Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 18, 2015

Bond markets anticipate European inflation

Mario Draghi's aim of kick starting inflation across the eurozone seems to be paying off, according to recent activity in the bond markets.

- German inflation linked bonds have seen a surge in breakeven inflation post QE

- Inflation linked government bond ETFs outperformed European peers in the last six months

- Flows into these ETFs have accelerated in recent weeks, hinting at inflation anticipation

Kick starting inflation was one of the cornerstone aims of the recent ECB QE steps. The prospects of a deflation driven "lost decade", such as that seen in Japan in the 1990s, prompted a €60bn per month stimulus program from the ECB. While the program's success won't be evident for another few years at least, initial reactions from bond markets indicate that inflation expectations for the region are picking up.

Bonds react in line with policymakers

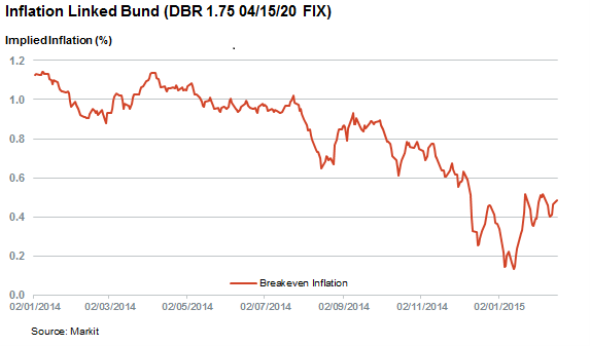

Breakeven inflation priced into European sovereign bonds has picked up in the wake of the ECB's move. This number, calculated as the yield difference between inflation indexed bonds and conventional bonds of the same maturity, had been steadily declining in the lead up to the latest QE decision, but have since jumped since mid-January.

One such listing, the German 2020 inflation linked Bund, saw its level of breakeven inflation fall from 1.1% at the start of last year to as low as 0.14% just ahead of the QE announcement. That number has since more than doubled and now sits 0.48%, with most of the increase occurring in the third week of January when QE was instated.

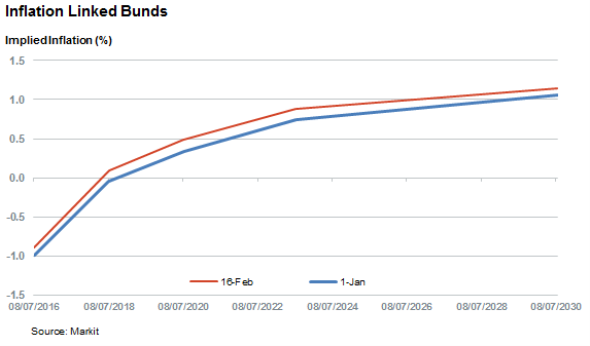

This surge in inflation expectation was reflected in all five German inflation linked bond issuances in both near and short term.

Near term bonds still indicate some level of near term deflation however, as bund inflation linked bonds expiring in 2016 are priced with a negative breakeven inflation.

Inflation ETFs outperform

These surging inflation expectations have been beneficial to investors as inflation linked bond ETFs have managed to outperform their conventional peers since the start of the year. The largest such fund, the iShares Euro Inflation Linked Government Bond UCITS ETF, has outperformed the SPDR Barclays EURO Government UCITS ETF by over 1% over the last six weeks. Most of this outperformance occurred in the last two weeks of January, coinciding with the ECB action.

This helped the fund regain some of the ground it lost last year as the spectre of inflation receded from investors' minds. The inflation linked fund has still trailed its conventional peer by over 5% in the last 12 months.

Investors pile into inflation linked bonds

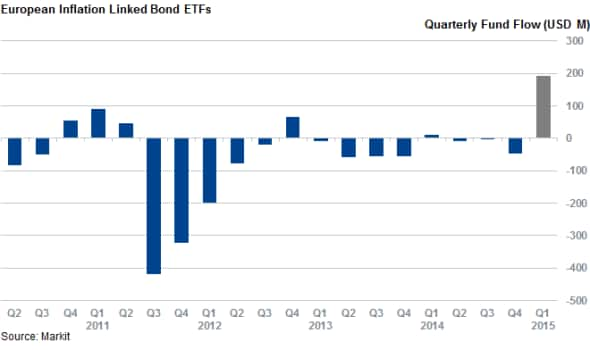

This strong performance has not gone unnoticed by investors as the six ETFs that track European inflation linked bonds have experienced their strongest inflows in over five years in the current quarter. These funds have seen €168m of inflows so far this quarter led by the previously mentioned iShares fund which took half these inflows to take its AUM to the highest level since mid-2011.

Much like the performance, the timing of these flows coincided with the QE announcement.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18022015-Credit-Bond-markets-anticipate-European-inflation.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18022015-Credit-Bond-markets-anticipate-European-inflation.html&text=Bond+markets+anticipate+European+inflation","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18022015-Credit-Bond-markets-anticipate-European-inflation.html","enabled":true},{"name":"email","url":"?subject=Bond markets anticipate European inflation&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18022015-Credit-Bond-markets-anticipate-European-inflation.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bond+markets+anticipate+European+inflation http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18022015-Credit-Bond-markets-anticipate-European-inflation.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}