Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 18, 2015

Asian corporates hold up during bond selloff

The recent bond selloff in Europe and the US has led to corporate spreads widening, but Asian bonds have bucked the trend with long maturity bonds leading the way.

- Long dated 30-yr US treasuries yields hit 3% in wake of recent selloff

- USD Asian corporate debt has seen credit spreads tighten 9bps over the last month

- High quality industrial names have led the spread tightening over the last month

With attention focused on the US Fed's timing around monetary tightening, investors have kept a close eye any signals that could trigger large moves in emerging market dollar sector.

US treasuries have sold off sharply over the past month. The 10-yr benchmark treasury rate has gained 35bps to yield 2.15% since April 20th. The long dated treasuries have been particularly volatile over the recent selloff. The 30-yr rate has widened nearly 50bps over the past six weeks, causing the US treasury curve to steepen to its widest level in over seven months.

Asian spreads tighten

Unlike 2013's 'taper tantrum', which was the last time such large moves in treasuries were observed, emerging market dollar denominated debt has this time remained resilient, particularly in Asia; an area where corporates are prolific issuers in US dollars.

The Markit iBoxx $ Corporates index has returned (on a total return basis) -0.48% so far in May, extending the selloff which saw the index retreat by -0.56% in April. By contrast the Markit iBoxx USD Asia ex-Japan Corporates index has performed superiorly, having remained mostly flat over the month with a 0.03% fall in the last two weeks. The index also managed a positive 0.42% return last month, despite the broader selloff.

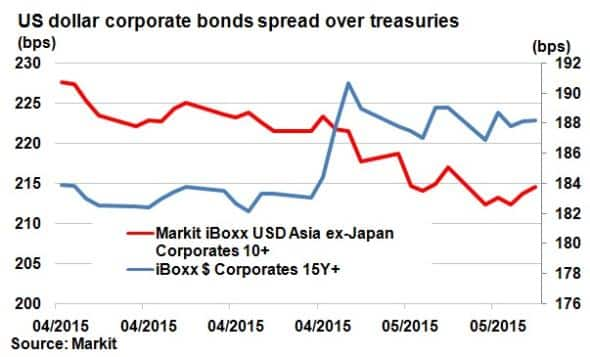

The return differences on the long end of the curve have been starkest. While yields have increased across both indexes, bond spreads, which incorporate credit risk, have diverged. The Markit iBoxx $ Corporates 15Y+ index has seen its spread over treasuries increase 5bps over the past month whereas the Markit iBoxx USD Asia ex-Japan Corporates 10+ index has seen its spread over treasuries decrease by 9bps.

The divergence could signal the robustness of Asia's dollar denominated corporate bond market amid a sharp selloff underlying treasuries. But it may also indicate that credit spreads were perceived by the market to be on the high side. The last time the Markit iBoxx USD Asia ex-Japan Corporates 10+ index had a spread to treasuries of 214bps, last December, 30-yr treasuries were hovering around 3%. With the 30-yr rate returning to this key 3% mark, investors have started buying opportunistically in quality corporate names in that maturity band.

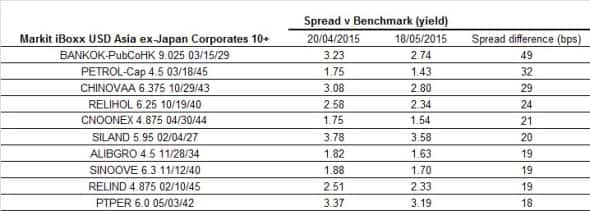

The corporate names that led the charge were largely high quality industrial corporations. Looking at the constituents of the Markit iBoxx USD Asia ex-Japan Corporates 10+ index, Petronas' 4.5% 30 year bond's spread tightened 32bps over the last month. Other names such as Reliance and energy firm Nexen also saw considerable tightening over the last month.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052015-credit-asian-corporates-hold-up-during-bond-selloff.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052015-credit-asian-corporates-hold-up-during-bond-selloff.html&text=Asian+corporates+hold+up+during+bond+selloff","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052015-credit-asian-corporates-hold-up-during-bond-selloff.html","enabled":true},{"name":"email","url":"?subject=Asian corporates hold up during bond selloff&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052015-credit-asian-corporates-hold-up-during-bond-selloff.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Asian+corporates+hold+up+during+bond+selloff http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052015-credit-asian-corporates-hold-up-during-bond-selloff.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}