Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Oct 17, 2014

Changing fortunes

Macroeconomic uncertainty is fuelling volatility and pushing earnings into the background

- Solid results from US banks

- Volatility possibly exacerbated by lack of liquidity

- Eurozone malaise threatens to spread to US

Earnings season is now underway, though the uncertainty over global macroeconomic direction is so far pushing corporate concerns into the background.

US banks, as usual, will set the tone, and so far the indications are that results will be mixed. JPMorgan's third-quarter net income of $1.36 per share was slightly below expectations, but total revenues of $25.16 were ahead of consensus estimates. Citigroup's adjusted EPS and revenues ($1.15 and $19.6bn) managed to beat expectations, and both banks posted an improvement compared to last year.

Aside from the headline figures, the most closely watched segment of the banks' results was the performance of fixed income trading. The whole sector has suffered in recent times from a lack of volatility, so the recent pick up in asset price fluctuations was expected to benefit investment banks. Both JPM and Citigroup reported higher fixed income revenues, though the increases weren't dramatic.

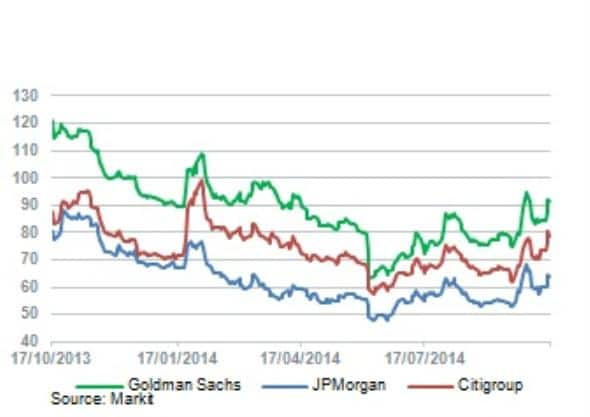

Regulatory change, particularly onerous capital requirements, will continue to weigh on revenues for the foreseeable future. JPM's CDS spreads have widened 11bps to 64bps over the past month, while Citigroup's gave up 18bps to 80bps. Goldman Sachs, which posted strong third-quarter numbers, is trading at 91bps, 16bps wider.

Volatility may continue to affect credit spreads as earnings season unfolds, but it is more likely that the macro environment will determine market direction ahead of year-end. The growth outlook for the eurozone seems to be getting grimmer with each economic release. Germany, the region's powerhouse, is spluttering, while France and most of the periphery are in the doldrums.

The ECB will probably wait and see the effect of the TLTROs and the "private QE" programme - purchase of ABS and covered bonds - before "full QE" is considered. The efficacy of the ECB's measures is one of many doubts afflicting the markets.

Meanwhile, the Federal Reserve is set to end its bond purchase programme, which could deprive credit of the central bank liquidity that it has depended on in recent years. A concerted depreciation of the euro against the dollar will have a significant impact on the US economy, making it even more difficult for the US to fulfil its usual role as the progenitor of global growth

Stagnation in Europe and a concomitant rise in the US dollar could pose serious problems for a world still suffering from imbalances. The wild swings we have seen in recent days - possibly exacerbated by weak trading liquidity - shows that the exit from unconventional monetary policies will not be easy. The Markit iTraxx Europe was trading at 81bps on October 16, 16bps wider than the first day of the index roll on October 6, but then recovered to 73bps only a day later.

Moves of this magnitude are rare in the QE era, so lack of liquidity may have been a factor. But volumes remain high, and the indices are among the most liquid financial instruments (and often see inflows during troubled times due to their reliability).

The recovery was sparked by comments from James Bullard, president of the St. Louis Fed, which suggested the central bank should pause in its tapering of QE due to low inflation expectations. The impending results of the EU's stress tests and Asset Quality Review, scheduled for October 26, will only add to the climate of uncertainty next week.

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17102014-credit-changing-fortunes.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17102014-credit-changing-fortunes.html&text=Changing+fortunes","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17102014-credit-changing-fortunes.html","enabled":true},{"name":"email","url":"?subject=Changing fortunes&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17102014-credit-changing-fortunes.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Changing+fortunes http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17102014-credit-changing-fortunes.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}