Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Sep 17, 2015

German utilities' credit under strain

Germany's rejection of nuclear power and its decision to offload the costs of decommissioning power plants onto utilities firms has seen their implied credit risk jump.

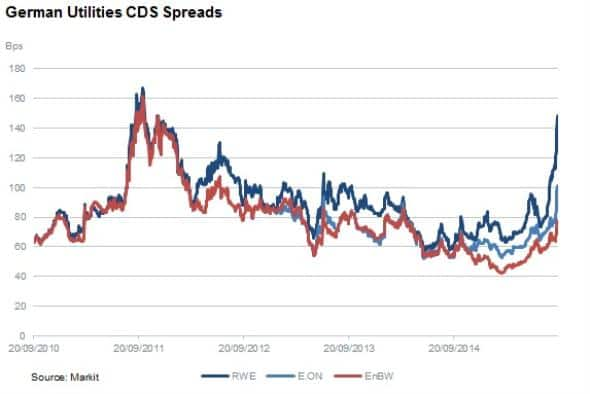

- RWE's CDS spread has widened by 24bps over the last week to hit 148bps

- EnBW and E.ON have also seen their CDS spreads surge significantly

- RWE's spread is still in line with its current BBB credit rating

The sharp fall in commodity prices over the past 12 months has placed the energy sector under increased scrutiny from credit investors. But it tends to be exploration and production firms, as well as mining companies, that have borne the brunt of negative sentiment. Utilities often benefit from lower prices in raw materials, and their spread performance over the last year has been typical of the sector's defensive status.

In Germany, however, a different scenario has emerged. In the wake of the Fukushima disaster four years ago, the German government decided to turn its back on nuclear generated power; a change in policy that has had serious consequences for utilities. The cost of decommissioning the nuclear plants falls on their owners: RWE, E.ON and EnBW. All three companies have made provisions to cover the costs of dismantling the reactors, estimated by the industry last year at €38bn.

CDS spreads surge

But a report this week suggested that the funds will fall short by as much as €40bn, mainly due to the extra cost of nuclear waste storage. This news sent CDS spreads in the three firms sharply wider.

RWE, the power provider with the largest nuclear burden, saw its spreads climb 24bps to 148bps, its widest level since November 2011. E.ON and EnBW also gave up significant ground. The basis between RWE and its two main domestic rivals is the largest on record, partly a reflection of investors' concern about the company's nuclear problem.

Implied rating in line with agencies

RWE is still trading with an implied rating of BBB, in line with the average of the three rating agencies. But its recent credit deterioration - at least in terms of market perception - underlines how companies need to be cognisant of the health of their counterparties. This is a particular concern for firms operating in the energy sector, where downstream and upstream supply chains, as well as trading operations, mean that there are more counterparties than in other industries.

Banks are now taking account of counterparty risk through CVA, and large energy firms are increasingly taking a more sophisticated approach. Credit ratings will always have their place, but CDS data is essential for a timely and accurate assessment of counterparty risk, as we saw in Germany this week.

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092015-credit-german-utilities-credit-under-strain.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092015-credit-german-utilities-credit-under-strain.html&text=German+utilities%27+credit+under+strain","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092015-credit-german-utilities-credit-under-strain.html","enabled":true},{"name":"email","url":"?subject=German utilities' credit under strain&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092015-credit-german-utilities-credit-under-strain.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=German+utilities%27+credit+under+strain http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092015-credit-german-utilities-credit-under-strain.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}