Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 18, 2015

UK household survey highlights economy's dependence on low inflation

An upturn in household sentiment about their future finances in March is a welcome sign, but also highlights a vulnerability of the UK economy.

The upturn in consumer wellbeing, as signalled by the Markit Household Finance Index" (HFI") survey, has been driven by the twin factors of higher workplace activity and lower inflation. The former has helped via greater job security and modest income growth, while the latter has meant incomes go further in terms of spending power.

However, in recent months low inflation has been key to the improvement in household sentiment while workplace activity has had a waning impact. This suggests that the recent upturn in consumer spending, which has been a key driver of the economy, has become increasingly dependent upon inflation remaining low. Any increase in inflation therefore threatens to derail the wider economic upturn.

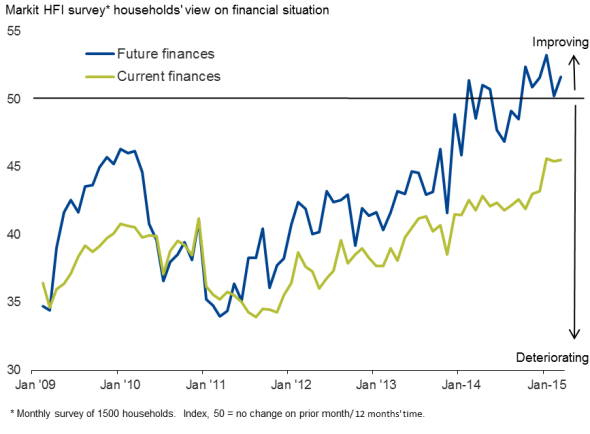

Household sentiment, current and future finances

Households more optimistic

UK households' optimism about their finances picked up in March to paint one of the brightest pictures seen since the financial crisis. Markit's Household Finance Index relating to conditions one year ahead rose from 50.2 in February to 51.7 in March, falling shy of January's post-recession high of 53.3 but remaining in positive territory for a sixth successive month, meaning more households expect their finances to improve than expect a deterioration.

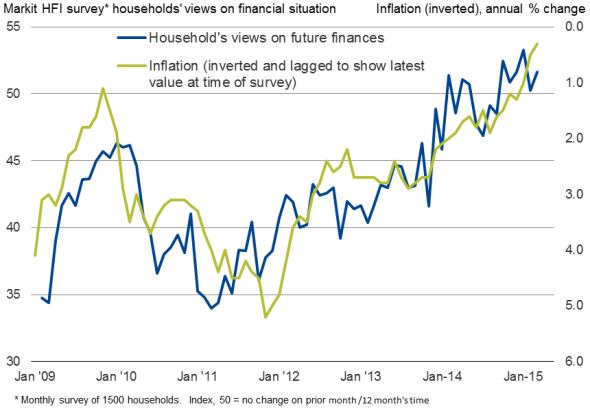

Household sentiment and inflation

The HFI measure of current finances also edged higher, close to January's post-recession high, but at 45.5 (below the critical 50.0 no-change level) continued to show that more households reported a deterioration in the finances than saw an improvement in March.

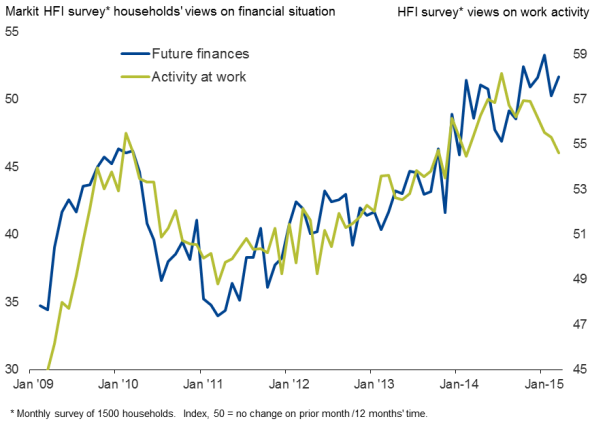

Household sentiment and activity at work

Dependence on falling prices

Despite the still weak current conditions readings, the survey's measures of household finances have risen sharply since late last year. This improvement has coincided with a marked easing in inflation, as well as survey respondents reporting that they have been busier at work, which has in turn led to modest growth of incomes (see charts).

At the time of the March HFI survey, the latest published statistics showed inflation dropping to just 0.3%. The survey's measure has been closely, but inversely, correlated with inflation, and the lower inflation rate has helped households perceive greater spending power in recent months, including March.

Being busier at work has also correlated closely with household sentiment about their finances, although recent months have seen the relationship break down as household sentiment has improved but workplace activity growth has eased further from October's peak to hit the weakest for more than a year in March.

Lower inflation therefore appears to have become the most important driver of household wellbeing and therefore consumer spending in the first quarter.

Rather than deferring purchases in the hope that prices will fall further in coming months, as conventional theory regarding deflation suggests, consumer have been taking advantage of lower prices for many items. This is probably why consumer spending rose 0.5% in the final quarter of last year, helping generate a similar 0.5% rise in GDP and offsetting a 0.7% drop in business investment.

An additional concern is that the survey continues to show that the current upturn in consumer spending is being finances by households eating into their savings. Average debt levels fell, but at the slowest rate seen so far this year.

With workplace activity growth slowing, the economic upturn therefore appears to have become even more reliant upon consumer spending, which is in turn dependent upon lower prices. Any increases in inflation therefore poses a risk to the wider upturn unless business spending revives.

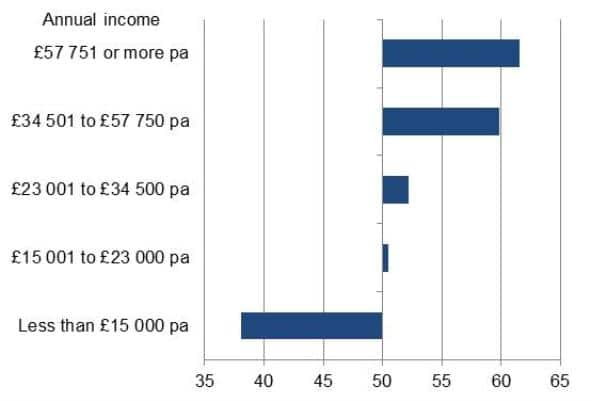

Sentiment strongest among high-earners

Looking further into the HFI data indicates that the economy is in fact dependent on high earners. The March upturn in sentiment about future finances was led by the private sector, though government workers did also become more upbeat about future prospects.

The increase in optimism was also directly linked to incomes, with the highest earners the most upbeat about their future finances. In contrast, future finances are expected to deteriorate among those earning less than "23k per annum, and especially sharply for those with incomes of less than "15k.

HFI Future Finances Index by income group*

* Any reading above 50 signals an expected improvement in finances over the coming year; readings below 50 signal a deterioration.

Source: Markit.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032015-Economics-UK-household-survey-highlights-economy-s-dependence-on-low-inflation.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032015-Economics-UK-household-survey-highlights-economy-s-dependence-on-low-inflation.html&text=UK+household+survey+highlights+economy%27s+dependence+on+low+inflation","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032015-Economics-UK-household-survey-highlights-economy-s-dependence-on-low-inflation.html","enabled":true},{"name":"email","url":"?subject=UK household survey highlights economy's dependence on low inflation&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032015-Economics-UK-household-survey-highlights-economy-s-dependence-on-low-inflation.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+household+survey+highlights+economy%27s+dependence+on+low+inflation http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032015-Economics-UK-household-survey-highlights-economy-s-dependence-on-low-inflation.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}