Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 17, 2016

Brexit fears spark credit volatility; loans recovery

In this week's credit wrap, fears of a UK exit from the European Union sparks market volatility, the Fed holds interest rates steady and leveraged loans continue to outperform.

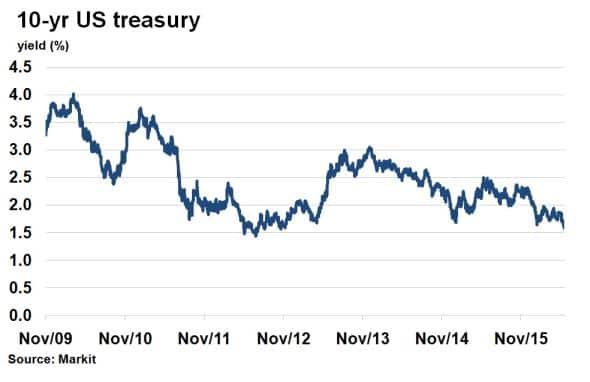

- 10-yr US treasury yields have fallen to 1.58%, the lowest level since mid-2012

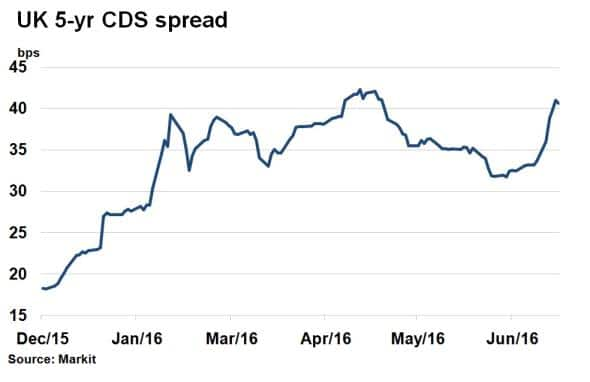

- UK's 5-yr CDS spread has widened back out to 2016 highs

- Markit iBoxx USD Leveraged Loans Index sees 4.7% total return so far this year

Fed stays put

US Federal Reserve chair Janet Yellen cited fears around Britain leaving the EU in next week's referendum as a contributing factor in the decision to keep interest rates on hold this week. After increasing interest rates by 25bps last December, external factors have since halted any further action from the Fed. Given the credit market reaction to the growing probability of a Brexit this week, it is clear to see why the Fed chose to err on the side of caution.

The Markit iTraxx Europe main index widened to 88bps as of June 14th, a three month high, with the banking sector taking the biggest hit. Global government bond yields have continued to fall, with 10-yr US treasury yields sinking to 1.58%; the lowest since mid-2012 according to Markit's bond pricing service.

Meanwhile, the cost to protect against the UK defaulting on its government debt has widened back to the highs seen in April. The UK's 5-yr CDS spread is now over double the level seen at the beginning of the year, 41bps, from 18bps.

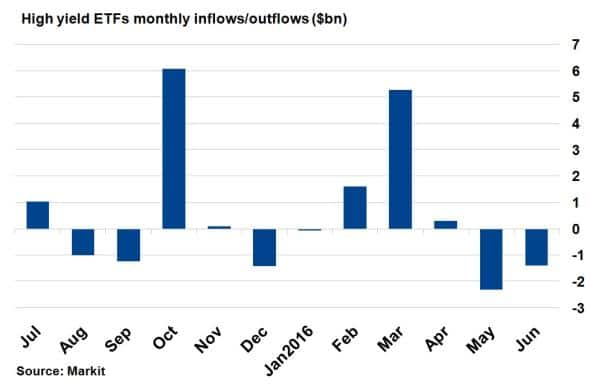

Investors have also been keen to steer clear of any volatility by de-risking. ETFs tracking high yields bonds have seen significant outflows over the past week according to Markit's ETP analytics. June's total outflow is $1.4bn so far, on course for two consecutive monthly outflows - similar to periods of heightened market volatility seen last December/January and last August/September.

Loans roar on

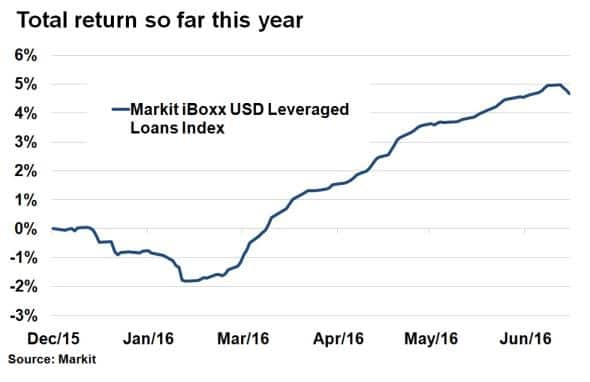

After a tough start to the year, leveraged loans have recovered to produce consistent returns over the past few months amid a more positive economic backdrop.

The positive sentiment around the asset class can be observed in the performance of the Markit iBoxx USD Leveraged Loans Index. The index has returned 4.7% on a total return basis so far this year and has gathered momentum. This comes in sharp contrast to the performance seen towards the second half of 2015 and the first two months of 2016, as investors dumped risky assets.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17062016-Credit-Brexit-fears-spark-credit-volatility-loans-recovery.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17062016-Credit-Brexit-fears-spark-credit-volatility-loans-recovery.html&text=Brexit+fears+spark+credit+volatility%3b+loans+recovery","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17062016-Credit-Brexit-fears-spark-credit-volatility-loans-recovery.html","enabled":true},{"name":"email","url":"?subject=Brexit fears spark credit volatility; loans recovery&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17062016-Credit-Brexit-fears-spark-credit-volatility-loans-recovery.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Brexit+fears+spark+credit+volatility%3b+loans+recovery http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17062016-Credit-Brexit-fears-spark-credit-volatility-loans-recovery.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}