Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jan 18, 2016

Global volatility shifts CDS-bond basis more positive

Weak commodity and energy prices continue to drive a positive basis among single name European credits

- CDS spreads have been more reactive to market volatility, with 66% of names with a more positive basis since December.

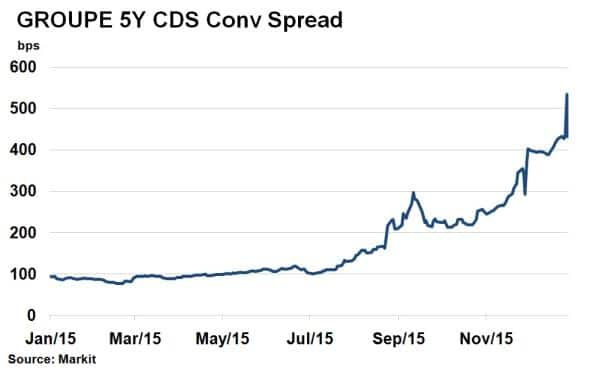

- Casino Guichard-Perrachon has a large positive basis, with a 9% sec lending utilisation rate

- Energy names ENI and America Movil seen 44bps positive basis move since December

The CDS-bond basis captures the relative value between a cash bond and CDS contract of the same credit entity. Fluctuations in the basis give rise to arbitrage opportunities. It is defined as an entities bond swap spread subtracted from its CDS spread.

CDS-bond basis = CDS spread - cash bond spread

Both spreads measure an entity's credit risk, so theoretically the basis should be zero. In practice other factors such as liquidity and transaction costs come into play.

Taking advantage of a positive basis would involve selling the cash bond (paying spread) while selling protection (receiving spread) on the same credit. Conversely, a negative basis trade would involve buying the bond (receiving spread) while buying protection (paying spread) on the same credit.

Dataset

An analysis of European investment grade corporate bonds sees many such discrepancies that could be arbitraged away. The sample of bonds is taken from Markit's iBoxx indices, which incorporates liquid bonds. Since the 5-yr point on a CDS curve is typically the most liquid tenor, only bonds maturing between June 2020 and June 2021 have been taken for practical reasons. This analysis is based on the actual CDS-bond basis (mid) as calculated by Markit's bond pricing service.

Energy drives basis

Of the liquid bonds, the split between those exhibiting a negative basis and those with a positive basis remains fairly even, although there has been greater shift on the positive side since the start of December.

One of the names exhibiting the highest positive CDS-bond basis is the 4.726% Casino Guichard-Perrachon bond maturing in 2021. The French retailer is on the brink of maintaining its investment grade status after being put on negative watch by S&P, which cited concerns based on the firm's leverage and dwindling economic conditions. Its soaring CDS spread has opened up a large positive basis (+22bps since the start of December), and its bond currently has a securities lending utilisation rate of 9% according to Markit, presenting ample opportunity to take advantage of such basis discrepancies.

Unsurprisingly, other names that feature high on the list exhibiting a wide positive basis are energy names such as ENI and America Movil, which have both seen a 44bps shift on the positive side since the start of December.

With weak oil and commodity prices continuing to exert significant clout on financial markets, CDS have been used as a tool of choice to negate potential downside risks. America Movil's 3% bond maturing in 2021 has a $115k available in lending programmes and a securities lending utilisation of just 4%.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18012016-Credit-Global-volatility-shifts-CDS-bond-basis-more-positive.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18012016-Credit-Global-volatility-shifts-CDS-bond-basis-more-positive.html&text=Global+volatility+shifts+CDS-bond+basis+more+positive","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18012016-Credit-Global-volatility-shifts-CDS-bond-basis-more-positive.html","enabled":true},{"name":"email","url":"?subject=Global volatility shifts CDS-bond basis more positive&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18012016-Credit-Global-volatility-shifts-CDS-bond-basis-more-positive.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+volatility+shifts+CDS-bond+basis+more+positive http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18012016-Credit-Global-volatility-shifts-CDS-bond-basis-more-positive.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}