Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 18, 2014

UK inflation remains key concern for policymakers despite upturn in October

UK inflation picked up slightly to 1.3% in October, in what appears to be a temporary upturn. Inflation looks set to ease in coming months due to a wide range of factors. Oil and global commodity prices are falling, sterling's strength has helped reduce import costs, domestic retailers are engaged in intense price competition and wage growth remains subdued.

The Bank of England will need to be firmly focused on ensuring economic growth does not slow too sharply in coming months, leading to even lower inflation than current projected.

Data from the Office for National Statistics showed consumer prices rising at an annual rate of 1.3% in October. However, that's up only slightly from the five-year low of 1.2% seen in September.

The increase was largely due to transport prices, notably petrol and air fare prices, falling less steeply than a year ago rather than any upward pressure on consumer prices, with one exception being computer games.

Inflation to fall again in coming months

The Bank of England expects the rate of inflation to drop below 1.0% in coming months, meaning Mark Carney will need to write an open letter to the Chancellor explaining the shortfall against the Bank's 2.0% inflation target.

It's hard to see how inflation will do anything other than fall in coming months.

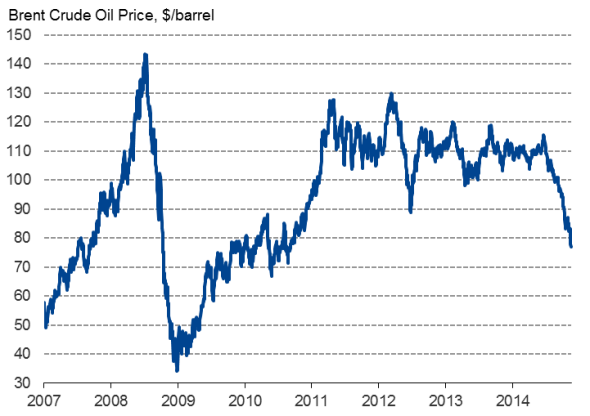

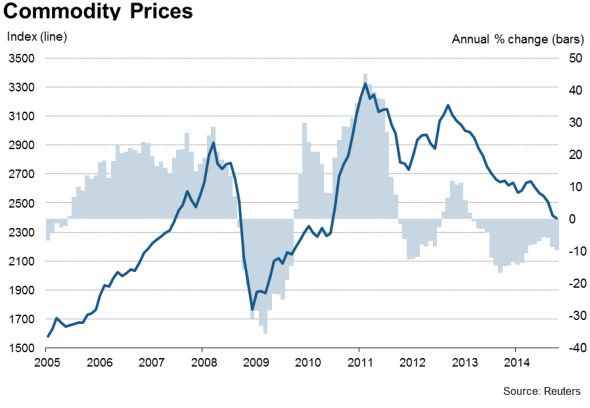

The benign outlook for inflation in part reflects global factors, and especially falling prices for raw materials, stemming in turn from weaker global economic growth, notably in emerging markets such as China. Most importantly, oil prices have dropped to their lowest for four years, with Brent Crude down to $77.1 per barrel, having slumped by a third from the peak seen in June. Alongside weaker demand for oil, supply has risen in recent years, boosted in particular by increased capacity from the US's shale revolution.

Oil prices

It's not just oil that's lower in price, commodity prices in general are 10% lower than a year ago due to weak global demand.

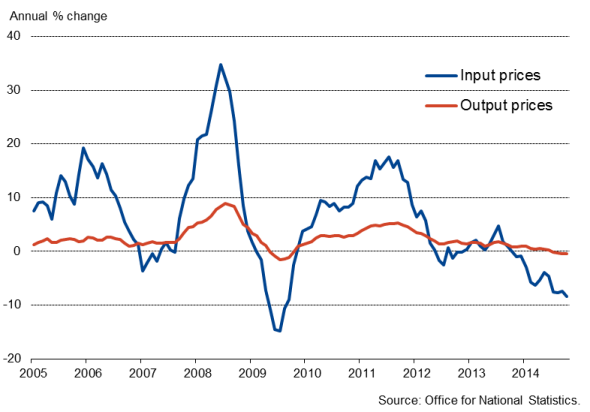

Producer price data consequently showed input costs at UK factories down 8.4% on a year ago in October, the steepest rate of decline since September 2009.

Producer prices

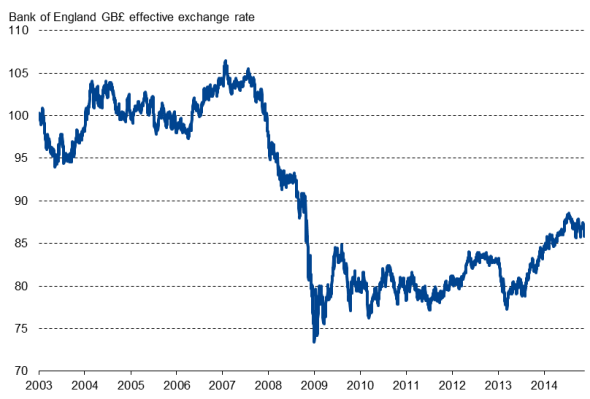

Lower global commodity prices have occurred alongside a strengthening of sterling throughout much of the past year, which has reduced the cost of imported goods. Although down from its recent peak, the pound is trading around 5% stronger in November compared to a year ago, measured against a trade-weighted basket of currencies.

Domestic factors are also at play in helping to bring inflation down. First, supermarkets are engaged in intense price wars, putting further downward pressure on food, clothing and petrol prices. The ONS reported that food and non-alcoholic drinks have seen the longest run of falling prices since 2000 due in part to supermarket discounting. Food prices were down 1.6% on a year ago in October and fuel prices down 4.8%.

High street clothing prices are also likely to fall in coming months as warm weather has left many retailers with excess stocks of winter gear.

Finally, wage growth remains subdued. Although showing signs of rising, historically weak pay growth looks set to persist for some time, auguring well for benign consumer price inflation in the future.

Bank of England to focus on growth

Lower inflation will be helpful, as wages are now starting to rise in real terms, which bodes well for consumer spending.

However, the concern at the Bank of England is that low inflation could turn into deflation, inducing another economic slump as consumers defer purchases in the hope of lower prices in the future. The Bank's latest projections are for inflation not to rise to its 2.0% target until the end of its three-year forecast horizon, dipping below 1% in coming months. Given the rapid pace of economic growth seen in the UK over the past year, this is a worrying outlook.

If economic growth slows more than the Bank is expecting, and we note than the Bank's projections for the economy to expand 2.9% next year look somewhat optimistic, then inflation could fall further. The Bank's main priority is therefore to ensure that economic growth remains robust in coming months to stop inflation falling even more than currently projected, which suggests any hike in interest rates remains a long way off.

Exchange rate

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18112014-economics-uk-inflation-remains-key-concern-for-policymakers-despite-upturn-in-october.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18112014-economics-uk-inflation-remains-key-concern-for-policymakers-despite-upturn-in-october.html&text=UK+inflation+remains+key+concern+for+policymakers+despite+upturn+in+October","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18112014-economics-uk-inflation-remains-key-concern-for-policymakers-despite-upturn-in-october.html","enabled":true},{"name":"email","url":"?subject=UK inflation remains key concern for policymakers despite upturn in October&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18112014-economics-uk-inflation-remains-key-concern-for-policymakers-despite-upturn-in-october.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+inflation+remains+key+concern+for+policymakers+despite+upturn+in+October http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18112014-economics-uk-inflation-remains-key-concern-for-policymakers-despite-upturn-in-october.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}