Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 17, 2014

Abe under pressure from renewed recession and slide in investor confidence in Japan

Japan's economy fell back into recession in the third quarter, dealing a blow to the government's plans for a further increase in the country's sales tax next year. The second consecutive quarterly contraction of gross domestic product has followed an increase in the sales tax from 5% to 8% in April, a hike designed to help bring down Japan's public debt, which is approaching 240% of GDP.

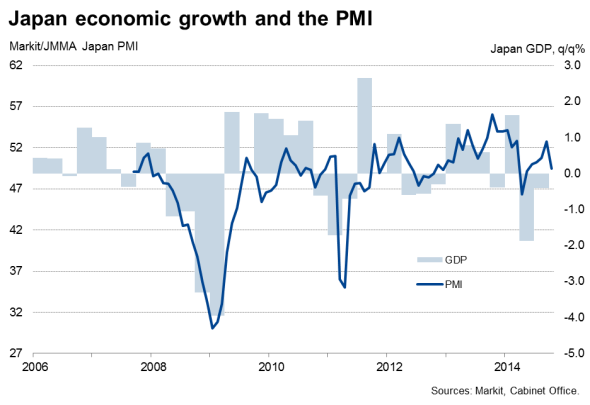

Fourth recession since global crisis

GDP fell 0.4% in the three months to September, a far weaker drop than the 1.9% decline seen in the second quarter but nevertheless tipping the economy into its fourth technical recession since the global financial crisis struck in 2007.

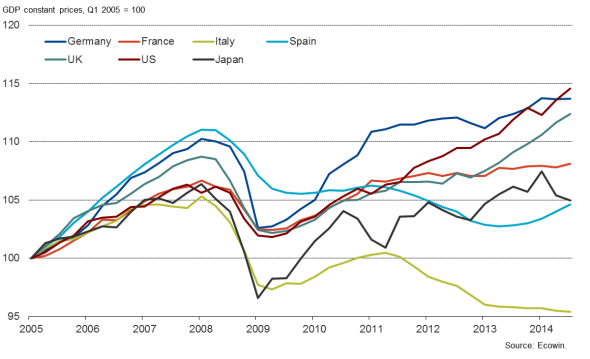

The decline leaves the economy 1.3% smaller than its pre-crisis peak reached in the first quarter of 2008. That compares with a US economy that has risen some 7.7% above its prior peak, and UK and German economies that are 3.4% and 3.1% larger respectively. The eurozone as a whole, however, is still down 2.2% on its 2008 peak.

GDP levels

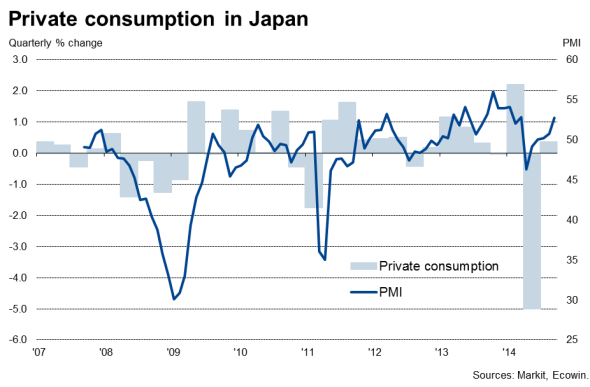

Modest upturn in private consumption

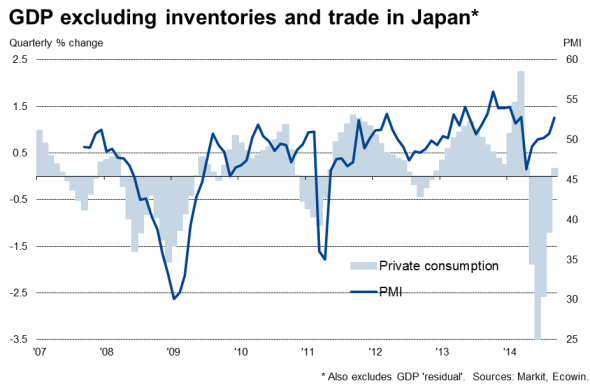

The situation is not quite as bad as the headline GDP number indicates. Excluding inventories, GDP rose by 0.1% in the third quarter, albeit after a 2.9% drop in the second quarter. Moreover, private consumption rose 0.4% following a 5.0% drop in the three months to June, which suggests that consumption is at least stabilising after the initial sales tax impact. Private consumption is only 0.1% below its pre-crisis peak.

