Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 18, 2014

US flash PMI surveys signal warning on economic growth

Markit's flash PMI data, which signalled a marked easing in the rate of economic growth to a 14-month low in December, sit uncomfortably in an otherwise upbeat picture of the US economy. As such, the PMI data add justification to the Fed's recent decision to stress patience in determining the timing of the first hike in interest rates.

Upside surprises

The economic news flow out of the US has generally been beating expectations in recent weeks, presenting a near-uniform picture of an economy that shows no signs of slowing from super strong rates of expansion seen in the summer.

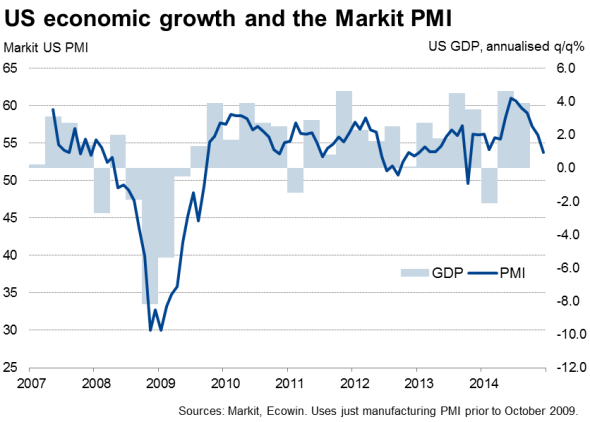

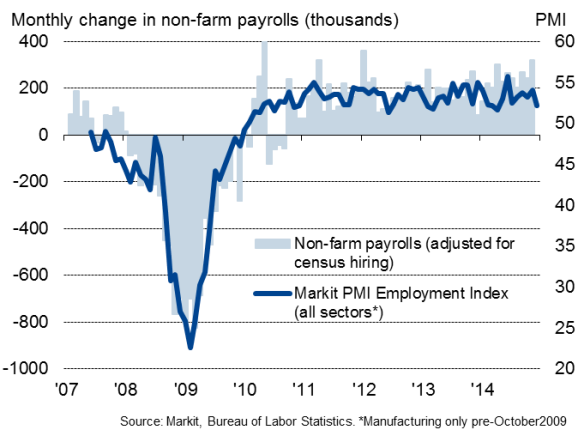

The economy enjoyed a growth spell unmatched over the prior ten years in the second and third quarters, with GDP rising at above-trend annualised rates of 4.6% and 3.9% respectively. This expansion has also led to the most consistently strong period of job creation seen for 20 years.

The Federal Reserve Open Market Committee sees the growth spurt as having persisted at a similar pace into the fourth quarter, suggesting the US economy (and corporate profits) has proven resistant to worrying signs of economic weakness in other regions, notably the eurozone and the major emerging markets.

There is certainly a wealth of data to support the Fed's view of a buoyant fourth quarter. Non-farm payrolls smashed expectations with a 321,000 increase in November, while retail sales in the fourth quarter so far are growing at an annualised rate of 4.0% and industrial production is growing at a rapid lick of 5.2%. Consumer confidence has meanwhile hit a seven-year high and ISM manufacturing and non-manufacturing surveys have been running close to post-crisis highs in October and November.

Interest rates to rise next year

The upbeat assessment of the US economy adds to the likelihood of interest rates rising next year. Following the FOMC's latest meeting, policymakers sent the strongest indication yet that they expect the first rise in US interest rates to take place in mid-2015, and possibly as early as April. Importantly, however, it is also envisaged that the pace of tightening thereafter would be somewhat less aggressive than previously anticipated. The Fed also stressed that it could afford to be "patient" in terms of the timing of the first rate hike.

The reasoning appears to be that the current strong growth spell is likely to warrant an early rate rise, but that a more benign inflation outlook, linked to the recent fall in oil prices, means the process of normalising policy can now be more relaxed than previously thought.

Stock markets have risen to all-time highs on the back of the signs that sustained strong US growth alongside low interest rates will boost corporate earnings. Working on the same assumptions, Markit's dividend forecasting team expects S&P 500 stocks to pay out $400bn in 2015, a 9.5% increase compared to 2014.

A bright light in a darker global landscape

This buoyant picture of the US economy presents a surprising contrast with darkening landscapes elsewhere. The eurozone economy has only narrowly avoided recession, while Japan is struggling to pull out of its fourth recession since the financial crisis. Emerging markets remain riddled with weakness. China looks to have grown at the slowest rate since 1990 in 2014, and the expectation is for a further cooling in 2015. Brazil is entering another downturn, as is Russia, where a currency crisis and plummeting oil prices have prompted the central bank to expect GDP to fall by almost 5% next year.

Growth is even showing signs of slowing in the UK, which has hitherto been a bright light in the global economy alongside the US.

These growth divergences have pushed the US dollar to a five-year high against a trade-weighted basket of currencies, rising against the yen, the euro and a host of emerging market currencies in particular.

PMI growth warning

A weakening of Markit's flash PMI data therefore act as a warning light that the US may not be proving quite so invulnerable to the economic malaise elsewhere. If the PMI is correct in providing an advance indication of a slowing US economy, it has important implications for policy, and also therefore the US dollar and asset prices in general.

The manufacturing and services flash PMI surveys both showed sharp slowdowns in December, collectively signalling the slowest rate of economic growth for 14 months and suggesting GDP growth in the fourth quarter could be the weakest seen since the first quarter, when the US reeled from the impact of extreme weather. The surveys are running at a rate consistent with annualised GDP growth of around 2% in the fourth quarter, having correctly signalling growth of around 4% in the second and third quarters. The surveys have also signalled a marked easing in job creation in December alongside the weaker growth picture.

Employment

It should be borne in mind that Markit's PMI has, to some extent, merely fallen from historically high levels earlier in the year. But, with the exception of official factory orders data, which showed a worryingly steep fall in October, the PMI is largely isolated in sending a signal of a US economic slowdown that is not priced into the market.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122014-economics-us-flash-pmi-surveys-signal-warning-on-economic-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122014-economics-us-flash-pmi-surveys-signal-warning-on-economic-growth.html&text=US+flash+PMI+surveys+signal+warning+on+economic+growth","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122014-economics-us-flash-pmi-surveys-signal-warning-on-economic-growth.html","enabled":true},{"name":"email","url":"?subject=US flash PMI surveys signal warning on economic growth&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122014-economics-us-flash-pmi-surveys-signal-warning-on-economic-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+flash+PMI+surveys+signal+warning+on+economic+growth http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122014-economics-us-flash-pmi-surveys-signal-warning-on-economic-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}