household Finance Index) survey provides the first snap-shot of actual household finance trends in February. The representative poll of 1,500 households showed a dramatic change in expectations of when the Bank of England will hike interest rates for the first time since the financial crisis, with the proportion of respondents expecting a hike within the next 12 months dropping below 50% for the first time for over two years, plunging from 71% in January to 46% in February, its lowest since October 2013.

The proportion of households expecting a rate hike within the next six months almost halved from 40% to 22% between January and February, also its lowest for over two years.

At 8%, the proportion expecting the bank's next move to be an interest rate cut meanwhile edged up to the highest ever recorded by the survey which began in July 2013.

The more 'dovish' interest rate outlook no doubt in part reflects gloomier rhetoric from the Bank of England. The survey data were collected after the release of the Bank's latest Inflation Report, which painted a darker picture of both future economic growth and the inflation outlook.

The survey also followed news that all nine members of the Monetary Policy Committee voted for policy to remain on hold, after Ian McCafferty fell back into line after voting to hike in previous months.

Markit HFI Survey

The latest data were collected between 10th and 14th February 2016.

Note that the chart excludes those who replied "Don't know".

* "The interest rate set by the Bank of England is currently 0.5%. Please let us know when and how you think the Bank will next change interest rates by choosing one of the options below: Please choose one answer."

Source: Markit

Low inflation outlook

The pushing back of the Bank's next move on interest rates was also accompanied by low inflation expectations. Households' expectations of future inflation, although at a three-month high, remained low by historical standards in February.

On the plus-side, households recognised the benefits of weak inflation and lower borrowing costs. The revised outlook for interest rates and inflation helped to lift households' views on their current finances to one of the highest seen this side of the recession, with views on future finances turning optimistic.

Low pay, but busier workplaces

Rising incomes also helped to lift the consumer mood, though pay growth remained frustratingly weak, especially in relation to how busy people were at work. Workplace activity rose at one of the fastest rates seen for over a year in February, however income from employment continued to show only modest growth. Although the survey shows incomes to have risen in each of the past 14 months, the rate of increase has failed to accelerate substantially, adding to worries that that low inflation is restraining workers' abilities to negotiate higher pay rates, therefore further darkening the outlook for inflation. The benefit, of course, is that the combination of rising workplace activity and meagre pay growth suggests that productivity is rising.

Despite the low pay growth, the survey brought good news on debt. Households' need for unsecured credit showed no growth for the first time since the financial crisis, suggesting that existing incomes are sufficient to support living standards. Debt levels meanwhile continued to fall, sustaining the downward trend seen over the last year-and-a-half, and savings showed one of the smallest deteriorations ever recorded by the survey.

Other key survey findings included:

" Job security collapsed in financial and business services, presumably linked to the recent drop in banks' share prices.

" Sharp increases in savings (and lower debt) at the upper end of the pay scale contrasted with falling savings (and rising debt) at the lower end.

" Better weather appears to have led to a big increase in cultural and entertainment services activity compared to January.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022016-economics-uk-households-grow-dovish-on-interest-rate-outlook.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022016-economics-uk-households-grow-dovish-on-interest-rate-outlook.html&text=UK+households+grow+dovish+on+interest+rate+outlook","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022016-economics-uk-households-grow-dovish-on-interest-rate-outlook.html","enabled":true},{"name":"email","url":"?subject=UK households grow dovish on interest rate outlook&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022016-economics-uk-households-grow-dovish-on-interest-rate-outlook.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+households+grow+dovish+on+interest+rate+outlook http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022016-economics-uk-households-grow-dovish-on-interest-rate-outlook.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}