Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 17, 2015

US economy worries mount as manufacturing output falls for third month running

US economic data continue to deteriorate, casting doubts on when the Federal Reserve will hike interest rates. The slowdown goes some way to vindicate the bond market's view that interest rates will rise slower than the Fed has been signalling, but raises questions about whether equity investors have fully priced in a slowing of the US economy.

Expectations have built that the Fed will remove the word 'patient' from its policy statement at its meeting this week, thereby opening the possibility of raising interest rates at its June meeting. However, with signs that the economy has slowed sharply in recent months, the Fed is likely to delay any tightening of policy until the data flow starts to improve again, effectively ruling out a June hike unless the data surprise to the upside in coming months.

Manufacturing and retail woes

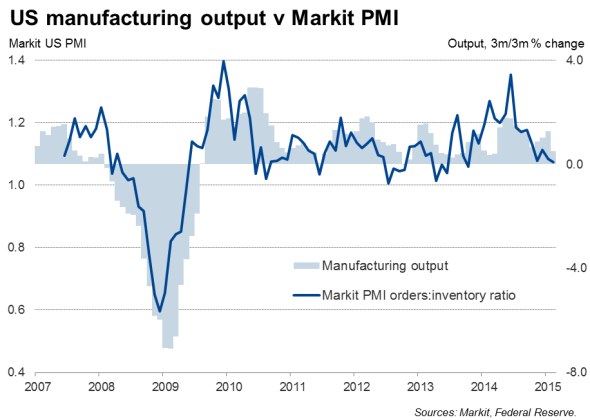

Manufacturing output fell for a third successive month in February, down 0.2% after a 0.3% drop in January. That was the first time since 2009 that manufacturing has contracted for three successive months, matching a similar three-month slide in retail sales.

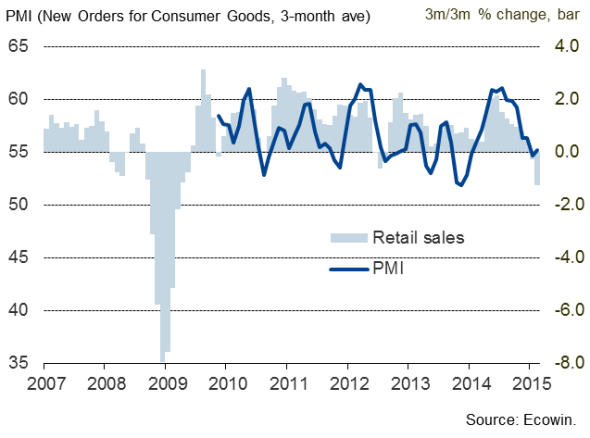

Retail sales and demand for consumer goods

Based on the data available so far, manufacturing output is running flat in the first quarter compared to the fourth quarter of last year, when it had enjoyed 1.0% (4.0% annualised) growth.

The wider measure of industrial production, which rose just 0.1% in February after falling in the previous two months, is meanwhile running 0.1% lower (0.4% annualised) in the first quarter.

The disappointing output data follow a worryingly steep decline in factory orders in recent months. Factory orders fell in each of the six months to January, leaving order book values their lowest since March 2013.

The drop in output and orders can in turn be linked to a deteriorating retail sales trend. Retail sales in the first quarter are down 1.6% on the fourth quarter, based on data available for the first two months of 2015. The three-month trend in retail sales is now the weakest since the first quarter of 2009.

Altogether, our nowcasting model of the official and survey data so far available point to US economic growth running at 2% annualised in the first quarter, after having already slowed from 5.0% to 2.2% between the third and fourth quarters of last year.

Underlying slowdown

The recent weak data may be linked to some extent to the combination of adverse weather in February and recent port strikes, which have hit supply chains. However, the fact that the production and retail data have now deteriorated for three months suggests that a more underlying weakening of the economy is taking place. Such a darker picture is something which is supported by Markit's Business Outlook Survey, which showed optimism among US companies falling to a post-crisis low in February.

The weakening of the data will no doubt be sufficient to encourage the Fed to hold off on any imminent hiking of interest rates until a clearer picture emerges. This week's FOMC statement may therefore pull the word "patient", leaving a June hike as an option, but the Fed will no doubt want to see some improvement in the numbers before feeling confident that the economy is able to withstand higher interest rates, as well as the appreciation of the dollar that will most likely follow any rate hike.

Darkened outlook

Investors are also growing wary of the US corporate outlook, a caution which these weak numbers are likely to intensify. ETF data show US-exposed equity funds are on course for the largest quarterly outflow for six years so far this year.

The S&P 500 is also so far down more than 3% from its peak earlier in the year, and Markit data show that short interest (borrowing shares in the hope that their price will fall) for S&P 500 stocks has risen steadily since the beginning of the year to the highest for a year-and-a-half. However, these declines have been mainly tied to energy names, linked in turn to the collapse in the price of oil. Ignoring energy, short interest has in fact been largely unchanged so far this year. This suggests that equity investors may not be fully pricing in a potential slowdown in the US economy.

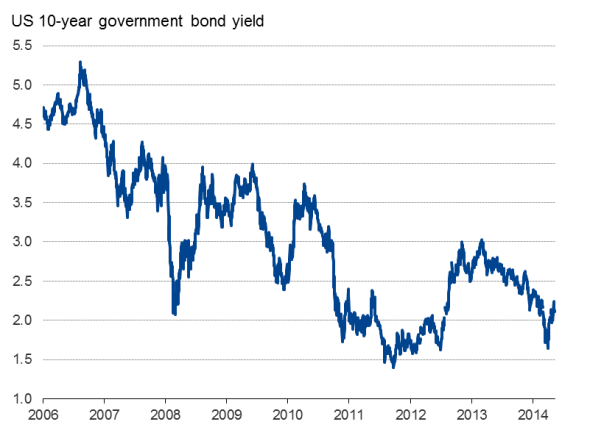

However, this weakening of the economy helps to explain why bond markets continue to diverge compared with Fed guidance on interest rates, with bond markets indicating that rates are going to rise as fast as policymakers have indicated. In December, the so called 'Dot-plot', showing the projections of Fed officials, indicated that the main policy rate would rise to 1.125% by the end of 2015, then 2.5% by the end of 2016 and up to 3.6% by the end of 2017. In contrast, although up on the lows seen earlier this year, ten-year US Treasuries are only yielding 2.13%, according to the latest Markit data, representing a very relaxed view of policy tightening.

Bond market

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032015-economics-us-economy-worries-mount-as-manufacturing-output-falls-for-third-month-running.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032015-economics-us-economy-worries-mount-as-manufacturing-output-falls-for-third-month-running.html&text=US+economy+worries+mount+as+manufacturing+output+falls+for+third+month+running","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032015-economics-us-economy-worries-mount-as-manufacturing-output-falls-for-third-month-running.html","enabled":true},{"name":"email","url":"?subject=US economy worries mount as manufacturing output falls for third month running&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032015-economics-us-economy-worries-mount-as-manufacturing-output-falls-for-third-month-running.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+economy+worries+mount+as+manufacturing+output+falls+for+third+month+running http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032015-economics-us-economy-worries-mount-as-manufacturing-output-falls-for-third-month-running.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}