Prime Minister Shinzo Abe has stated that the final reading of third quarter GDP to be published in December will need to be seen until a decision is made on next year's sales tax hike, most likely reflecting the revision-prone nature of Japan's GDP estimates.

In this respect, the modest upturn in PMI survey data in the third quarter provides hope for an upward revision to the first estimates of GDP. The PMI covering both services and manufacturing sank to an average of 48.5 in the second quarter, down from 53.0 in the first quarter. In the third quarter, an average reading of 51.3 pointed to a modest upturn in the economy. Of concern was a slide back in the PMI to 49.5 in October, suggesting a weak start to the fourth quarter.

However, this renewed downturn was at least in part driven by disruptions to businesses caused by extreme weather as a series of typhoons hit the country, a factor that will cause further complications to policymakers seeking to understand the true underlying health of the economy.

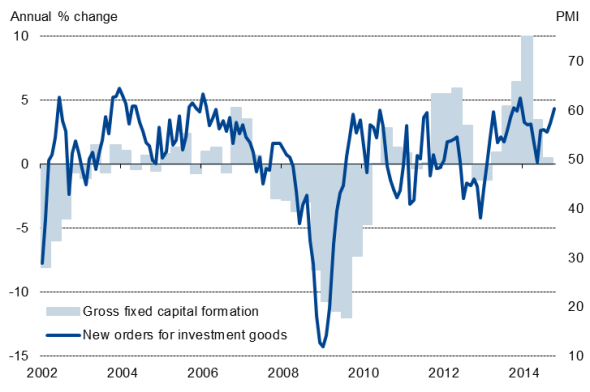

Rising investment

Perhaps most encouraging is the survey data on investment. Gross capital formation fell 0.6% in the third quarter, but remained 0.5% higher than a year ago. Markit's manufacturing PMI series tracking new orders for investment goods acts as a reliable advance indicator of capital formation, and rebounded to 60.3 in October, having sank to just 49.5 in May. This series suggests that companies have increased their investment spending, which will hopefully spur further economic growth.

Investment and PMI new orders

Snap election

Such indicators may prove to be of little solace to the government. Given the perceived need to take firm action to prevent a deflationary mind-set developing again among domestic consumers and, equally importantly, to display to investors that its policies of "Abenomics" have public support, the government looks poised to call a snap election.

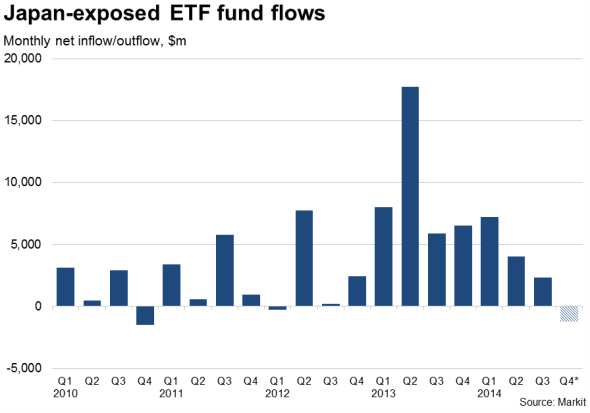

Largest ETF outflows for four years

Data compiled by Markit showed a net outflow from exchange traded funds with an exposure to Japan in November, highlighting a loss of investor confidence in Japan. The second decline in the past three months more than reversed a rise in October and puts the fourth quarter on course to see the largest net outflow from ETFs exposed to Japan since the fourth quarter of 2010, though it should be noted that the data only cover fund flows up to 17 November.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112014-economics-abe-under-pressure-from-renewed-recession-and-slide-in-investor-confidence-in-japan.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112014-economics-abe-under-pressure-from-renewed-recession-and-slide-in-investor-confidence-in-japan.html&text=Abe+under+pressure+from+renewed+recession+and+slide+in+investor+confidence+in+Japan","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112014-economics-abe-under-pressure-from-renewed-recession-and-slide-in-investor-confidence-in-japan.html","enabled":true},{"name":"email","url":"?subject=Abe under pressure from renewed recession and slide in investor confidence in Japan&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112014-economics-abe-under-pressure-from-renewed-recession-and-slide-in-investor-confidence-in-japan.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Abe+under+pressure+from+renewed+recession+and+slide+in+investor+confidence+in+Japan http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112014-economics-abe-under-pressure-from-renewed-recession-and-slide-in-investor-confidence-in-japan.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}